Bitcoin (BTC) was created in the aftermath of the 2008 financial crisis and planned to solve the problems created by loose monetary policies. The cryptocurrency’s creator, Satoshi Nakamoto, said in late 2008 that the cryptocurrency’s supply increases “by a planned amount” that “does not necessarily result in inflation.”

The cryptocurrency’s inflation rate has been fixed and its circulating supply is capped at 21 million coins, expected to be mined by 2140. By then, BTC’s inflation rate will drop to zero. In contrast, fiat currencies have no finite supply and can be printed to adjust monetary policy.

An expansionary monetary policy, such as the one that has been pursued over the last few years by most countries throughout the world, aims to expand the money supply by lowering interest rates and seeing central banks engage in quantitative easing.

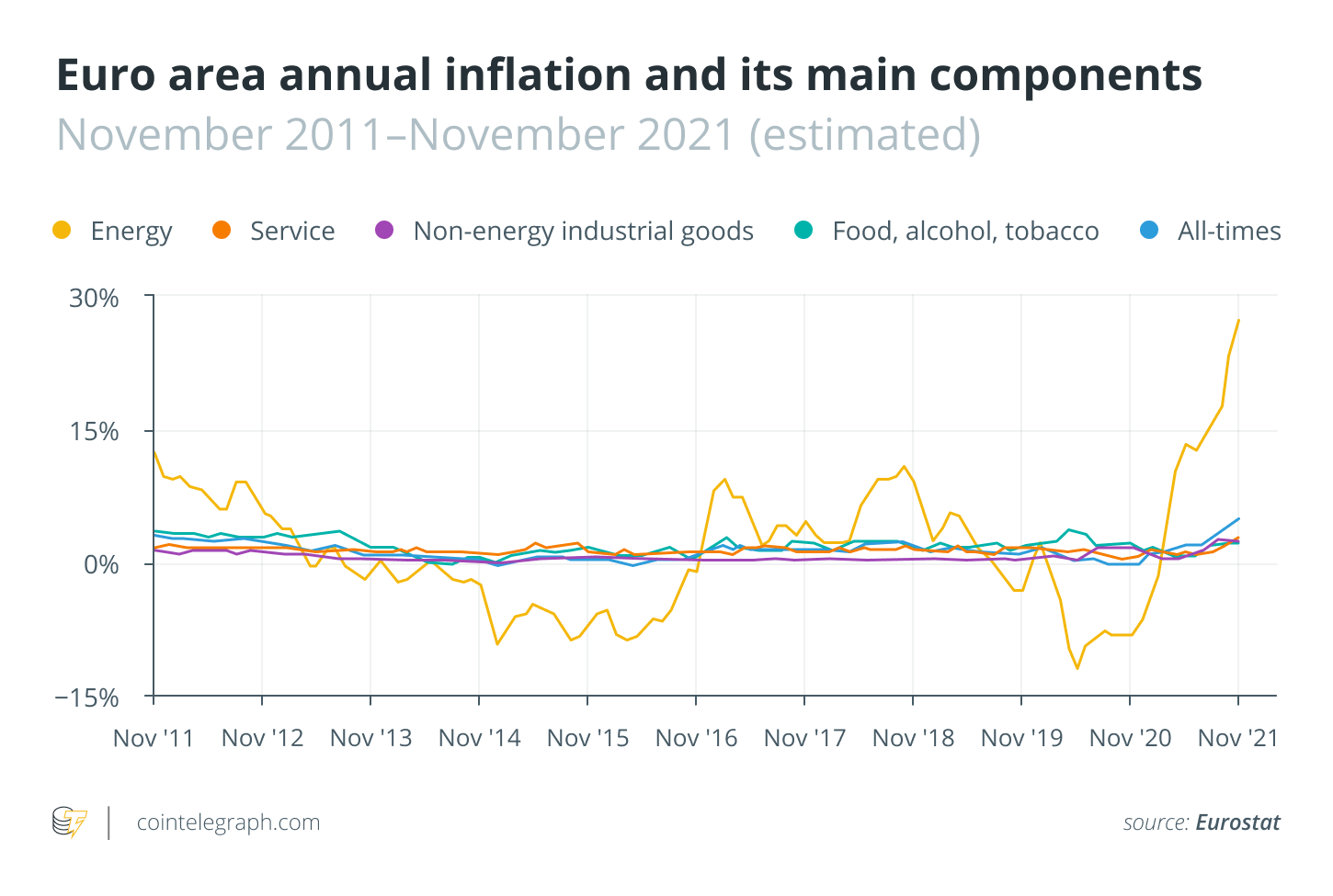

This expansionary monetary policy has long been believed to lead to higher inflation, defined as the devaluation of a payment vehicle amid the rising cost of goods and services. In November, inflation in the United States rose to a 30-year high while Eurozone inflation recorded the highest figure in the 25 years that data on it has been compiled.

Cointelegraph reached out to various experts in the industry for comment on these figures, and virtually all of them pointed the finger at expansionary monetary policies. Speaking to Cointelegraph, Chris Kline, chief operations officer and co-founder of crypto retirement platform Bitcoin IRA, said that inflation isn’t transitory and is forcing people to “find an alternative to protect their assets.”

Kline noted that while gold and real estate were strong options in the past, real estate prices are now “off the charts” while gold is “inaccessible to the average American.” Bitcoin, he added, is now a part of the “inflationary hedge mix” because its supply cannot be manipulated the same way the supply of fiat currencies can.

Speaking to Cointelegraph, Martha Reyes, head of research at cryptocurrency exchange Bequant, pointed out that the market quickly reacted to the latest inflation figures by pricing in potential interest rate hikes from central banks. To Reyes, the “root cause of these high inflation readings is a large increase in money supply, as trillions of dollars of new money were created due to the pandemic.”

