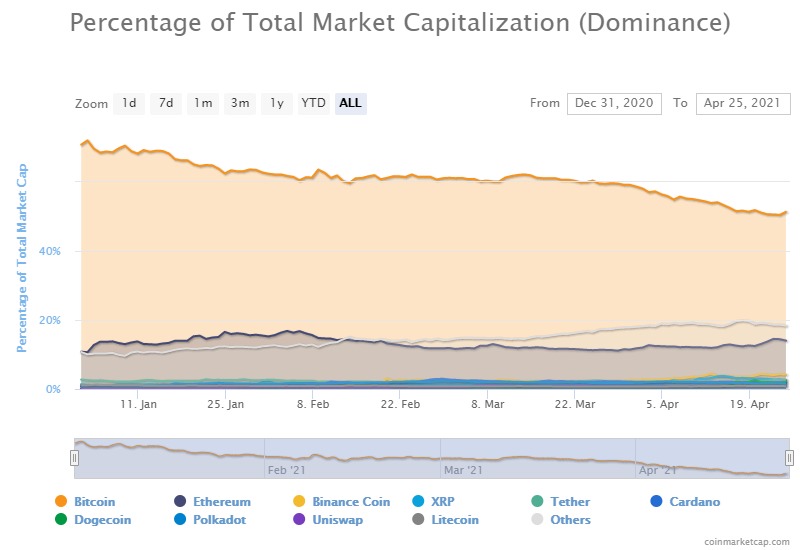

Bitcoin (BTC) dominance briefly fell below 50% last week for the first time since January 2018, sending a strong signal that more speculative bets on altcoins were on the rise.

The Bitcoin dominance index, which measures BTC’s market capitalization relative to the broader cryptocurrency market, reached a low of 49.35% on Thursday, according to CoinMarketCap. At the beginning of 2021, BTC dominance was 70.68%.

Ethereum (ETH), meanwhile, accounted for nearly 15% of the overall market at its peak on Thursday. ETH dominance is up nearly 4 percentage points since the start of 2021.

ETH has outperformed BTC over the past seven days, charting an impressive 9.5% return. The second-largest cryptocurrency by market cap is down 10% from its previous all-time high whereas Bitcoin has corrected over 20%.

Binance Coin (BNB) has also seen its share of the overall market grow steadily this year, from 0.71% on January 1 to 4.17% on April 25. BNB is being supported by several fundamental factors, including growing adoption of the Binance platform and a coordinated burn of $600 million worth of tokens in the first quarter.

Meanwhile, cryptocurrencies outside the top ten have seen their share of the overall market inflate from less than 11% to over 18% since January 1.

Despite registering multiple record highs this year, Bitcoin’s dominance relative to altcoins has declined sharply. Source: CoinMarketCap

Despite registering multiple record highs this year, Bitcoin’s dominance relative to altcoins has declined sharply. Source: CoinMarketCap

Commenting on the market shuffle, Meltem Demirors, the chief strategy officer of crypto investment manager CoinShares, said she is “seeing a lot of folks chasing returns by moving further out on the risk spectrum.”

1/ on thursday, bitcoin dominance fell below 50% for the first time in nearly 3 years

the last time this happened was January 2018, and that cycle last about 6 months

seeing a lot of folks chasing returns by moving further out on the risk spectrum

94 coins w/ mcap > $1B pic.twitter.com/s2BX48rqao

— Meltem Demirors (@Melt_Dem) April 25, 2021

Demirors also observed that 94 cryptocurrencies now have a market capitalization of $1 billion or more. At the time of writing, that figure had fallen to 87, according to CoinMarketCap. An additional seven projects were valued at $900 million or more.

Analysts are divided about the pace and timing of the so-called alt season, a period of the market cycle where many altcoins surge against the dollar and Bitcoin. Ben Lilly, co-founder and analyst at Jarvis Labs, told Cointelegraph last week that he doesn’t believe now is the best time to reallocate from BTC to altcoins from a risk-adjusted perspective.

Meanwhile, an analysis from Filbfilb, co-founder of the Decentrader trading suite, concluded that we are now approaching the major boom period for altcoins.

The current market cap for altcoins is $937 million.