Decentralized lending platform Aave has launched its permissioned lending and liquidity service Aave Arc to help institutions participate in regulation-compliant decentralized finance.

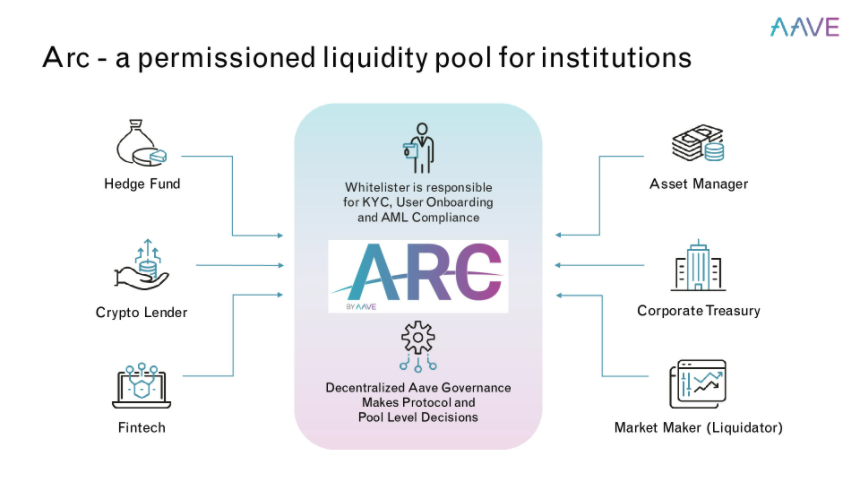

As opposed to its permissionless cross-chain counterparts on the platform, Aave Arc is a permissioned liquidity pool specifically designed for institutions to maintain regulatory compliance in the decentralized finance (DeFi) space.

The first of 30 entities lined up for the whitelist for Aave Arc was Fireblocks, the institutional digital asset custodian. It explained in a Jan. 5 announcement the pool “enables whitelisted institutions to securely participate in DeFi as liquidity suppliers and borrowers.”

Users of Aave Arc must perform due diligence procedures such as know your customer/ anti-money laundering (KYC/AML) in order to gain access.

Slides from Aave’s first reveal of the permissioned pool in July 2021.

Slides from Aave’s first reveal of the permissioned pool in July 2021.

Fireblocks also serves as a whitelisting agent for Aave Arc, ensuring other institutions that wish to join the permission pool perform KYC/AML requirements. Aave cannot perform this task itself because it is not a regulated entity such as a bank or other traditional finance institution.

As the whitelisting agent, Fireblocks has already approved “30 licensed financial institutions to participate on Aave Arc as suppliers, borrowers, and liquidators.”

Among some of the whitelisted entities are Anubi Capital, Canvas Digital, CoinShares, GSR, and crypto yield aggregator Celsius.

Related: SBF ‘optimistic’ about institutional crypto adoption in 2022

Aave’s new permissioned liquidity pool aims to onboard more institutions to the burgeoning DeFi space that has $133 billion in total value locked (TVL) as of time of writing. That TVL has grown 4.5 times since Jan. 10 of 2021 according to DappRadar.

While institutions began purchasing cryptocurrency in increasingly sizable portions in 2021, most remained skittish about dabbling in DeFi due to compliance hurdles and regulatory uncertainty.