Litecoin (LTC) emerged as one of the best-performing cryptocurrencies on June 1 as the market’s attention shifted to its strong network growth in recent months.

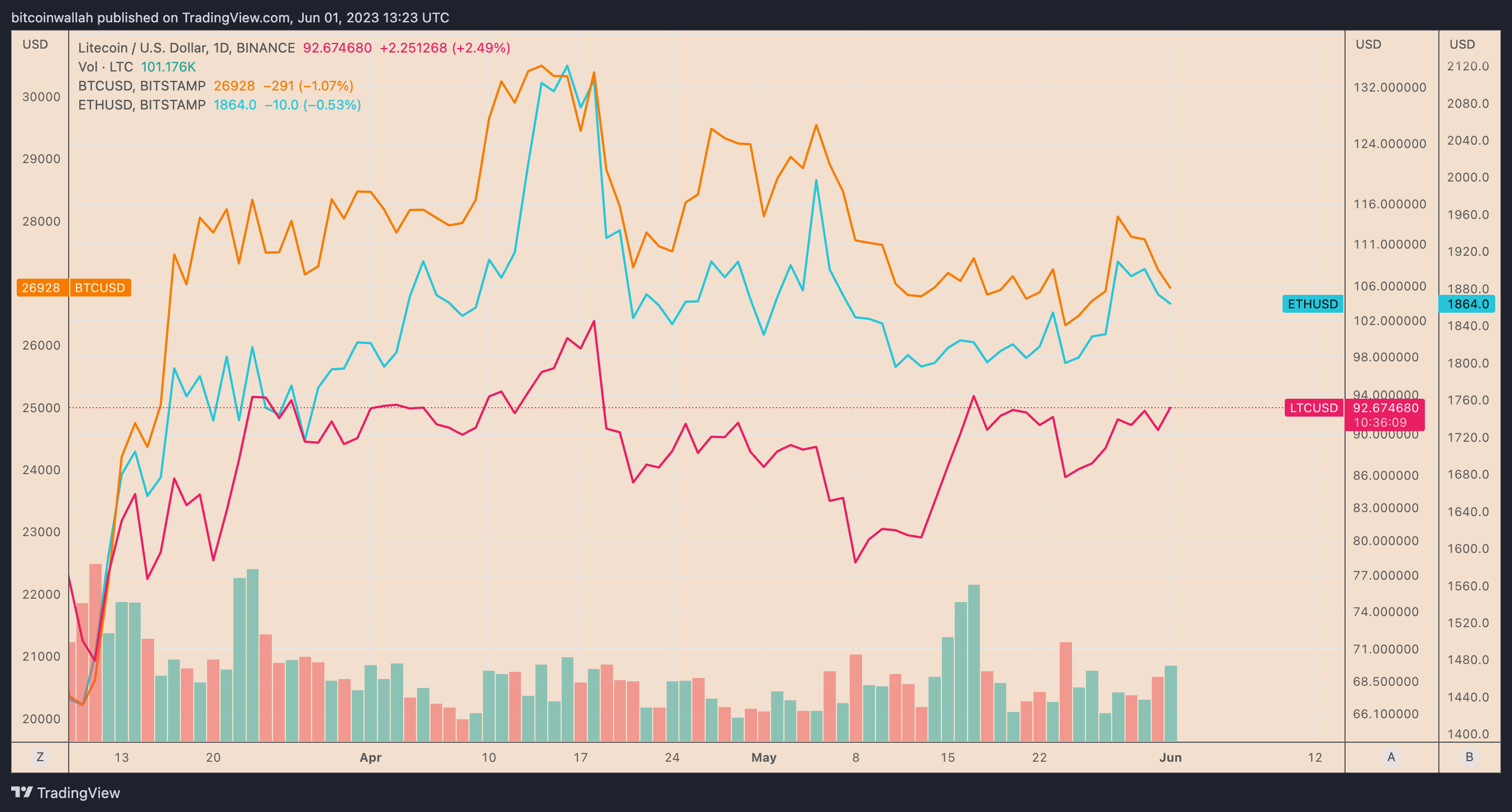

The LTC price jumped 3% to an intraday high of around $95. In comparison, its top-rivaling assets, Bitcoin (BTC) and Ethereum (ETH), dropped 2.25% and 1.75%, respectively, thus registering a rare decoupling between the markets.

Litecoin unique addresses jump in May, shatterin previous records

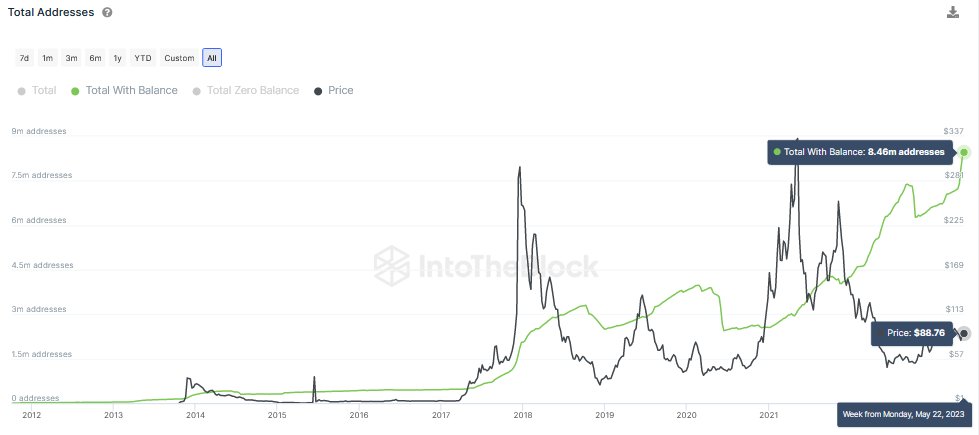

The recent Litecoin market gains appeared two days after IntoTheBlock’s favorable tweet about the token.

