Bitcoin’s (BTC) massive drop in May 2021 is among its worst monthly performances, according to data from Bybt. The decline has divided the crypto community, with long-term investors considering the fall as a buying opportunity while short-term traders are dumping their positions out of fear.

Glassnode data suggests that long-term HODLers and miners are using the current weakness to accumulate Bitcoin. This transfer of Bitcoin from weaker hands to stronger hands is a positive sign because long-term investors are unlikely to panic and dump their holdings on every bear market correction.

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360

In April, the U.S. personal consumption expenditures price index soared by 3.1% compared to a year ago, the biggest increase over 12 months since July 1992. This indicates that inflation is knocking on the doors. Several institutional investors may use the current correction to add Bitcoin to their portfolios as it is an uncorrelated asset and many consider it as a good hedge against inflation.

Therefore, a sharp plunge below $30,000 looks unlikely. However, that does not mean a new bull market will start in a hurry. The price is likely to remain volatile and range-bound before the start of a sustained uptrend.

Let’s analyze the charts of the top-10 cryptocurrencies to spot the critical support and resistance levels.

BTC/USDT

Bitcoin is in a downtrend. The downsloping moving averages and the relative strength index in negative territory suggest the bears have the upper hand. However, the bulls have other plans as they are trying to start a relief rally.

BTC/USDT daily chart. Source: TradingView

BTC/USDT daily chart. Source: TradingView

The BTC/USDT pair has formed a symmetrical triangle pattern. If the bulls push and sustain the price above the resistance line of the triangle, the pair could start a move to the 50% Fibonacci retracement level at $44,750 and then to the 50-day simple moving average ($50,161). Such a move will suggest that the downtrend could be over.

Contrary to this assumption, if the price turns down from the resistance line of the triangle, the pair could extend its stay inside the triangle for a few more days. A breakdown and close below the support line of the triangle will indicate the resumption of the downtrend.

The bears could then pull the price down to $30,000 and if this level cracks, the selling may intensify and the pair could drop to $28,000 and then $20,000.

ETH/USDT

Ether (ETH) has rebounded sharply off the support line of the symmetrical triangle as traders attempt to put a higher low. The price could now challenge the resistance line of the triangle where the bears are likely to mount a stiff resistance.

ETH/USDT daily chart. Source: TradingView

ETH/USDT daily chart. Source: TradingView

If the bulls push the price above the triangle, the ETH/USDT pair could rally to the 61.8% retracement level at $3,362.72. Such a move will suggest strong buying at lower levels. A break above $3,362.72 may signal an end of the downtrend.

However, the bears are unlikely to give up easily. The downsloping 20-day EMA ($2,756) and the RSI just below the midpoint suggest the sellers have a minor advantage.

If the price turns down from the resistance line of the triangle, the bears will try to sink the price below the support line of the triangle. If they succeed, the pair may retest the May 23 panic low at $1,728.74.

BNB/USDT

Binance Coin (BNB) slipped below the $306.61 support on May 29 but the bears could not sustain the selling pressure at lower levels. The altcoin quickly bounced back above $306.61 on May 30, suggesting accumulation on dips.

BNB/USDT daily chart. Source: TradingView

BNB/USDT daily chart. Source: TradingView

The bulls will now try to push the price to the 20-day EMA ($400), which is likely to act as a stiff resistance. If the price turns down from the 20-day EMA, it will suggest the sentiment remains negative and traders are selling on rallies.

The bears will then try to pull the price down to $211.70. On the contrary, if the bulls thrust the price above the 20-day EMA and the $428 resistance, the BNB/USDT pair could rally to the 50-day SMA ($512).

ADA/USDT

Cardano (ADA) dipped below the 50-day SMA ($1.51) on May 29 but the bears could not capitalize on the breakdown. The altcoin bounced back above the 50-day SMA on May 30, indicating buying at lower levels.

ADA/USDT daily chart. Source: TradingView

ADA/USDT daily chart. Source: TradingView

The flat 20-day EMA ($1.61) and the RSI near the midpoint suggest a balance between supply and demand.

This balance will tilt in favor of the buyers if they can push and sustain the price above the downtrend line. The ADA/USDT pair could then rally to $1.94 and if this level is crossed, the next stop could be a retest of the all-time high at $2.47.

