Momentum trading driven by retail investors seems to have taken on a new life since the onset of the global standstill occasioned by the ongoing coronavirus pandemic. Where celebrity challenges used to dominate viral trends on social media, issues relating to personal finance and investments seem to be as popular these days.

This increasing interest in the financial markets from workaday folks has also spread to the crypto space as digital currencies posted sharp price recoveries from the slumps that characterized the Black Thursday crash of March 12, 2020.

While interest is palpable, some gatekeepers question whether the new generation of retail investors is sufficiently knowledgeable to be investing in risky assets. But has the management of personal finances and investing become a new fashionable trend?

COVID-19: Challenge and opportunity

Trading apps like Robinhood and Coinbase have recently become the most downloaded on Apple’s App Store, ahead of popular social media services such as TikTok and Instagram. Given the sway held by social media over popular culture in the last decade, investment apps seeing the most downloads could point to a pivot in interests especially among the younger demographic.

According to a survey published by U.S. investment giant Charles Schwab, 15% of the current retail investors in America began investing in 2020. Indeed, the United States brokerage industry is estimated to have added 10 million new clients in 2020, with retail trading app Robinhood accounting for over 60% of the total figure.

The retail investment boom in 2020 can be attributed to two factors: market volatility and coronavirus lockdowns. With the global economy virtually on standstill, governments sought to stimulate growth and recovery by significant cash infusions in the form of stimulus packages.

According to the Charles Schwab survey, Millennials and Generation Z constitute the majority of the newbie investor class created in 2020. Indeed, Millennials accounted for over half the number of participants who said they got into the asset market amid the onset of the COVID-19 pandemic. Jonathan Craig, senior executive vice president and head of investor services at Charles Schwab, told Cointelegraph:

“We’ve seen tremendous growth and engagement among individual investors over the past year as a result of lower trading costs, new products and services aimed at greater ease and accessibility, and the investing opportunities presented by market volatility.”

Perhaps fearful of inflation and monetary debasement, more retail investors appear keen to secure suitable hedges against economic uncertainty. In a conversation with Cointelegraph, Jay Hao, CEO of crypto exchange giant OKEx, identified the COVID-19 pandemic as a significant trigger for the current retail investment surge, adding:

“The pandemic has probably sped up crypto adoption due to the Federal Reserve massively pumping money into the market over last year to save the U.S. economy. […] With more platforms having granted retail investors direct access to invest in equities, we are seeing a democratization of the investment space and more power in the hands of the people.”

The coronavirus continues to have a significant impact on personal finances ranging from salary cuts to furloughs or even outright job losses. Thus, it is perhaps unsurprising to see more people becoming incentivized to build emergency income sources outside the traditional 9-to-5 structure.

Throwing crypto into the mix

As previously stated, Robinhood accounted for over 60% of the new investors added by U.S. brokerages in 2020. This figure puts the retail trading platform in a suitable position to determine newbie investment trends within the last year.

According to a blog post on the company’s website earlier in April, the trading platform declared that its customers were leading the vanguard of the demographic change in the financial markets. In the aforementioned Charles Schwab survey, the investment giant called this new investor class “Generation Investor,” or Gen I.

Gen I has a median age of 35 years, which once again positions Millennials and Gen Z at the heart of this investment demographic shift. Numerous surveys have also put this particular age range as being the most interested in cryptocurrencies, as Hao put it:

“Cryptocurrency is probably one of the first financial instruments that has drawn attention from millennials, who have the capability to further vitalize the market. From popular TikTok accounts to memetic crypto marketing, these communities and their sophistication in producing action bring on a new scene of user-behavior to altcoins.”

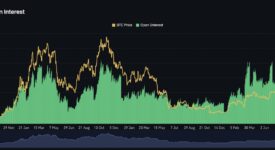

Earlier in April, crypto exchange OKEx published a joint research study with blockchain analytics service Catallact showing the impact of retail interest in the crypto market. According to the report, retail activity in the Bitcoin (BTC) market outpaced that of institutional players in Q1 2021.

Such is the growth in retail cryptocurrency trading activity that Robinhood has reported that 9.5 million customers traded crypto on its platform in Q1 2021 alone. This figure represents a sixfold increase in the number of customers recorded by the company in Q4 2020.

Other investment and payment services have also begun onboarding crypto clients to take advantage of the current retail trading hype. The likes of Venmo and PayPal have broken from previously anti-crypto stances to adopt friendlier dispositions to digital currencies amid the potential for massive revenue streams.

Outside the U.S., a resurgence in retail crypto trading has significantly impacted South Korea’s financial markets. Firms invested in cryptocurrency exchanges are experiencing massive stock price growths. K Bank, the major banker for Upbit — one of South Korea’s largest crypto exchanges — has enjoyed a sharp reversal of fortunes. The bank has recovered from the $89 million in losses recorded in 2019 to be within a year of possibly pursuing a public listing.

What about financial literacy?

In February, Thailand’s finance minister Arkhom Termpittayapaisith bemoaned the surge of speculative crypto investment among retail traders in the country. At the time, the government official warned that the trend could have dire implications for the country’s capital market.

Thailand’s finance minister is not alone in espousing such sentiments as similar remarks have emerged from government officials and financial regulators across the world. In January 2021, the United Kingdom’s Financial Conduct Authority warned that crypto investors were liable to lose all their money owing to the high level of risk in the market.

Apart from volatility and other well-worn anti-crypto rhetoric, issuers of these cryptocurrency crash portents often point to the presumed ignorance of retail investors about the intricacies of the investment market. Indeed, Thailand’s Securities and Exchange Commission came under significant backlash from the Thai crypto community when it sought to introduce investor qualification requirements for cryptocurrency investments back in February.

Hong Kong is also another jurisdiction looking to limit retail involvement in crypto trading amid reports of a blanket ban. Like the Thai proposal, Hong Kong regulators are looking to enact a minimum income threshold for cryptocurrency investments, which could disqualify up to 93% of the city’s population.

There is perhaps no better scale for examining financial literacy arguments than the GameStop saga from earlier in the year. A horde of retail investors leveraged the power of social media engagement to counter shorting of GME stock.

Save for regulatory paternalism that saw stock market gatekeepers unfairly favoring the hedge funds on the losing side, the retail traders on r/Wallstreetbets may probably have run the naked shorters to the ground. It could be argued that the GameStop drama proved financial literacy is not the issue for retail traders but rather the undemocratized nature of the legacy financial system.

The Charles Schwab survey offers a glimpse of the extent to which newbie investors are going in terms of financial education and advice. In its published report on the poll, the investment firm revealed that about 94% of investors are keen to access more information and tools to conduct their own research.

Commenting on the investment mindset of newbie investors, Andrew D’Anna, senior vice-president at the company’s retail client experience division, stated: “Now that they’ve dipped their toes into investing, Gen I is eager to keep learning and evolving its strategies to successfully build wealth for the long-term.”

According to D’Anna, the company’s survey offers proof that Gen I investors are not all about short-term risk-taking for huge gains. Instead, the emerging generational change in the financial markets led by Millennials and Gen Z are keen to acquire guidance and education to make informed decisions.