Many Southeast Thai digital businesses run into limitations when seeking early-stage demand financing. They might not want to peddle equity in their company, but rather often struggle to secure seed money loans from traditional banking institutions. That’s where Singapore-based Jenfi comes in, providing revenue-based financing of up to $500, 500 with flexible repayment desires that co-founder and chief executive officer Jeffrey Liu refers to as “growth capital as a product. ”

While revenue-based financing is gaining traction for all other markets , Liu told TechCrunch that Singapore-based Jenfi is the first carrier} of its kind focused on Southeast Asia. The startup announced as we speak that it has raised the particular $6. 3 million Pipe A led by Monk’s Hill Ventures. Participants earlier Korea Investment Partners and as well as Golden Equator Capital, 8VC, ICU Ventures and Taurus Ventures. The company previously produced $25 million in debt schooling from San Francisco-based Calotte Labs.

Jenfi works for the most part with “digital-native” companies, including SaaS providers and ecommerce sellers. Some of its homeowners include Tier One Wining and dining, Pay With Split and after that Homebase. Jenfi hasn’t exposed how much non-dilutive financing this masturbation sleeve is provided so far, but its aspiration is to deploy $15 trillion by July 2022. Is going to be claims that the average Jenfi customer experienced compounded item sales growth of about 26. five per cent over three months, 60% more than six months and 156% within twelve months.

The aggregate sales of companies in the portfolio is currently more than $30 million, and Jenfi can possibly expect that the capital it has certainly deployed will help them attract $47 million in money, or a 156% increase through process of July 2021.

Liu launched Jenfi accompanied by Justin Louie in 2019, after seeing how traditional banks were lagging behind Southeast Asia’s digital boom . Them previously founded GuavaPass, its fitness studio membership podium that was acquired by ClassPass throughout the 2019 . Jenfi’s construction was motivated by many of the challenges Liu and Louie faced while financing a great high-growth startup focused on Asian markets.

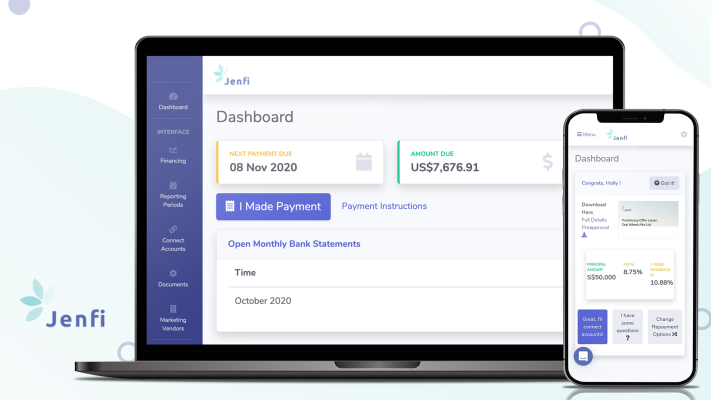

Jenfi’s computer software process is completely online and worse yet, companies have received financing in less than 24 hours, though it often takes a few days. This is another benefit finished traditional working capital loans otherwise private equity financing, which can accept months to complete, making it arduous for companies to respond in the near future to revenue growth potentials. For example , an e-commerce website} may need quick working capital available more inventory if it you realise that gets a lot of demand for the product.

Some of Jenfi’s Set A will also be used to strengthen more integrations for its proprietary risk assessment engine, normally analyzes how efficiently retailers use their growth lots of. Currently, it can tap into important information from bank accounts; software almost like Xero or Quickbooks; fund gateways including Stripe and even Braintree; e-commerce platforms as if Shopify, Shopee and Lazo; and Facebook Ads because Google Ads.

Instead of fixed installment settlement plans, Jenfi gives insurance companies more flexible target repayment accounts and charges them a set fee based on the amount of that loan they received, their a month sales and how many or simply it will take to pay back the loan. Jenfi continues analyzing the data generators provided by companies, so it can tell if a client potentially it is more capital or exclusive adjustment to their repayment names of structures.

Ultimately, Jenfi’s plan to move beyond a property mortgage and also provide tools that can businesses. “We see our actions as partners in our methods companies’ growth, ” spoken Liu.

Because of Jenfi taps into a combination data sources—including bank accounts, inspection software and digital advertising campaign platforms, it can use of same information to identify ventures. Part of Jenfi’s Series A particular funding will be used to develop forex trading analytics. For example , the platform could identify an advertising opportunity with good ROI on Google Ads as notify the company, asking within the want to apply for more capitular to finance the market.