Historically, gold has been used as a hedge against inflation. Bitcoin and other cryptocurrencies have often been referred to as “gold 2.0” because they possess properties that could make them a digital version of the precious metal.

Crypto as a solution against inflation

Cryptocurrencies are known for their sharp volatility, with crashes of up to 50% occurring in short periods of time even for blue-chip crypto assets. This type of volatility has left many questioning whether BTC and other cryptocurrencies could be a viable inflation hedge.

In a note sent to clients, strategists at Wall Street banking giant JPMorgan have suggested that a 1% portfolio allocation to Bitcoin could serve as a hedge against fluctuations in traditional asset classes. Billionaire investor Carl Icahn has also endorsed BTC as a hedge against inflation.

Speaking to Cointelegraph, Adrian Kolody, founder of non-custodial decentralized exchange Domination Finance, echoed Kline’s sentiment on Bitcoin being a solution to inflation but noted that in the cryptocurrency space, there are other ways to hedge against inflation.

Kolody pointed to the decentralized finance (DeFi) sector as a viable alternative. He suggested that by using stablecoins — cryptocurrencies with a price control mechanism — and decentralized applications (DApps), investors could “outpace inflation” while resisting the “risks of a spot position.” To do this, they would simply have to find a way to earn interest on their stablecoins that would be above annual inflation rates. Kolody said:

“The best way to look at it is that crypto gives you the flexibility to take control of your finances in a variety of methods instead of being at the mercy of the federal government.”

Reyes noted that Bitcoin is “more attractive as a store of value than other assets such as commodities,” as growing demand can only be met by rising prices and not additional production.

The exchange’s head of research added that the cryptocurrency is in an “early stage adoption phase” which means it “does not tend to have consistent correlations with other assets, and its price appreciation should come from the halving cycles and the growth of the network.”

Bitcoin, she added, is, as such, more “resilient to economic downturns, though in a sharp market selloff, it would probably initially also be impacted as some investors trim position across the board.”

