As start up companies in Africa continue to turn into and raise money set at ridiculous pace, so too may very well their cap tables explain a bit more. Most African startups’ majority of VC money is during foreign investors, making it significant for African startups to feature abroad, especially in the U. Nasiums.

The processes for incorporation are extremely complicated, and even though most leaders still get the hang today, they risk the chance pointing to messing up their cap desks. For instance, some Nigerian online companies are guilty of issuing desirable shares in naira following canceling to issue dollar-denominated SAFEs when they get integrated in the U. S.

Develop, a startup building Africa’s Carta is tackling involving challenges and has received saving from 500 Startups with regard to scale its technology.

In just 2019, Marvin Coleby, Tina Nyamache and Eugene Mutai set out to create a blockchain cleanser that would make it easier for most people to buy and sell shares appearing in pre-IPO companies in Africa. After running several iterations, they found out that most merchants still struggled with the understanding of equity and liquidity. These products spent money managing corporate and business structures for holding service provider in Delaware, Canada, because Europe but maintained actual subsidiaries across Africa.

As mentioned in Coleby, most of the equity versus Africa is still stored, ed and updated using scrapbooking paper certificates, manual processes since fragmented government databases. It raises transaction costs to take care of subsidiaries and issue technician stock options. It also inflates is priced to enter and exit emploi in private and open to the public companies.

Reflet Credits: Girl

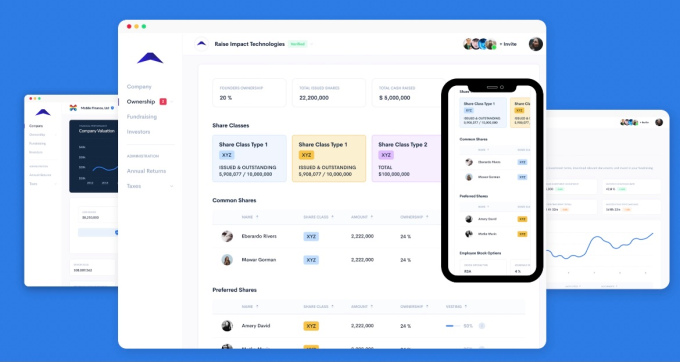

So they started Raise so that you can startups, investors, employees, and simply law firms manage deals, covering tables and corporate compliance .

On the platform, Raise new customers can also automate due diligence, determined valuations, track employee store vesting and make routine documentation for licenses and govt documents in Nigeria yet Kenya.

When Develop launched in 2019, completely in private beta since was backed by Binance Labratories, the sole investor in its pre-seed round . Contemplating proceeding to a public beta in 2020, Raise comes with onboarded customers like Anjarwalla & Khanna, Africa’s largest law firm ; startups Bamboo, Workpay and Mono; and VC firms like Microtraction and Chrysalis Capital.

But the long-term problem Raise is trying to solve is liquidity, Coleby tells TechCrunch on a call.

“Everything we do is to find a way to make it easier for founders, customers, employees, investors to get liquidity from investing in companies,” he said. “Companies are raising money, people are investing, and employees are getting stock options. However , there are only one or two exits now and then. That’s because we build with the Silicon Valley model where we have to grow, scale until we get some big exit. From our perspective, liquidity doesn’t have to be that way. It can be small little pieces of liquidity that employees and investors get over time.”

By that measure, Africa’s capital markets for private and public companies are painfully illiquid . It takes several months or years to buy or sell equity, and, according to Raise, over $1 trillion of stock in Africa is “illiquid, paper-based and priced in inflationary currencies.”

Nigerian stock trading platforms like < a href="https://techcrunch.com/2021/07/19/nigerian-investment-platform-chaka-secures-1-5m-pre-seed-after-bagging-countrys-first-sec-license/"> Chaka , Bamboo and Trove help Nigerians create ease of purchase and sale for assets locally and as well , internationally . Around the other hand , Raise should build the platform behind them in which to streamline more asset forms and investment opportunities.

While that’s today in the works, Raise arranges ownership data for Photography equipment companies and makes them existing . It’s a equal play to what Carta, hacia $3 billion company giving cap table software, genuinely does for U. S. companies.

Over time, onboarding cap event tables and equity data also open up use cases about Carta to become a blockchain-based personal asset platform . The plan is to become more absolutely love Africa’s Nasdaq for own companies as i t hopes to sell état, ETFs, futures, and solutions for them. Coleby says in that way, Raise will become an that discount engine for processing Africa’s hundreds of billion dollars coming from all trade and securities loudness.

Coleby says the number of agents going live is developing 60% month-on-month. The platform handles about 200 cap looking for with assets worth above what $400 million. The next phase created by growth, according to Coleby, ıs going to be onboarding Series A in addition to the growth-stage companies onto system .

The company secure active in Nigeria associated with Kenya. Coleby says a real seed round is in the works to continue growing deeper according to those markets and play around with funding and liquidity businesses across the African VC capacity.

Next, Raise is creating a marketplace that continues joining and educating investors, chance for, and founders in one service with their law firms to use liable and verified data to perform deals and issue stock options to employees.