On the other hand, if the price turns down from the downtrend line, the bears will once again try to break the $1.33 support. If they succeed, the pair could drop to $1.24 and then $1.

XRP/USDT

The bears pulled XRP below the $0.88 support on May 29 but they could not sustain the lower levels. The altcoin bounced back above $0.88 on May 30, indicating strong buying by the bulls.

XRP/USDT daily chart. Source: TradingView

XRP/USDT daily chart. Source: TradingView

If the buyers can propel the price above the 20-day EMA ($1.08), it will suggest that a short-term bottom has been made at $0.65. The XRP/USDT pair could then rally to the 50-day SMA ($1.32) and later to the downtrend line.

This positive view will invalidate if the price turns down from the 20-day EMA. If that happens, the bears will try to pull the price back below $0.80. If they manage to do that, the pair may challenge the $0.65 support.

DOGE/USDT

The volatility in Dogecoin (DOGE) has reduced due to lack of aggressive buying or selling by traders. The moving averages have completed a bearish crossover and the RSI is in the negative territory, indicating the bears have the upper hand.

DOGE/USDT daily chart. Source: TradingView

DOGE/USDT daily chart. Source: TradingView

If the price turns down from the 20day EMA ($0.36), the bears will try to pull the price below the critical support at $0.21. If they succeed, the DOGE/USDT pair will complete a bearish head and shoulders pattern. The pair could then correct to $0.10 and then $0.05.

Conversely, if the bulls push the price above the 20-day EMA, the pair could rise to the overhead resistance at $0.47. A breakout of this resistance could result in a rally to $0.59.

DOT/USDT

Polkadot (DOT) is trying to rebound off the support at $17.50. This is a positive sign as it shows that the bulls are not waiting for a dip to $15 to buy. The altcoin could rise to the $26.50 level, which is likely to act as a stiff resistance.

DOT/USDT daily chart. Source: TradingView

DOT/USDT daily chart. Source: TradingView

The downsloping moving averages and the RSI below 40 suggest the bears have the upper hand. If the price turns down from $26.50, the DOT/USDT pair could extend its stay inside the range for a few more days.

The next bullish move could start if the buyers push the price above $26.50. That could result in a rally to $31.28 and then to the 50-day SMA ($33). Alternatively, the next leg of the downtrend could start if the bears sink the price below $15.

UNI/USDT

Uniswap (UNI) is in a downtrend but the bulls are trying to form a higher low at $21.50. The price rebounded off this support on May 30 and the bulls will now try to push the price above the 20-day EMA ($28.27) and the overhead resistance at $30.

UNI/USDT daily chart. Source: TradingView

UNI/USDT daily chart. Source: TradingView

If they succeed, it will suggest the downtrend could be over in the short term. The UNI/USDT pair may then rally to the 50-day SMA ($33.94). This level may act as stiff resistance but if the bulls can clear the hurdle, the pair could rise to $38.15.

The downsloping 20-day EMA suggests the bears have the upper hand but the RSI above 44 suggests the bulls are making a comeback.

This positive view will nullify if the price turns down from the 20-day EMA and breaks below $21.50. Such a move could result in a decline to the May 23 low at $13.04.