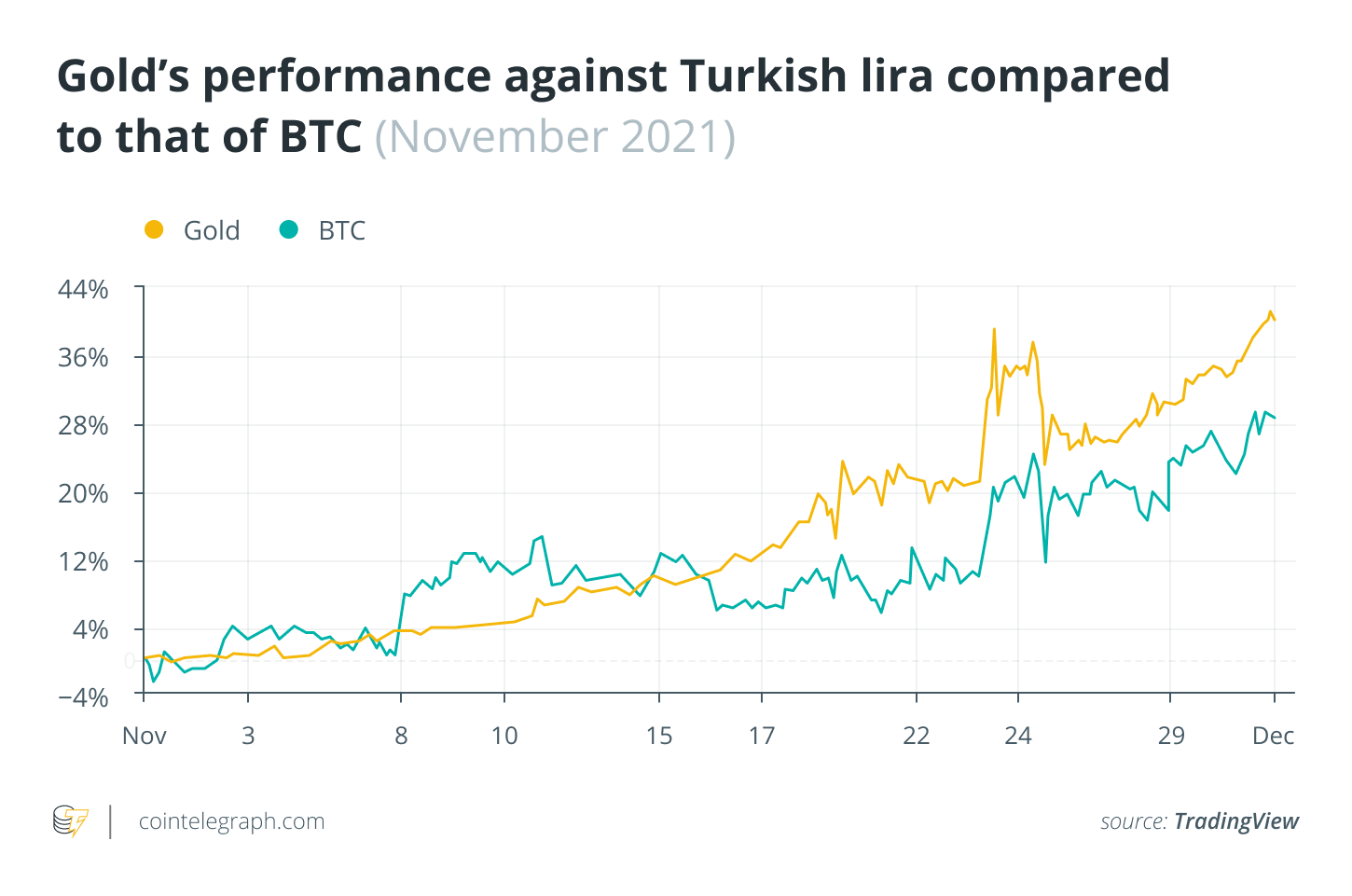

Earlier this month, Bitcoin seemingly showed off its potential as a hedge against inflation as it hit a new all-time high in Turkey as the country’s fiat currency, the lira, went into freefall. Others maintain that people in Turkey would have been better off investing in gold.

Utility and freedom, or a legacy asset?

Bitcoin has greatly outperformed gold so far this year, as it has already moved up 94% since early January. Gold, in comparison, dropped by over 8% during the same period, meaning it has so far failed investors who bet on the precious metal to hedge against inflation.

