Major protocol upgrades can play a significant role in altcoin rallies regardless of the state of the wider cryptocurrency market because new features excite token holders and help to attract new investors.

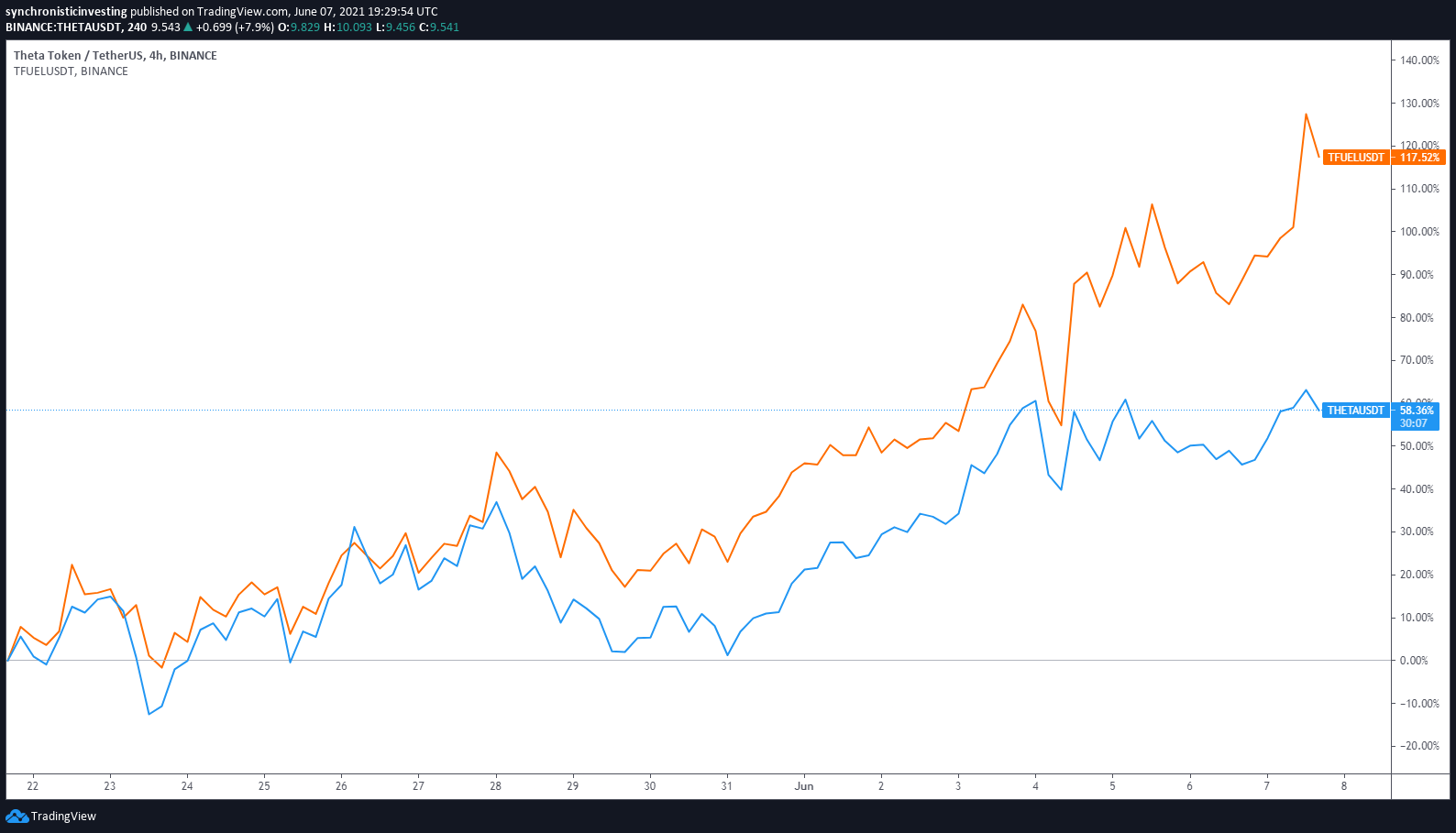

One ecosystem that has been heating up over the past two weeks is the Theta protocol. The project’s THETA token rallied 50% and Theta Fuel (TFUEL) gained 71% ahead of the network’s upcoming Mainnet 3.0 launch scheduled for June 30.

