The price of Bitcoin (BTC) is continuing to range between $48,000 and $51,000, unable to break out of the $51,600 resistance level.

If Bitcoin struggles to surpass the $51,600 resistance area in the near term, technical analysts say the probability of a correction rises.

BTC/USDT 4-hour price chart (Binance). Source: TradingView

BTC/USDT 4-hour price chart (Binance). Source: TradingView

$51,600 is the key level to watch

According to Josh Olszewicz, a cryptocurrency trader and technical analyst, the $51,600 level is currently acting as a strong resistance level.

For Bitcoin to retest the all-time high at $58,000 and initiate a potential rally towards $62,000, it needs to cleanly move past $51,600, he explained.

Hence, a rally beyond $51,600 is the clear invalidation point for any short-term bearish scenario for Bitcoin.

The failure to break out in the near term could result in a bearish test of lower support areas, found at around $42,000. He said:

“If 4h breaks down, be prepared for some uber bearish calls to start popping at 36.7k meanwhile, I’ll be bidding the daily Kijun at 42k. Alternatively, if $BTC breaks above 4h Cloud at 51.6k, I like ATH retest at 58k, R3 yearly pivot test at 62k, macro PF diag test at 70k, R4 yearly pivot test at 80K. Seasonality suggests we go neutral/sideways through March and then reach for those higher targets in Q2.”

The $42,000 support area is a key level because it marks the top of the previous rally. On Jan. 8, the price of Bitcoin peaked at $42,085 on Binance, seeing a steep correction afterwards.

Bitcoin dropping to $42,000 to retest the previous top as a support area would not be necessarily bearish beyond the short term, however.

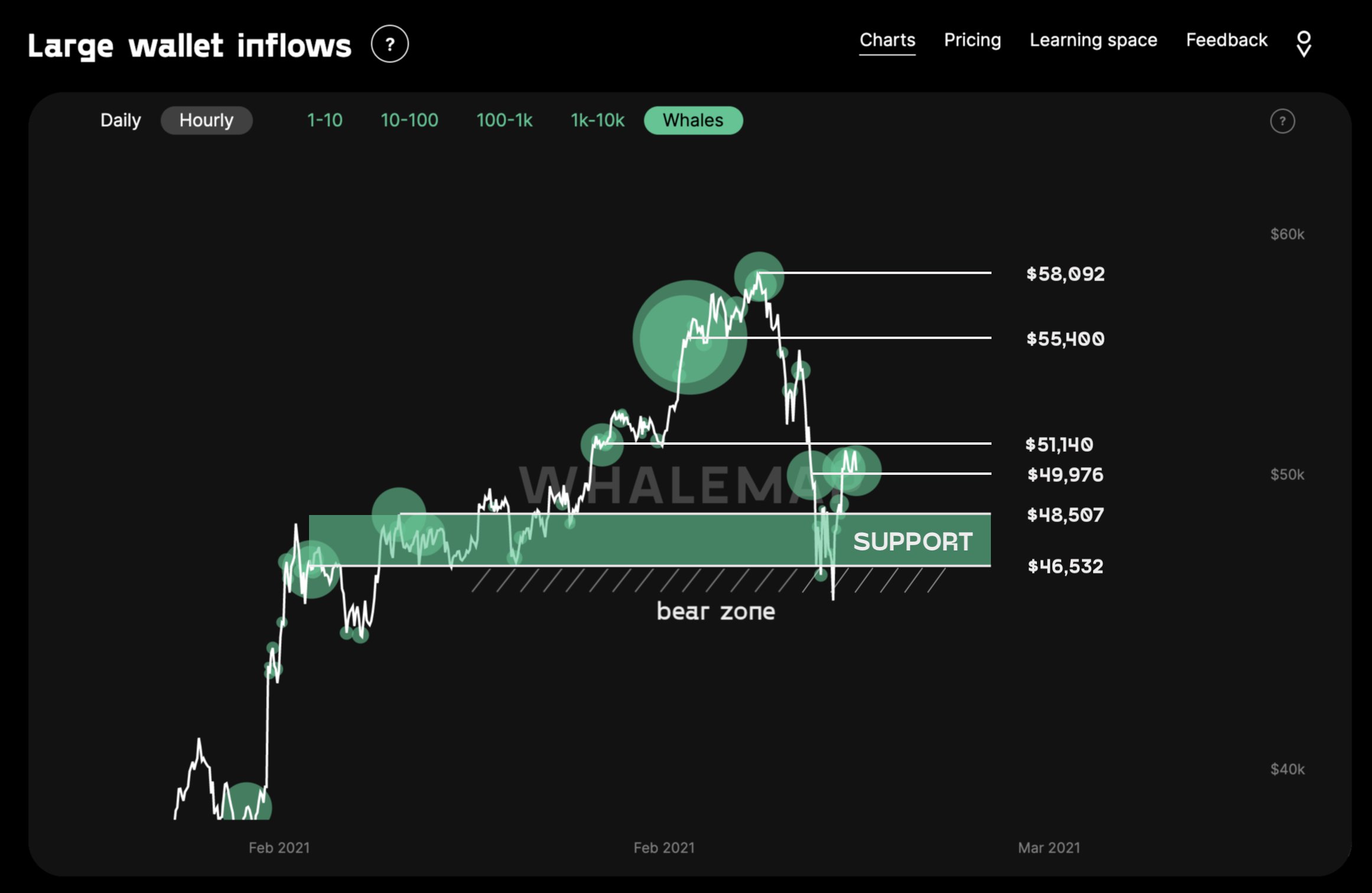

Whale clusters show similar levels of support

Moreover, analysts at Whalemap noted large inflows to whale wallets at $48,500 and $46,500, which they say should provide BTC with some support.

“The current situation looks similar to the one we had at 29K,” they explained. What’s more, the $46,532 level may now be “the new $29,000,” which held as support during the previous correction in January before the rally continued. They added:

The $55,400 is an important level to keep an eye on as well. Getting back above it will be a good sign

Whale cluster levels. Source: Twitter/@whale_map

Whale cluster levels. Source: Twitter/@whale_map

The most compelling argument for a short-term Bitcoin drop

Bitcoin tends to seek liquidity after a prolonged consolidation, which means it can drop down to fill buy orders at lower support areas that can ultimately fuel a new rally.

A pseudonymous trader known as “Salsa Tekila” echoed this sentiment. He said that there is a big support area at $41,000, followed by resistance at $54,000. He wrote:

“My current take on $BTC mid term: 1) Support around $41K. 2) Resistance around $54K. Depending on context, I might trigger swings around those two vicinities. Likely just scalp until then, unless major events come to fruition.”

Bitcoin tested the $44,800 support level in the past 72 hours, but it was not enough to propel BTC above $51,600.

This trend could cause the price of Bitcoin to drop back to the $44,800 level or to a lower support level, at $42,000.

The ideal scenario would be for Bitcoin to hold onto the $44,800 support area if it drops again, stabilize it as a macro support level, and move back up.