Bain Capital Ventures, one of the world’s largest startup-investment firms with $5.1 billion in assets under management, has announced the formation of a new $560 million fund that will focus on crypto-related investments.

According to a March 8 Bloomberg report, the fund closed in November and it has already invested $100 million in 12 undisclosed projects.

Bain Capital Ventures has a history of investing in the crypto and blockchain sector, having previously backed companies such as BlockFi, Compound, and Digital Currency Group. The most recent fund BCV Fund I is the first of its kind from Bain Capital Ventures, focusing solely on the crypto market.

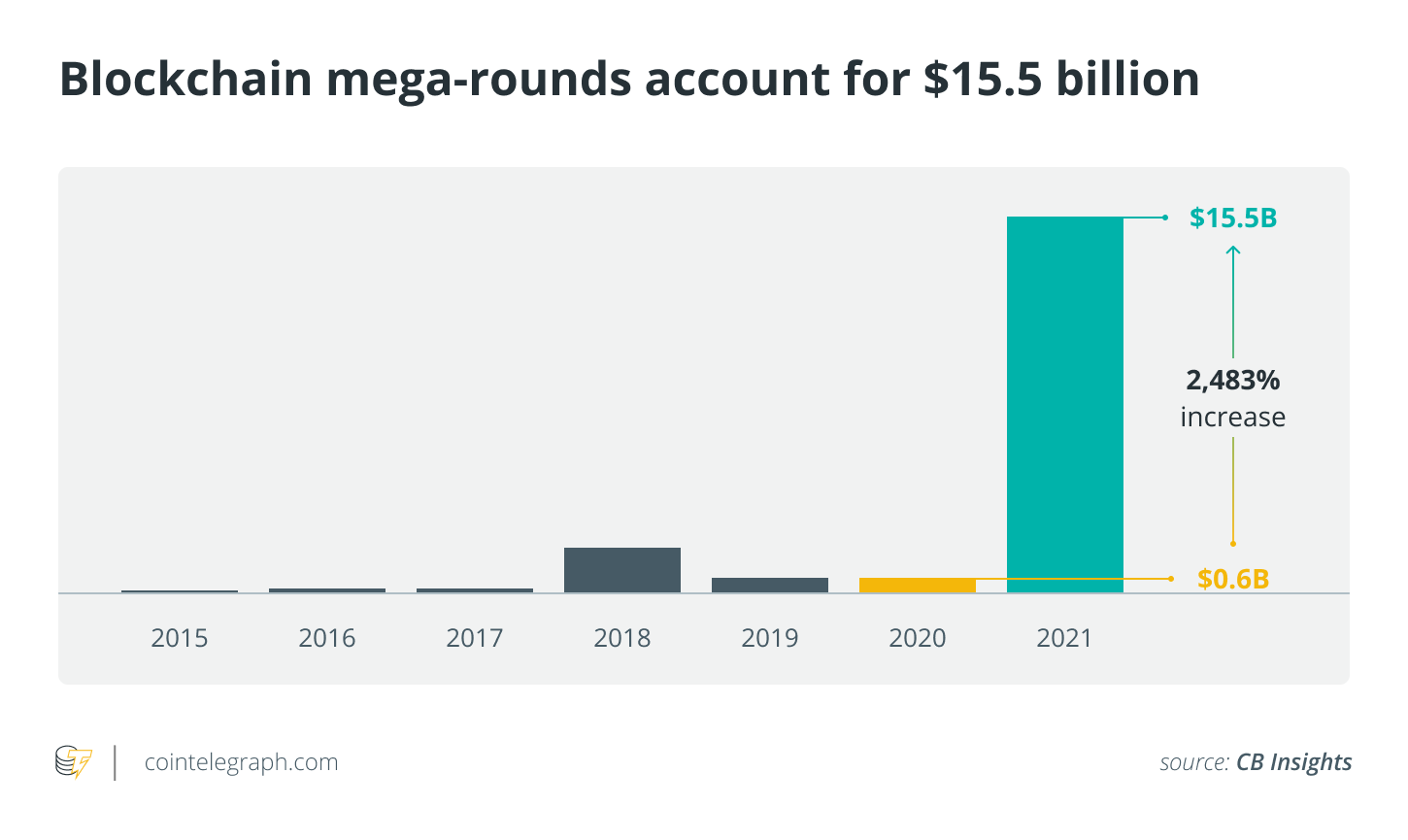

The latest development comes following a slew of venture capital interest in crypto throughout 2021. According to data from Pitchbook, venture capital investment in crypto projects topped $25 billion last year, the highest amount ever on record.

Related: Meet the top 5 busiest crypto funders of 2021, according to PwC

In 2022, although crypto asset prices are highly volatile, venture funds have continued to make key investments in the sector. In February, American venture capital firm Sequoia Capital announced the creation of a $600 million cryptocurrency fund. Polygon raised $450 million in a funding round backed by some of blockchain’s top venture firms.

The cryptocurrency market is in a slump. Bitcoin (BTC) price has dropped around 40% from its all-time high in early November as concerns mount over the Federal Reserve’s monetary policies to combat rising expenses and geo-political conflicts.

Cointelegraph has contacted Bain Capital Venture for further details regarding the crypto fund and will update the article when more information becomes available.