THETA/USDT vs. TFUEL/USDT. Source: TradingView

THETA/USDT vs. TFUEL/USDT. Source: TradingView

Toward the end of May, price action for THETA and TFUEL began to ramp up after the project revealed that the Creative Artists Agency (CAA), a talent and sports agency, had become the newest validator node operator for the network.

The subsequent release of one-click delegated staking for the Theta web wallet also raised excitement in the community as the simplified method for earning a yield is ideal for holders who don’t want to deal with more complicated ways of yield farming.

Theta 1-click delegated staking now live in the Theta Web Wallet! With this new feature, you can delegate your THETA to stake to community-run Guardian Nodes that have volunteered their nodes for use. You can find all the details in the latest Theta blog:https://t.co/sXWRiypr60

— Theta Network (@Theta_Network) June 4, 2021

Investors looking to stake on the network are required to hold a minimum of 1,000 THETA tokens which are worth roughly $9,750 at current prices.

As of June 6, more than 60% of all THETA tokens in circulation have been locked on the protocol for network validation purposes. Ideally, this reduction in the available supply should help reduce the risk of a major price drop, even though the token corrected sharply as Bitcoin price imploded on May 19.

The dual token system received another momentum boost on June 7 following the release of the updated Theta protocol v2.4.0. The release was followed by a 35% rally in the price of TFUEL from a low of $0.42 on June 6 to an intraday high at $0.565 on June 7.

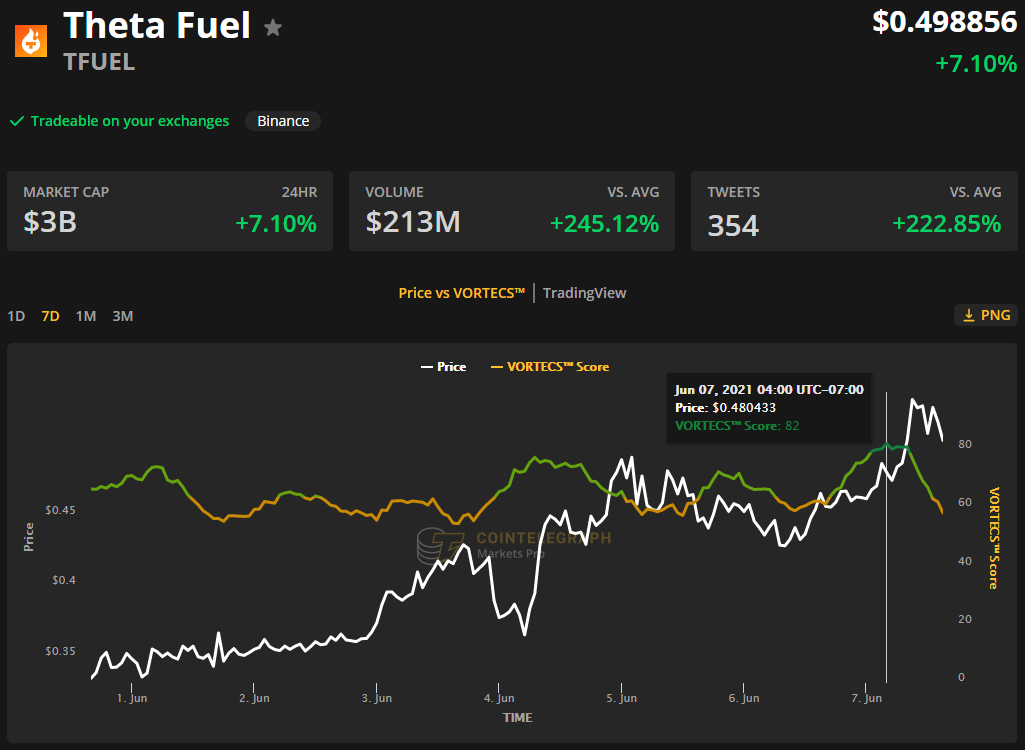

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for TFUEL on June 4, prior to the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

VORTECS™ Score (green) vs. TFUEL price. Source: Cointelegraph Markets Pro

VORTECS™ Score (green) vs. TFUEL price. Source: Cointelegraph Markets Pro

As seen in the chart above, the VORTECS™ Score for TFUEL saw first increased to a high of 78 on June 4 and eventually recorded a score of 82 on June 7 as the price of TFUEL rallied 62% from a low of $0.35 to a high of $0.565 over the three-day period.

The price of THETA rallied 26% during the same three-day period from a low of $8 to a high at $10.08, but has since dropped below $9.20 as the fears over a bearish Bitcoin outcome have traders apprehensive about holding altcoins.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.