Over the short term in Turkey, the precious metal did exactly what it needed to do: It protected people’s buying power by maintaining its value while the lira plunged. Over the last 30 days, it even outperformed BTC in lira terms.

Zooming out, it’s clear BTC was a much better bet, going up 270% against the fiat currency so far this year compared with gold’s 70%. Data shows that investors would have only been better off betting on gold when the crisis escalated but that in the long run, BTC would have been a better bet.

On whether investors should choose Bitcoin or gold as an inflation hedge, Kolody argued that a “Bitcoin and crypto standard” is a better alternative to a fiat currency or the gold standard, adding that being trustless and permissionless helps crypto stand out.

This, he said, allows crypto and DeFi structures to be as powerful as they are, as investors “don’t have to worry about a political figurehead” who can “nuke” the value of their money by “simply throttling the system.” While he sees gold as a proper inflation hedge, to him, BTC is “the clear choice:”

“Investors who are trying to decide whether they should go into BTC or gold as an inflation hedge need to ask themselves if they want utility and freedom with their hedge, or a legacy asset.”

Karan Sood, CEO and managing director at Cboe Vest, an asset management partner of Cboe Global Markets, told Cointelegraph it’s worth noting that Bitcoin’s relatively nascent history has “cut both ways in the past” as there have been “periods where both Bitcoin and inflation have risen and fallen in tandem.”

Sood added that Bitcoin’s inherent volatility has the potential to magnify these moves. As an example, he said that if current inflation levels prove transitory and fall from their highs, Bitcoin “may also fall precipitously, exposing investors to significant potential losses.”

As a solution, Sood suggested investors looking to use BTC to hedge against inflation may “benefit from accessing Bitcoin exposure via a strategy that seeks to manage the volatility of Bitcoin itself.”

Speaking to Cointelegraph, Yuriy Kovalev, CEO and founder of crypto trading platform Zenfuse, said that while the lira’s freefall could have meant betting on gold was a good move, for U.S.-based investors it wasn’t:

“Gold has underperformed this year, dropping by 8.6% against the dollar while the CPI in the U.S. moved up 6.2%. Gold failed investors who bet on it while BTC is up 92.3% year-to-date, rewarding those who believed in it as a hedge.”

Reyes conceded that while Bitcoin offers better returns as measured by the Sharpe ratio, investors may “want gold in their portfolio for diversification purposes even though it has not performed well this year.”

A diversified portfolio may, for more conservative investors at least, be a more sensible solution to hedge against inflation, as it isn’t yet clear how Bitcoin’s price will move if inflation keeps rising.

A muddied truth

Whether Bitcoin and cryptocurrencies, in general, offer a better solution to the current financial system isn’t clear. To Stephen Stonberg, CEO of crypto exchange Bittrex Global, a “balanced combination of both systems is what we should be striving for.” Stonberg said:

“There are advantages to both models, but Bitcoin and the entire digital asset economy need to be further integrated into the traditional financial system if we want to reach those who are unbanked in the world.”

Caleb Silver, editor-in-chief of the financial information portal Investopedia, told Cointelegraph that the “truth is muddy” when it comes to Bitcoin acting as a hedge against inflation.

Per Silver, Bitcoin is a relatively young asset compared to traditional inflation hedges like gold or the Japanese yen, and while it has features that are “important ingredients in its perception as an inflation hedge,” its wild price swings affect its reliability.

To him, investors need to keep its volatility over the past decade in mind:

“It has entered 20 distinct bear markets over the past ten years and experienced a 20% or greater drawdown for nearly 80% of its history. Consumer prices, until the pandemic, have been distinctly non-volatile for the past decade.”

Silver added that Bitcoin is a “highly speculative asset” even though institutional investors have been adopting it for more than two years. He concluded by saying that Bitcoin not being seen as a store of wealth by most market participants “hurts its credibility as an inflation hedge.”

To hedge against inflation, investors have a plethora of tools at their disposal, not just Bitcoin. Only time will tell what will and won’t work, so a diversified portfolio may be the answer for some investors. Tools at their disposal, according to our experts, include BTC, gold and even DeFi protocols that help them outpace inflation.