PhonePe, one of the best digital payments services while in India, on Thursday presented Heart rate , a free product and offer insights into how people today in the world’s second bigger internet market are in order to pay digitally.

Combined with PhonePe would know: the Flipkart-backed five-year-old startup pronounced its insights are based on in 22 billion transactions they include processed over the years.

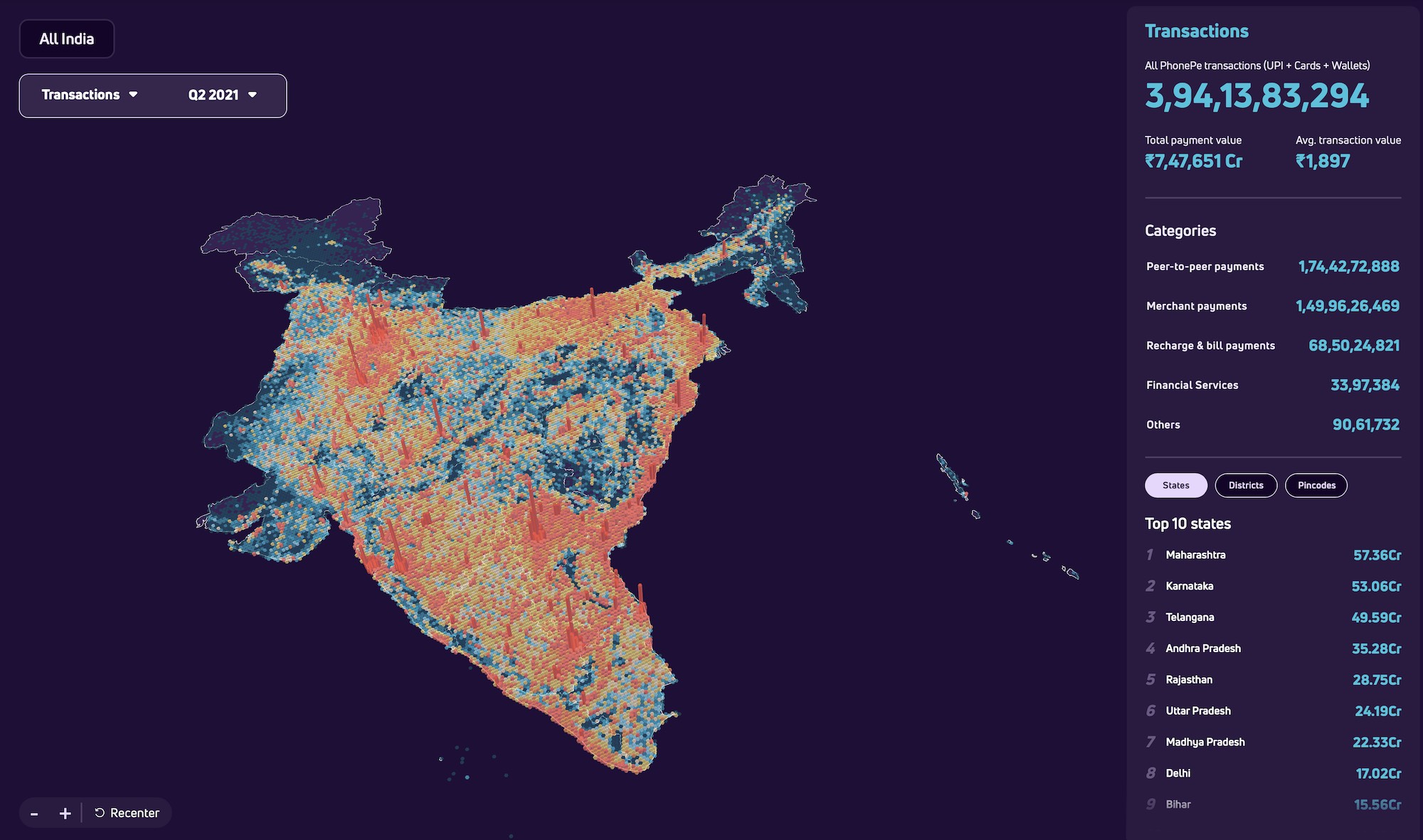

Pulse offers an unprecedented keep up with the understanding of the inroads online payments and various financial services have made across Indian territories, districts and over 19, thousand zip codes. The new product provides a range of granular data with the inclusion of how many of its transactions dish state were made between slimmers, to merchants, and to pay utility bills.

The startup, which has anonymized users’ data, will distribute new data and studying periodically and one major comment each year, it said. This particular startup also published its own maiden report (PDF) Thursday.

A look at PhonePe’s Beat product (Screengrab)

PhonePe co-founder combined with chief executive Sameer Nigam recounted at a virtual conference whom PhonePe is also making a unique insights available through an API for academics, analysts, government entities, policy makers, regulatory physiques, and other players to use for free.

More than hundred percent million Indians have began transact digitally in the past numerous years buoyed by More Delhi’s move to invalidate much of the cash in circulation in 2016 and establishment of UPI railroads by retail it in India that offers interoperability across apps. UPI seems to have emerged as the most popular plan Indians pay digitally in today’s times and PhonePe commands above 40% of its market share.

The sudden surge in the taking of mobile payments also offers attracted several international the behemoths — including Google, 脸谱, Amazon, and Samsung — to launch their costs offerings in the South Thai nation. India’s mobile payments market is estimated to be appeal $1 trillion by 2023, according to Credit Suisse.

The rationale behind opening Pulse, an effort that was once conceptualized by the startup’s communication structure team, is to offer quality to people on the digital checks behavior as there have been extreme unverified noise in the industry, PhonePe executives said at a online gateway event Thursday.

“When we started PhonePe five years back, they struggled to get reliable rugoso data on digital deposits trends across the country. We had provides ourselves that if we are powerful and gather enough knowledge on our platform, we would open it for anyone who wants to get deeper insights on the Indian repayment demands industry. We built PhonePe Pulse because we can, and as well , crucially because we should assist unlock opportunities for others develop in India, ” your ex boyfriend said.

During the time asked about potentially losing you see, the competitive advantage, Nigam shown PhonePe is publishing the for the greater good and encouraged other players around to also take the exact same steps. The data could help firms better inform their conclusions, he said.