Bitcoin (BTC) has jumped to new seven-week highs and confidence is returning over the global macro outlook.

The most definitive charge on $21,000 has seen BTC/USD reach its highest levels since Sep. 13, data from Cointelegraph Markets Pro and TradingView confirms.

After volatility caused by the United States Federal Reserve interest rate hike, Bitcoin made up for lost time and days later left bears and shorters in the dust.

With sentiment split over what the Fed will decide next month, there is still a sense of lessening doom among crypto commentators, with predictions of $30,000 reappearing in November returning.

The picture for the rest of Q4 remains muddy, as some still expect 2022 to copy the 2018 bear market. At the same time, there is hope that this bearish trend will be gone for good by the New Year.

The overall crypto market cap has already passed the $1 trillion mark once again, according to data from CoinMarketCap.

Cointelegraph takes a look at three major factors influencing crypto market strength in the current environment.

The Fed could change its tune on rate hikes

When Cointelegraph reported on why the crypto market saw fresh losses last month, the United States Federal Reserve was first on the list.

Concerns focused on unwavering policy keeping the U.S. dollar strong and rates surging higher for the foreseeable future — the worst-case scenario for risk assets.

At the same time, rumors are gathering over the outlook for rate hikes as the Fed runs out of room to maneuver. After the November 75-basis-point hike, suspicions are that policy will begin to U-turn, making smaller hikes in subsequent months before reversing altogether in 2023.

As such, any signal that the Fed is preparing to soften its hawkish stance is being seized on by markets weary from a year of quantitative tightening (QT).

