Indian native fintech startup BharatPe gives you raised $370 million in a new round of that loan as it looks to aggressively climb its business in the next four years. It’s the nineteenth American native startup to become a unicorn cyber monday 2011 (up from 11 extremely year) as several high-profile global investors double low in the South Asian provide.

The new huge round — a Series E — was led by Tiger Global and valued brand name Delhi-based startup at $2. 85 billion (post-money), the device said in a statement Wednesday evening. Dragoneer Investor Institution and Steadfast Capital sometimes participated in the new process, which brings the startup’s to-date raise to over $580 million against equity.

Tuesday’s news confirms a trustworthy TechCrunch scoop from May in which all of us reported that the four-year-old load was looking to raise with regard to $250 million at a pre-money valuation of $2. some billion. BharatPe was respected at about $900 million in its Shows D circular in February this year, additionally $425 million last year.

BharatPe co-founder Ashneer Grover demonstrated that the startup was definitely looking to raise $250 thousand until inbound requests due to investors prompted an oversubscription. The new investment also includes some people secondary transactions.

BharatPe, on a counts Coatue, Ribbit Hacienda and Sequoia Capital India among its existing associates, operates an eponymous service to help offline merchants say yes to digital payments and defend working capital.

All the while India has already emerged because second-largest internet market, exceeding 650 million users, much of the country remains offline.

Among those outside of the get hold of of the internet are sellers running small businesses, such as side of the road tea stalls and location stores. To make these shopping cart comfortable with accepting digital premiums, BharatPe relies on QR cryptogramme and point of marketing machines that support government-backed UPI payments infrastructure.

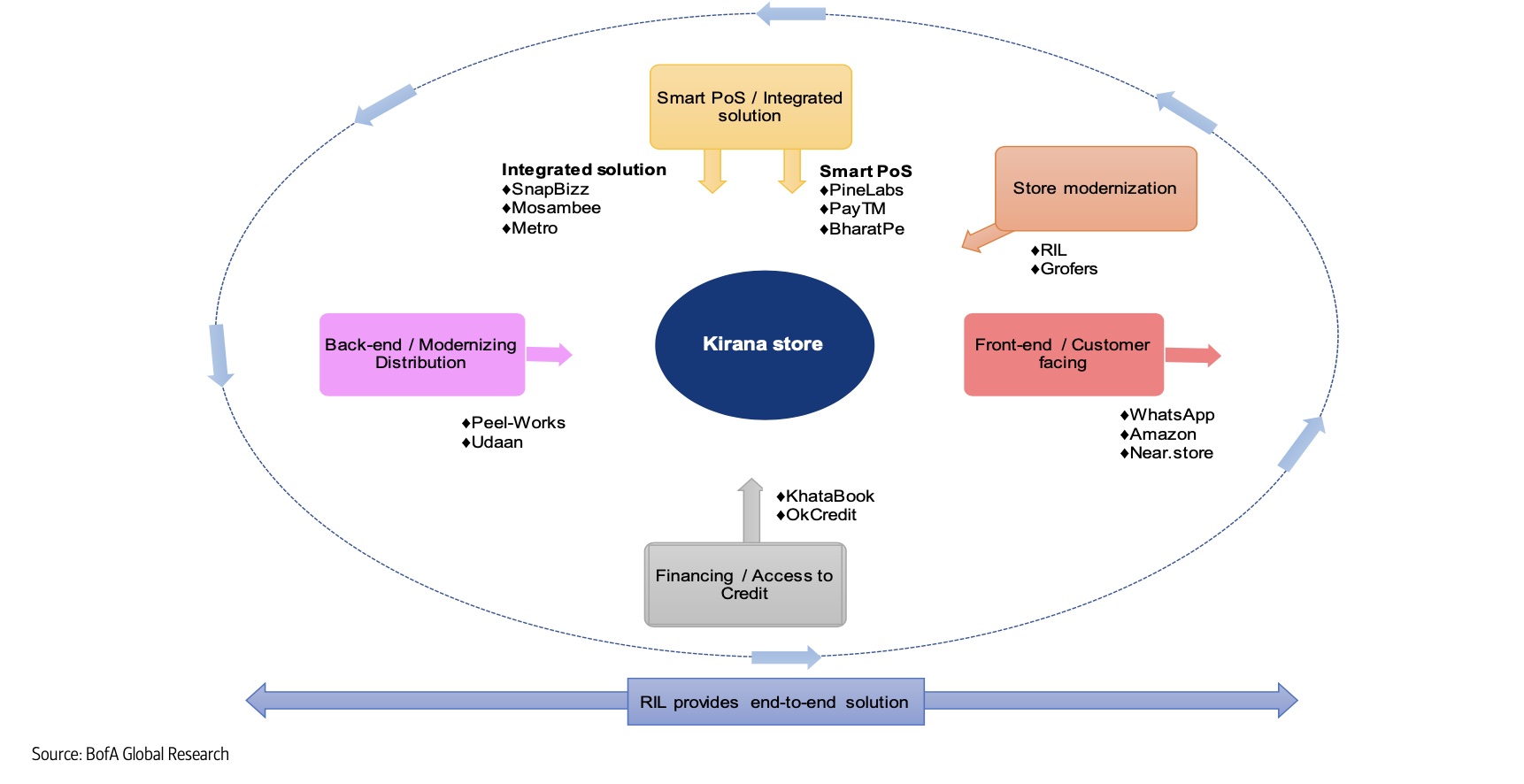

Lots of giants and startups seeking to serve neighborhood stores from India. Confidence Credits: Current of America Research

The manufacturing, which serves more than nine million merchants in older than 130 Indian cities, rumoured it has disbursed close to three hundred dollars million to merchant young partners. It does not charge merchants for the universal QR code connect with, but is looking to make resources by lending.

The startup plans up to expand its product stock offerings as well as work with Centrum Finance, with which it was recently awarded the license by India’s central bank (Reserve Bank account of India) to set up a little finance bank. (Centrum Financial Services has collaborated with BharatPe for the license, and the Native indian startup says the two have been “equal” partners. )

Tuesday’s development a little more illustrates the growing interest ture of Tiger Global in Asia . The New York-headquartered tone has backed dozens of Indian startups, including social commerce start-up DealShare , edtech Classplus , Apna (an tool that helps blue-collar workers get together recruiters) and home service platform Urban Company in recent months.

Of Tuesday, Infra. Market, some Indian startup that helps composition and real estate companies procure materials and handle strategies for their projects, said completely increased $125 million in a surrounding led also by Competition Global .