VGX is the native token of Voyager, a cryptocurrency broker, and the asset is designed to generate staking rewards for its holders as well as boost their yield earnings on other digital assets.

Over the last 30 days, the asset delivered even more value as it has more than doubled its price against the United States dollar and gained 46% over the resurging Bitcoin (BTC).

What caused the coin’s price to soar, and was there a way to anticipate its rally early on?

Breaking news, familiar market patterns

VGX’s August price surge was an expected byproduct of bullish news coming out of the Voyager ecosystem throughout August. On Aug. 2, Voyager Digital announced the purchase of payments firm Coinify, a move aimed at expanding the platform’s infrastructure for cross-border transactions. At the time, VGX had been trading at around $2.30.

Simultaneously, Voyager rolled out a technological update: its VGX 2.0 portal for token swaps and staking. Fueled by this one-two punch, the price of Voyager Token embarked on a multi-leg rally that would last — barring brief periods of correction — for almost three weeks and culminated in the price hitting a high of $6.56 on Aug. 19.

With such long upward runs, one puzzle for traders to solve is whether each new price recoil is the end of the feast or whether there is still enough fodder for the hike to continue. At this point, historical data can come in handy.

Historically speaking, VGX is not new to long, dramatic rallies. From early January to late February, the token rose from a few cents to an all-time high above $7. This streak generated enough data on price movement, trading activity and social sentiment around the coin for the VORTECS™ Score — an artificial intelligence-driven tool available to Cointelegraph Market’s Pro users — to become proficient in assessing VGX’s market outlook.

Ahead of the price curve

VORTECS™ Score is an algorithm that compares historic and current market conditions around crypto assets to serve traders actionable insights. The model considers several indicators — including market outlook, price movement, social sentiment and trading activity — to generate a score that assesses whether the present conditions are historically bullish, neutral or bearish for a coin.

During VGX’s August run, the indicator consistently lit up ahead of each new leg of the coin’s long rally, signaling that, judging from historical precedent, the market and social conditions are ripe for a further dramatic price increase.

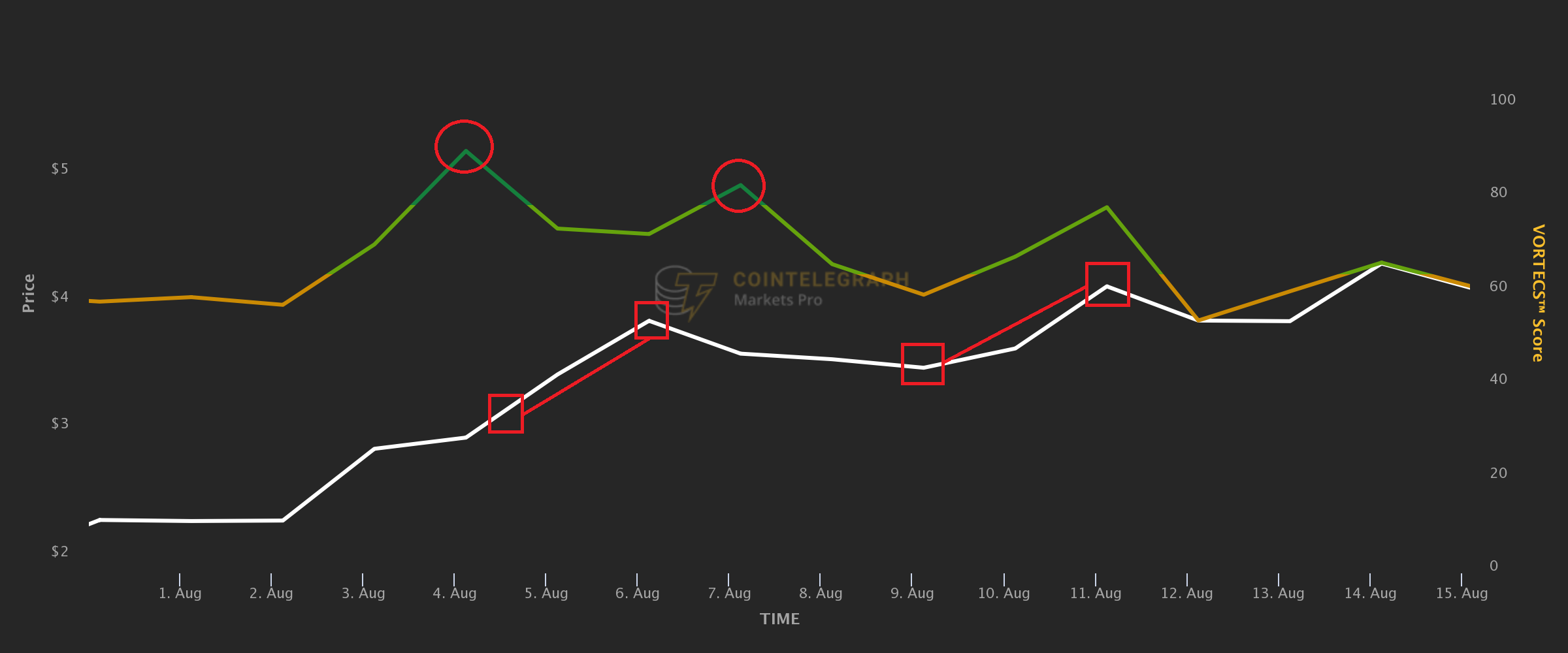

VGX price vs VORTECS™, Aug. 1-15. Source: Cointelegraph Markets Pro

VGX price vs VORTECS™, Aug. 1-15. Source: Cointelegraph Markets Pro

As visible in the chart, dark-green VORTECS™ Score peaks, which correspond to scores above 80 and mark the model’s high confidence in favorability of the observed conditions, showed up on Aug. 4 and Aug. 8 ahead of VGX’s upside phases.