In the tweet, the blockchain analytics platform highlighted historically strong growth in Litecoin’s non-zero addresses. Notably, the count reached nearly 8.5 million on May 22 from around 7.09 million at the beginning of April.

The growth may have resulted from existing Litecoin holders distributing their coins across newly-created wallets. In addition, it may have come due to the arrival of new Litecoin users, which suggests a rise in buying demand for LTC tokens.

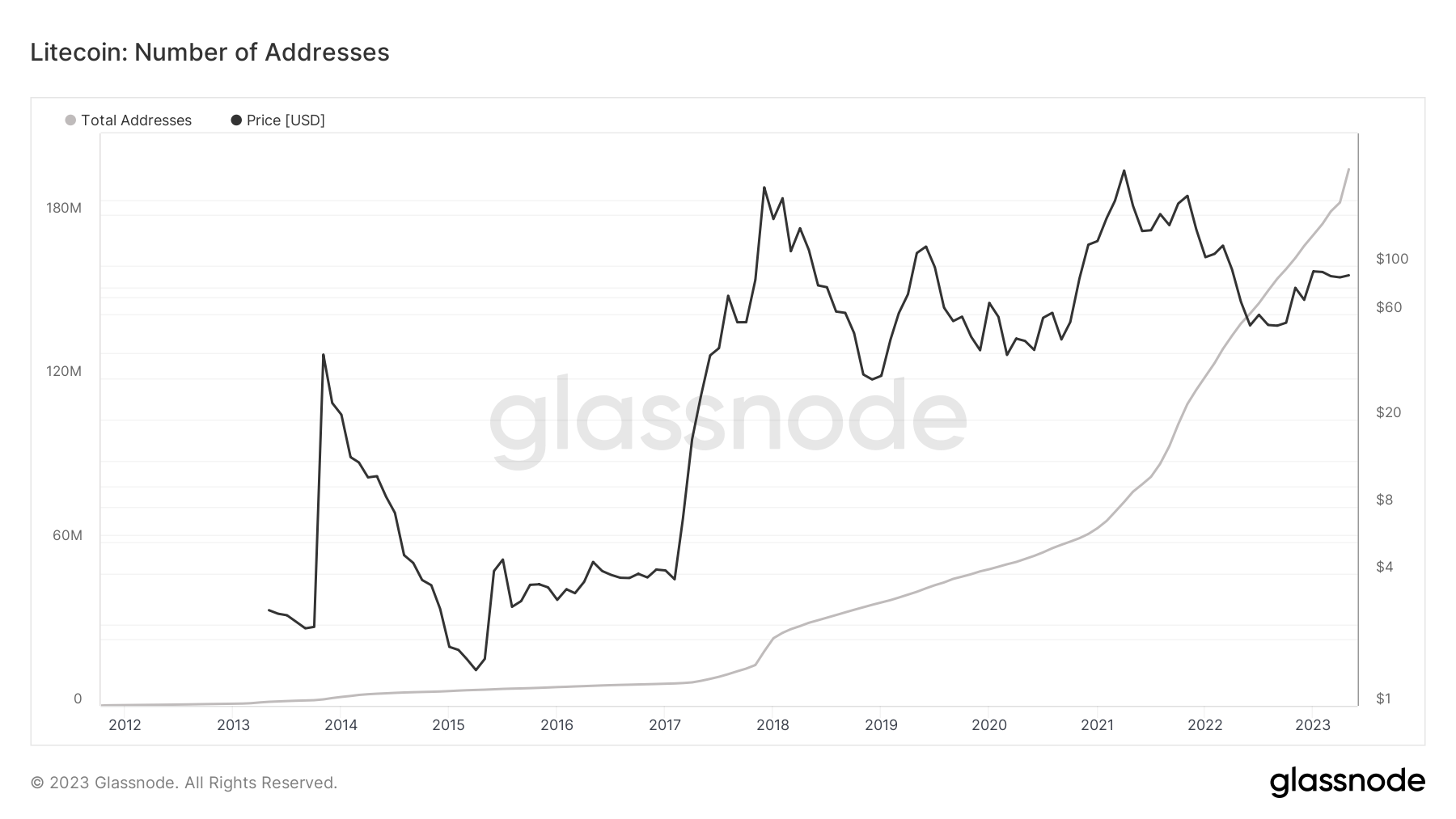

Meanwhile, the total number of unique Litecoin addresses grew in May from 184.66 million to 196.84 million, the strongest monthly rise on record.

The rise in Litecoin’s network activity coincided with its foray into the nonfungible token (NFT) sector with a new token standard called LTC-20. Furthermore, growing upside speculation in the days leading up to Litecoin’s halving in August may have also boosted the LTC address count.

Is $100 Litecoin next?

Litecoin’s intraday jump has brought its price near a short-term resistance range of around $93 to $96, which has capped its upside attempts since April.

A decisive move above the $93 to $96 area could have LTC price eye $100 as its next upside target. Conversely, a pullback from the range could mean a run-down toward Litecoin’s short-term ascending trendline support, which coincides with its 50-day exponential moving average (the red wave) near $89.

Related: Litecoin price poised for 700% gains vs. Bitcoin, says Charlie Lee

Looking long-term, Litecoin sees a run-up toward $250, partly due to a classic bullish reversal formation and the other due to growing euphoria around its halving, a pattern observed in the chart below.

Another analyst operating under the alias ‘Doctor Profit’ expects the LTC price to rise on halving FOMO, but until $150. He added:

“My plan is to sell in mid June, one month before halving.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.