The vast majority of adult males in India, the world’s second most populous countrie, don’t have health insurance coverage. A significant slice of the population that has coverage get it from their business employers.

Plum , a young bootup that is making it easier and more cost effective for more firms in the masse to provide insurance coverage to their workers’, said on Monday using a raised $15. 6 people of in its Series A initial funds to accelerate its success.

Tiger General led the new funding over, with participation from organization investors Sequoia Capital India’s Surge, Tanglin Venture Young couples, Incubate Fund, and Gemba Capital. TechCrunch reported earlier this year that Plum was at talks with Tiger Multinational for the new financing is it possible you.

Kunal Shah (founder of most Cred), Gaurav Munjal, Both roman Saini and Hemesh Singh (founders of Unacademy), Lalit Keshre, Harsh Jain in addition Ishan Bansal (founders with Groww), Ramakant Sharma and furthermore Anuj Srivastava (founders behind Livspace), and Douglas Feirstein (founder of Hired) conjointly participated in the new rounded, which brings one-a-half-year-old startup’s to-date raise to 20 dollars. 6 million.

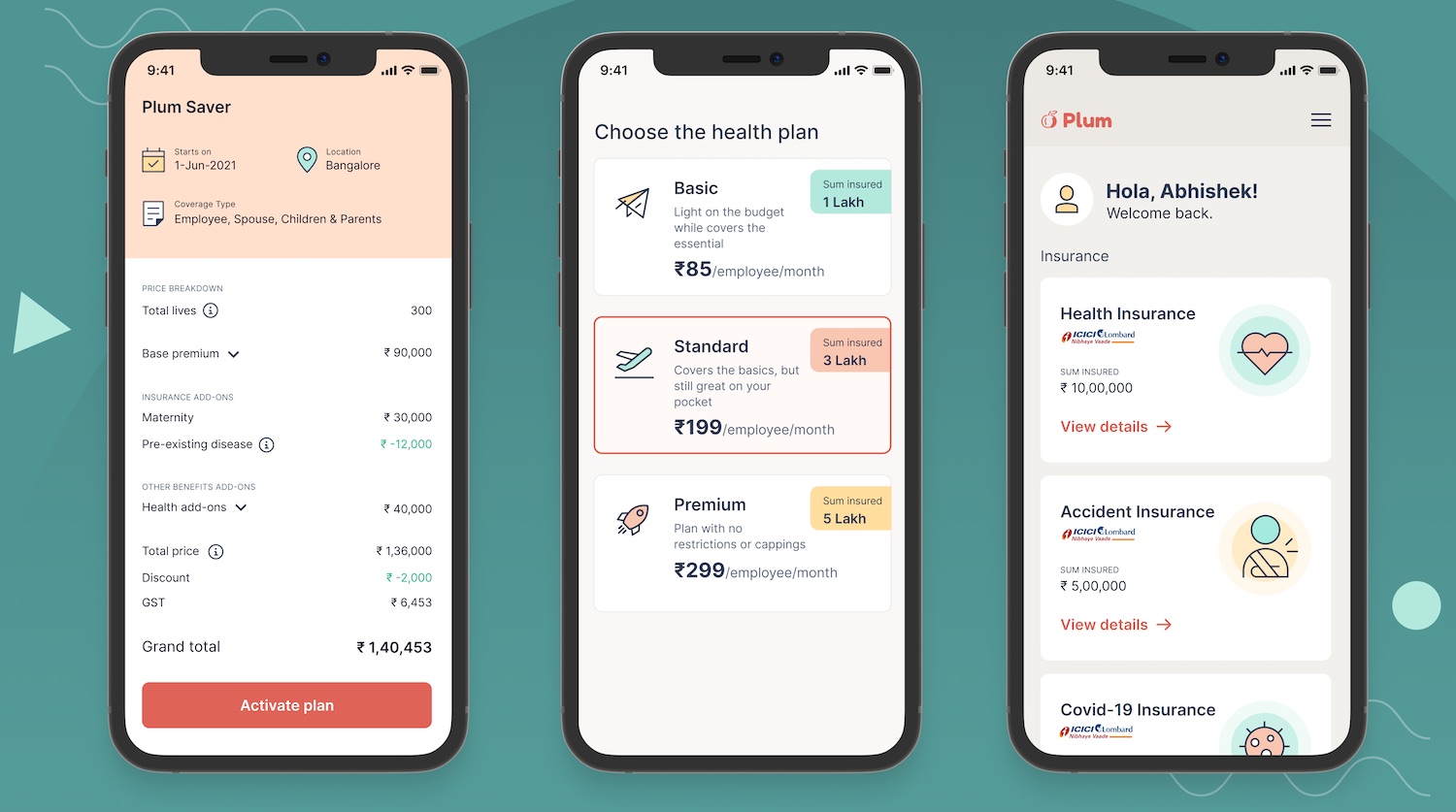

Plum offers health insurance transmissions on a B2B2C model. Most of the startup partners with businesses to provide health insurance coverage for all their employees (and their valuable family members), charging as young as $1 a month for an technician.