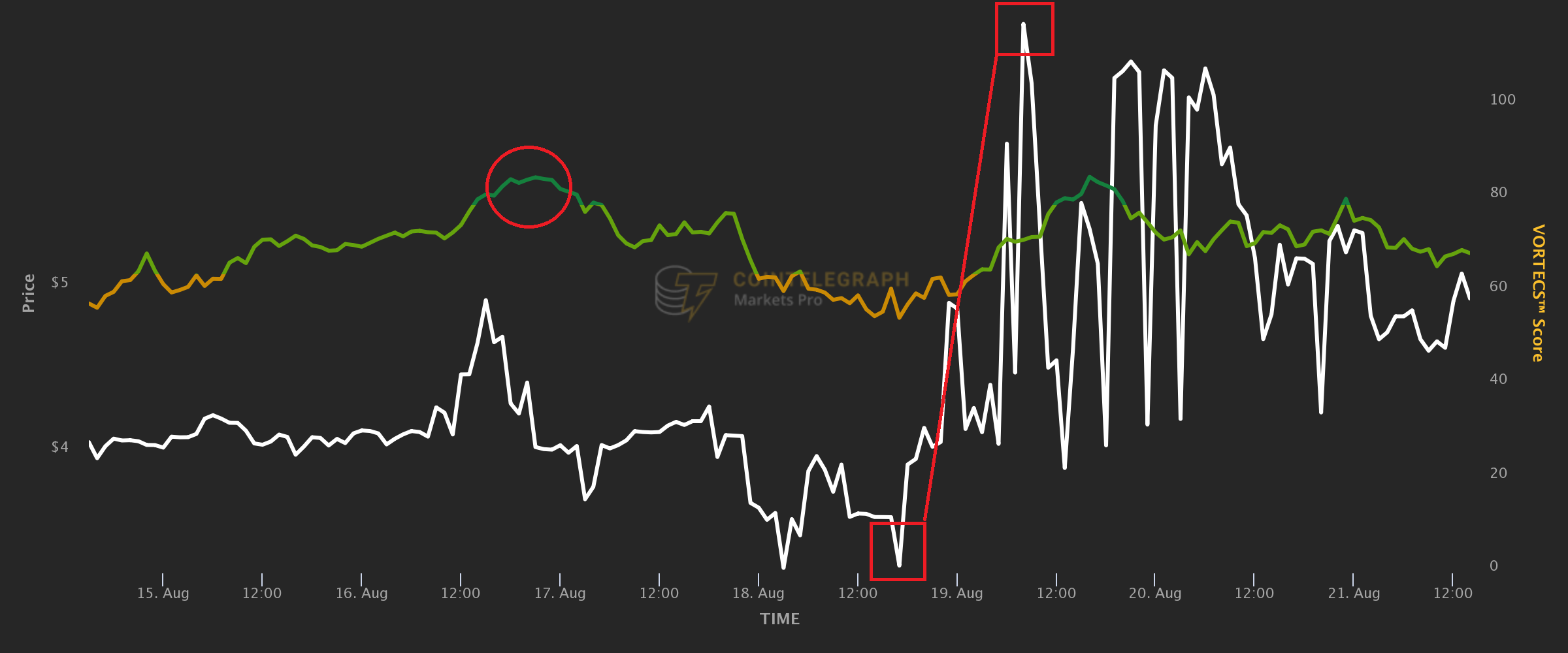

VGX price vs VORTECS™, Aug. 15-21. Source: Cointelegraph Markets Pro

VGX price vs VORTECS™, Aug. 15-21. Source: Cointelegraph Markets Pro

More recently, On Aug. 16, the token’s VORTECS™ Score went from green to dark green (red circle in the graph). The high score persisted even as the price briefly went down. It was not until 42 hours later that the favorable combination of market and social activity around the coin detected by the VORTECS™ algorithm materialized in a flash rally. VGX’s price almost doubled, exploding from $3.33 to $6.61 in just 12 hours; however, it began to swing wildly shortly thereafter.

VGX is one of Cointelegraph Markets Pro’s top assets by the all-time number of days when its VORTECS™ Score hit 80. The coin recorded 43 high-scoring days, trailing only AXS (52) and RUNE (72) since the platform launched in early 2021.

For 28 of these 43 days, the asset saw at least a 3% appreciation within 72 hours from hitting the benchmark score; on 23 occasions, the gains were 5% or more. On 19 occasions, the price of VGX rose by 10% or more within 72 hours after reaching the VORTECS™ Score of 80. And on average, the asset delivered 3.3% gains 24 hours after reaching the score, 4.3% after 48 hours, and 5% after 72 hours.

While the VORTECS™ Score is not a crystal ball telling investors when to go long or short, it can provide an actionable indication of historically bullish or bearish conditions for a particular coin — information that, as VGX’s example shows, can potentially be profitably incorporated into a trading strategy.

Cointelegraph is a publisher of financial information, not an investment adviser. We do not provide personalized or individualized investment advice. Cryptocurrencies are volatile investments and carry significant risk including the risk of permanent and total loss. Past performance is not indicative of future results. Figures and charts are correct at the time of writing or as otherwise specified. Live-tested strategies are not recommendations. Consult your financial advisor before making financial decisions.