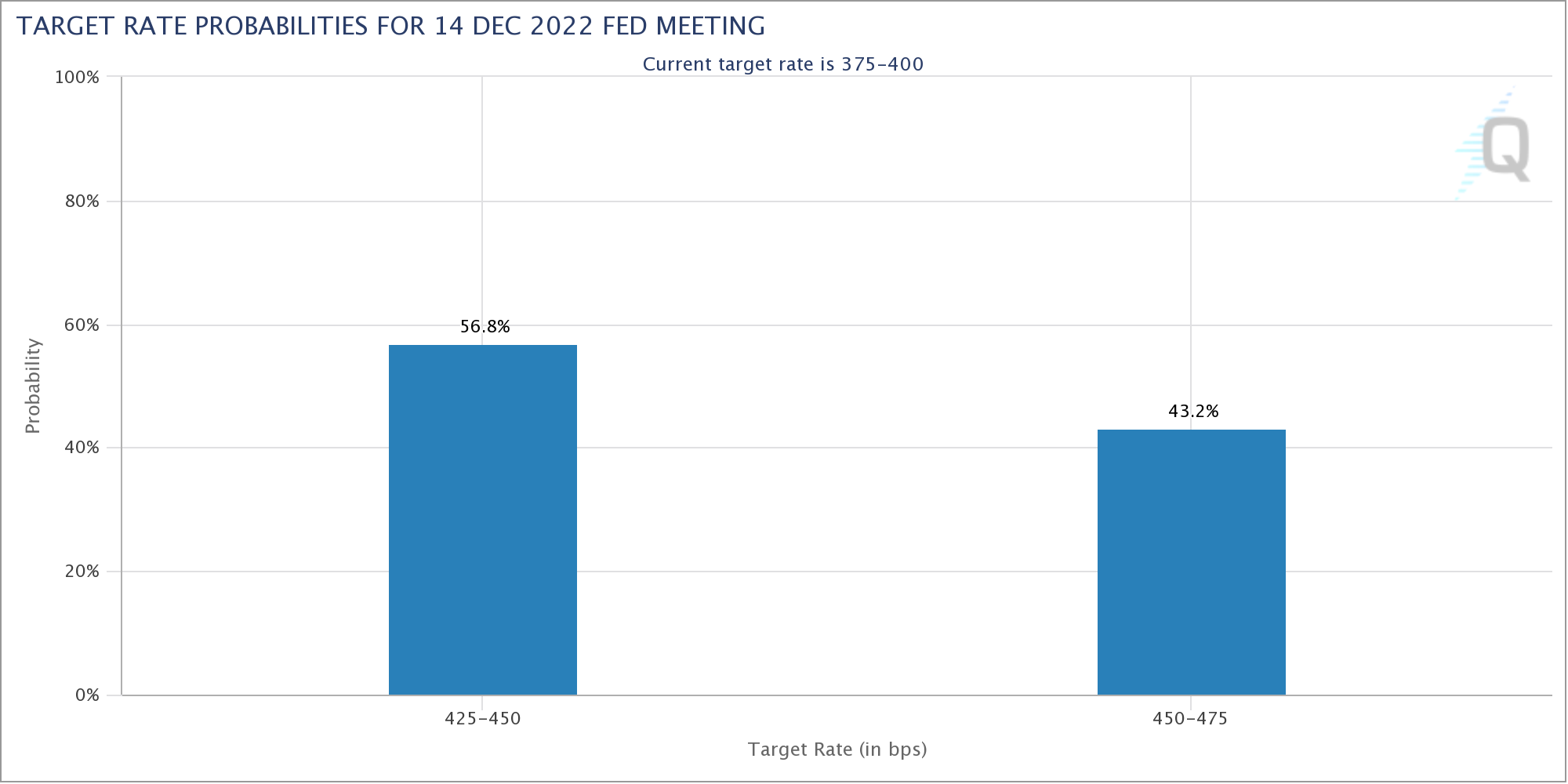

December’s Federal Open Market Committee (FOMC) is currently expected to yield a hike of 50, not 75, basis points, according to CME Group’s FedWatch Tool.

Unemployment data released on Nov. 4 fueled bulls’ confidence. Coming in higher than expected, the implication could be that the rate hikes are having their desired effect — and that a pivot could thus come sooner rather than later.

Bitcoin volatility snaps record low levels

Analyzing data from Cointelegraph Markets Pro and TradingView, it becomes clear that BTC/USD has been too quiet for too long.

This is especially visible in the Bollinger Bands volatility indicator, which has been rarely closer together in Bitcoin’s history and demanding a breakout for weeks.

Last month, Bitcoin volatility even fell below that of some major fiat currencies, making BTC look more like a stablecoin than a risk asset.

Analysts had long expected the trend to undergo a violent change, however; and true to form, crypto markets did not disappoint.

A look at the Bitcoin historical volatility index (BVOL), recently at multiyear lows seen only a handful of times, shows that Bitcoin still has a way to go to abandon this characteristic.

“Pretty funny that volatility has been so compressed and we’ve become so conditioned as market participants that the slightest 3% move feels like a 15-20% move,” William Clemente, co-founder of crypto research firm Reflexivity Research, commented.

Dollar eyes a new chapter

After a parabolic uptrend throughout 2022, the U.S. dollar is only just beginning to show signs of weakness.

Related: Bitcoin seller exhaustion hits 4-year low in ‘typical’ bear market move

The U.S. dollar index (DXY) recently hit its highest levels since 2002, and momentum may yet return to take it even higher — at the expense of risk assets and major currencies alike.

In the meantime, however, the DXY is under pressure, and its descent came in lockstep with a return to form for Bitcoin and altcoins.

This flags an issue that Bitcoin bulls are keen to shake — an ongoing strong correlation with traditional markets and inverse correlation with the dollar.

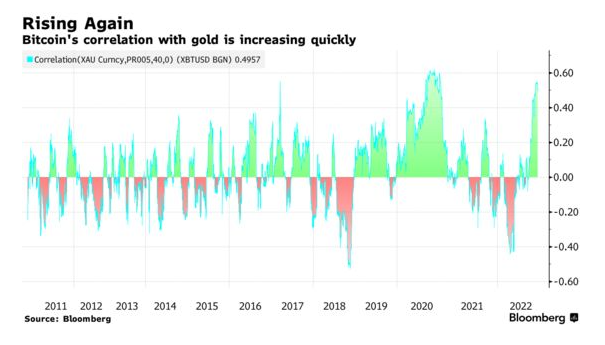

“Bitcoin now has a correlation with Gold of about 0.50, up from 0 in mid-August,” trading firm Barchart revealed this week.

“While the correlation is higher with $SPX (0.69) and $QQQ (0.72), the correlations have decreased of late.”

Fellow analyst Charles Edwards, founder of crypto asset manager Capriole, noted that Bitcoin macro price bottoms are often accompanied by increasing gold correlation.

Scott Melker, the analyst and podcast host known as “The Wolf of All Streets,” also confirmed a changing relationship between Bitcoin and the Nasdaq.

“Nasdaq futures are down. Bitcoin is up. The short term correlation between the two has disappeared over the past few weeks. I will take it,” he summarized.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.