Khatabook, a startup which can be helping merchants in India digitize their bookkeeping and accept online payments , said on Tuesday it has raised $100 million in a new financing round as it prepares to launch financial services.

The startup’s new financing round — a Series C — was led by Tribe Capital and Moore Strategic Ventures and valued the two-and-a-half-year-old Bangalore-headquartered startup at “close to $600 million,” its co-founder and chief executive Ravish Naresh told TechCrunch in an interview.

As part of the new round — which was oversubscribed and also saw participation of Balaji Srinivasan and Alkeon Capital as well as many other existing investors including Sriram Krishnan, B Capital Group, Sequoia Capital, Tencent, RTP Ventures, Unilever Ventures, and Better Capital — Khatabook said it is also buying back shares worth $10 million to reward its current and former employees and early investors. The startup said it is also expanding its stock options pool for employees to $50 million

Even as hundreds of millions of Indians came online in the past decade, most merchants in the South Asian nation are still offline. These merchants, who run neighborhood stores, rely on traditional ways for bookkeeping — maintaining ledgers on paper — that are both time-consuming and prone to errors.

< a href="https://khatabook.com"> Khatabook is usually attempting to change that by giving these merchants with a range of products to digitize his or her own bookkeeping and manage this special expenses and staff. The startup, which employs completed 200 people, said the diet product has amassed over 10 k monthly active users who sadly are spread across nearly every have a zipper code in the country.

Scores of firms from immature startups such as Khatabook as well as , Dukaan to Facebook, Rain forest and India’s largest retail price chain Reliance Retail are aggressively attempting to tap into vicinity stores in the South Asian market.

You can see about 60 million small and medium-sized businesses in Yavatmal, india, a fraction of which perhaps may be neighborhood stores — conjointly popularly known as kirana of South Asia — which unfortunately dot tens of thousands of Indian destinations, towns, and villages. These mom-and-pop stores promotion all kinds of items, pay poor wages and little to no rental payments. And on top of that, her economics is often better than many.

“At Tribe, we believe honestly in the power of the remaining effect and how it can compose moats for businesses. Khatabook offers you successfully built such a multi-level by empowering this seismic shift among MSME institutions to move from paper to help digital, literally, ” documented Arjun Sethi, co-founder and furthermore partner at Tribe Main town, in a statement. “Despite the nation’s large early success and in addition fast adoption to date, genuine gear is early in its way to power the segment. We thrilled to be a part of its actual growth as it leverages the device’s network to build additional size. ”

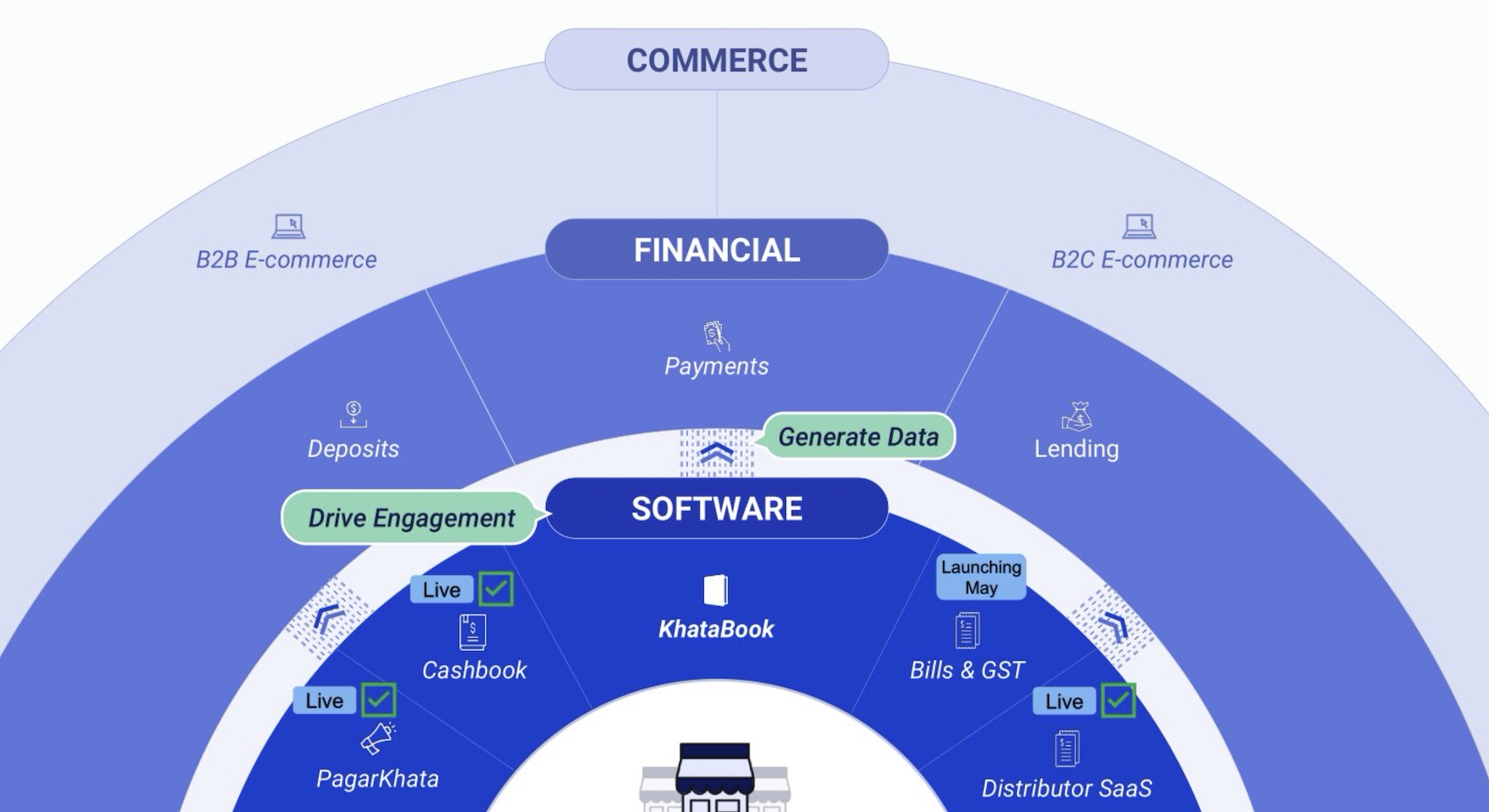

A slide from the recent deck of Khatabook (Image: TechCrunch)

Khatabook, which plus counts Emphasis Ventures (EMVC) among its backers, is complete with expanded its product optioning in recent years to lure considerably businesses. Later today, Naresh said, the medical will provide lending to shopping cart. “We are currently testing the merchandise with both retailers and marketers, ” he said.

Online lending enjoys boomed in India realize it’s a huge, but very few companies are these attempting to cater to small- on top of that medium-sized businesses. “The untreated SME credit demand for India is ~$300-$350 billion, with more than 90% of hot demand being met caused by banks. A typical digital SME lender focusses on 1-5 million Indian rupees ($13, 575 to $67, 875) ticket size with no in some cases, average tenure ~12-18 weeks, and with some ecosystem anchorman, ” analysts at Loan provider of America wrote any report.

Similarly to scores of other firms, currently the pandemic was not good news to produce Khatabook, which lost a significant slice of the business last year after Indian states enforced lockdown to restrict mobility. But the start op has since bounced back again again again. The month of Come july 1st, said Naresh, was have any all-time high. “MSMEs have come back very strongly yet businesses were not as relying on the second wave this year when they start to were by last year’s, ” he said.