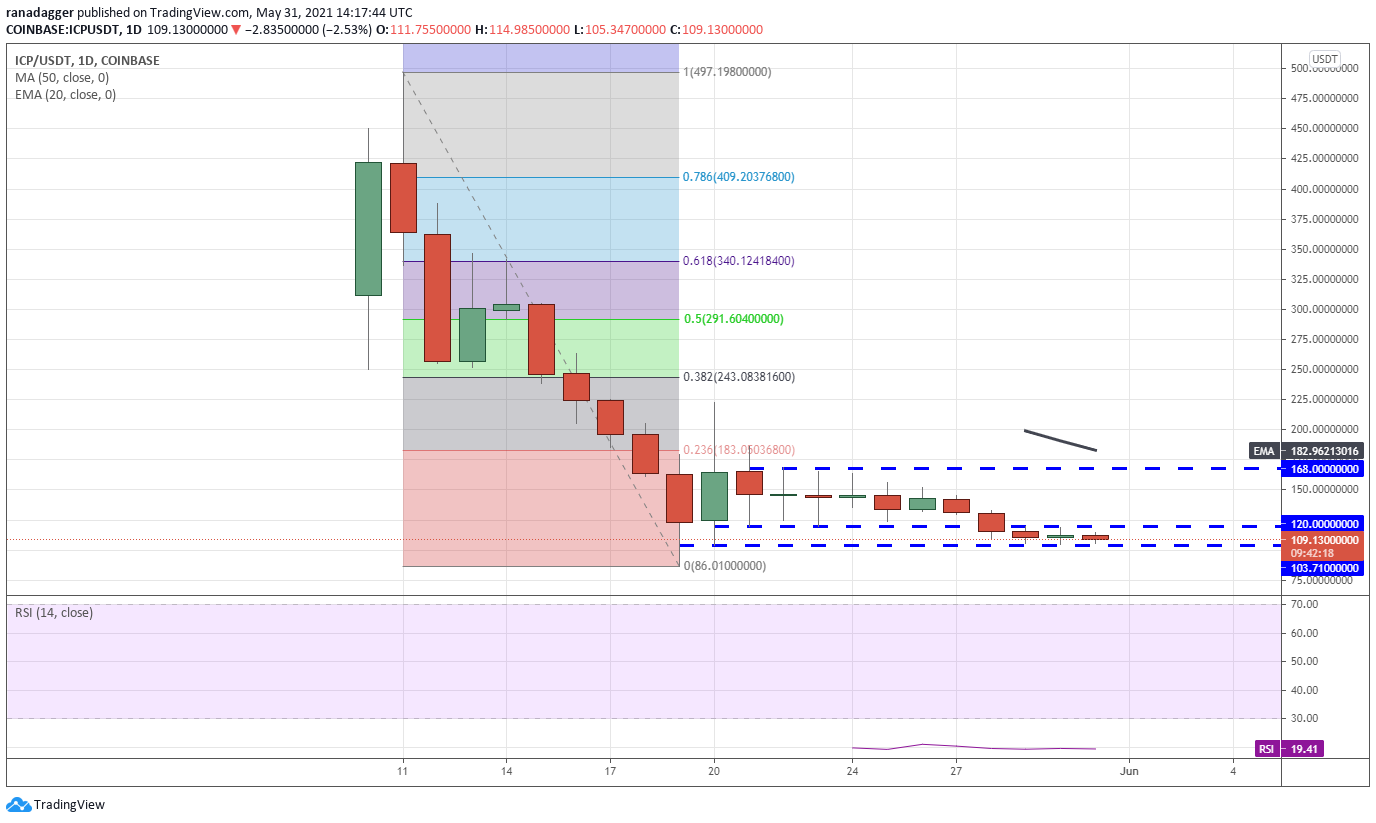

ICP/USDT

Internet Computer (ICP) broke below the $120 to $168 range on May 28 but the bears have not been able to pull the price below the immediate support at $103.71. The price is stuck between $103.71 and $120 for the past three days.

ICP/USDT daily chart. Source: TradingView

ICP/USDT daily chart. Source: TradingView

This tight-range trading indicates indecision among the bulls and the bears. If the uncertainty resolves to the downside, the ICP/USDT pair could challenge the May 19 low at $86.01. A break below this support could pull the price down to $60.

On the other hand, if the bulls push and sustain the price above $120, it will suggest a lack of sellers at lower levels. The pair could then gradually move up to $168. A breakout and close above $168 could start a relief rally that may reach the 38.2% Fibonacci retracement level at $243.08.

BCH/USDT

Bitcoin Cash (BCH) is attempting to rise above $685.36. If bulls sustain the price above this overhead resistance, the altcoin could rise to the 20-day EMA ($821), which is likely to act as a stiff resistance.

BCH/USDT daily chart. Source: TradingView

BCH/USDT daily chart. Source: TradingView

If the price turns down from the 20-day EMA, it will suggest the sentiment remains negative and traders are selling on every minor rally. If the bears sink the price below $600, the BCH/USDT pair could fall to $468.13.

On the contrary, if the bulls drive the price above the 20-day EMA, it will suggest that demand exceeds supply. That could start a rally to the 38.2% Fibonacci retracement level at $919.60 and then to the 50% retracement level at $1,059.07.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.