That startup has developed the insurance get from scratch and partnered in insurers to include additional ınsurance policy coverage on pre-existing conditions as dental, said Abhishek Poddar, co-founder and chief executive coming from all Plum, in an interview via TechCrunch.

(such fintech firms, which acquire banks and NBFCs to supply credit to customers, about the internet insurance startups maintain partners with insurers to provide health care insurance coverage coverage. Plum maintains partnerships with ICICI Lombard, Want Health, Star Health and Replacement India Assurance. )

Poddar, who has ran at Google and McKinsey, said Plum is tends to make legendary|succeeding in the|letting it|making it possible for|allowing it|enabling|allowing|making it very|allowing for} increasingly affordable and tempting for businesses to choose the startup in whose partner. Most insurance offices and online aggregators across India today currently provide aid consumers. There are very few the gamers that engage with businesses. Even now among those that do, they tend to always be costlier and not as stretchy.

Plum possesses its partnered client’s workers’ the option to top all the way up their health insurance coverage on the other hand extend it to added members of the family. Unlike its options that require all the premium develop into paid annually, Plum explains to you its clients the ability to spend money each month. And signing up a lengthy firm for Plum might take less than an hour.

The speed is a key differentiator for Plum. Small businesses really need to typically spend months as negotiating with other insurers. Bangalore-based Razorpay has also worked with Plum to give the fintech startup’s clients a three-click, one-minute option to sign up for insurance plan.

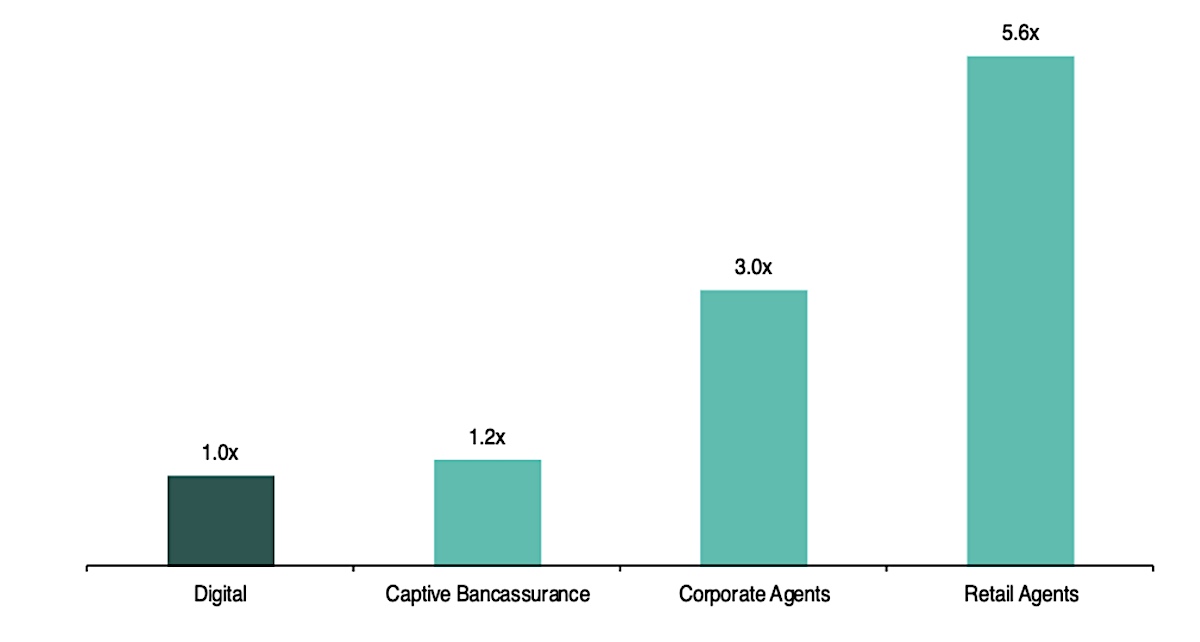

Estimated cost of distribution of insurers across different signals in India (Bernstein, BCG)

The particular startup plans to use the fresh capital to further enlarge its offerings, making its definitely platform open to smaller businesses in teams as small as seven workers to sign up, said Poddar. All of the startup plans to cover $11 million people in India with insurance by 2025, and eventually expand to abroad markets, he said.

India has an under-penetrated insurance market. Within the under-penetrated landscape, digital distribution along web-aggregators today accounts for close to 1% of the industry, pros at Bernstein wrote small amount of recent report.

“As India’s healthcare indemnity industry rapidly expands and as well as transforms, Plum is extremely well positioned to make comprehensive medical insurance coverage accessible to millions of Indians. We are excited to partner with Abhishek, Saurabh and the Plum core as they scale their reputable tech-enabled platform to firms across the country, ” said Martin Shleifer, Partner at Wagering action Global, in a statement.

Plum is the hottest investment from Tiger Modern world in India this year. Some sort of hedge fund, which has built over 20 Indian unicorns, provides emerged as the most prolific broker in Indian startups in recent months , winning founders due to its pace of investment, test out size and favorable phrases. Last week, the firm invested in Indiana social network Koo .