The non-fungible token rush has seen every man and his Doge flock to the non-fungible market to cash in on the recent craze for tokenized collectibles. Even celebrities one would presume to have little engagement with crypto assets have been rushing to cash in, with the likes of John Cleese, Tony Hawk, Lindsay Lohan and Ja Rule cobbling together NFTs of varying artistic merit in recent months.

However, surging NFT adoption has led to public backlash over the perceived carbon footprint associated with crypto asset technologies.

Nifty Gateway pledges to go carbon-negative

NFT platform Nifty Gateway announced on March 29 that it has plans to become carbon-negative in the near future.

In a post shared on the website of Nifty investor Gemini, the platform’s co-founders announced plans to calculate Nifty Gateway’s carbon emissions over time and purchase twice as many carbon offsets at the end of each month — theoretically making Nifty a net remover of carbon overall.

While the post acknowledged the environmental concerns regarding NFT proliferation, Nifty’s founders characterized the concerns as the product of double-standards the crypto industry is often subjected to.

“Ironically, because blockchains give the world such a transparent and accurate accounting of the energy consumption of our industry, they provide a tangible number to focus and dwell on, which has led to a double standard being applied to our industry,” the post said, adding:

“There is no blockchain to account for the carbon footprint of the traditional art world.”

Nifty will also deploy a new token minting system that will utilize Ethereum’s recent EIP-2309 upgrade that it expects to improve the energy efficiency of its token creation by 99%.

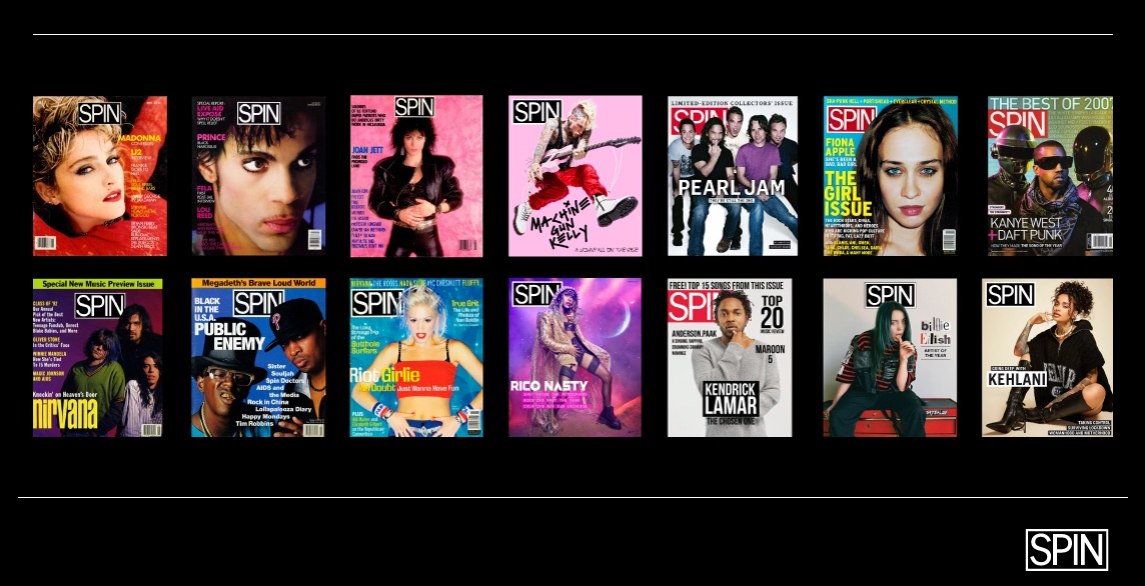

Defunct music mag to tokenize back catalog into “sustainable” NFTs

Popular music media publication Spin has partnered with corporate liquidity firm Nax to issue NFTs depicting the magazine’s acclaimed photography, claiming the tokens are environmentally sustainable.

Spin, which now operates as a media company after running as a print magazine between 1985 to 2012, will provide its full content archive to be tokenized and collected.

While the two companies have announced they will work to launch an “energy-friendly” NFT marketplace and issuance platform to host Spin’s tokens, the announcement did not make any estimates as to the upcoming platform’s carbon footprint.

Investing in NFTs is like going to the casino: CEO of BNP Paribas bank

During an interview with Bloomberg on March 24, the CEO of French bank BNP Paribas, John Egan, described NFTs among the most “risky categories of assets.”

Likening NFT investment to visiting a casino, Egan urged collectors to only purchase non-fungibles for fun:

“I don’t think we could find many more risky categories of assets at this point. I think it’s probably akin at this stage, to going into the casino. You know you’re going to spend money but maybe you’re doing it for enjoyment, for the experience.”

“If you win, you’ve got lucky and I think it’s the way we need to think about it at this point; it’s in its initial phase,” he added.

Despite the gambling analogy, Egan predicted that NFTs will become a “bedrock economic infrastructure” within the virtual economy over the next decade.

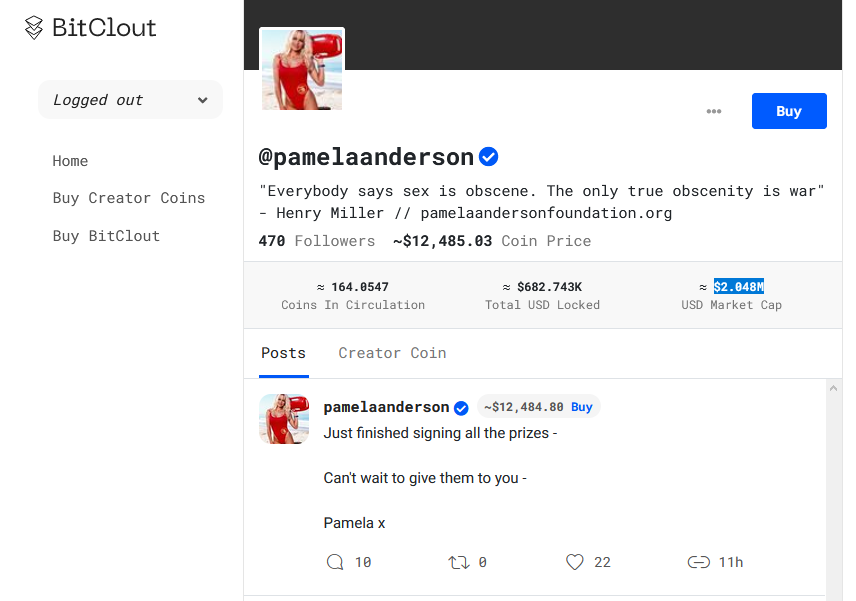

Pamela Anderson hints at upcoming NFTs

Pamela Anderson has been active on social token platform BitClout after becoming verified on March 27. The former Baywatch star is handing out signed copies of her final Playboy magazine cover from 2016 to the three biggest holders of her creator coin.

BitClout is among several platforms that have emerged to facilitate celebrity NFT cash-grabs, enabling influencers to mint “creator coins” for their fans to trade and collect.

Anderson’s coin is currently valued at more than $12,000, with the celebrity hinting that token holders may soon receive an NFT airdrop:

“My sons told me about NFTs — Who knows… I might just give a Pamela NFT to all my coin holders when the time comes ;)”