Bitcoin (BTC) hit $60,000 for the first time on March 13 as the long-awaited continuation of the BTC price bull run got underway.

BTC/USD 1-hour candle chart (Bitstamp). Source: Tradingview

BTC/USD 1-hour candle chart (Bitstamp). Source: Tradingview

BTC records another landmark price level

Data from Cointelegraph Markets and Tradingview tracked BTC/USD as the pair finally crossed the historic level after several weeks of mild corrections and periods of consolidation.

Bulls had spent a considerable time in limbo as Bitcoin tested prior all-time highs at $58,350 repeatedly, with a significant resistance zone beneath slowing progress.

In the end, however, optimism won out, and the largest cryptocurrency by market capitalization clinched its latest milestone. At press time, price action focused on an area just below $60,000 amid characteristic volatility.

As Bitcoin price inched its way closer to the previous all-time high, analysts at Whalemap observed some interesting on-chain activity taking place.

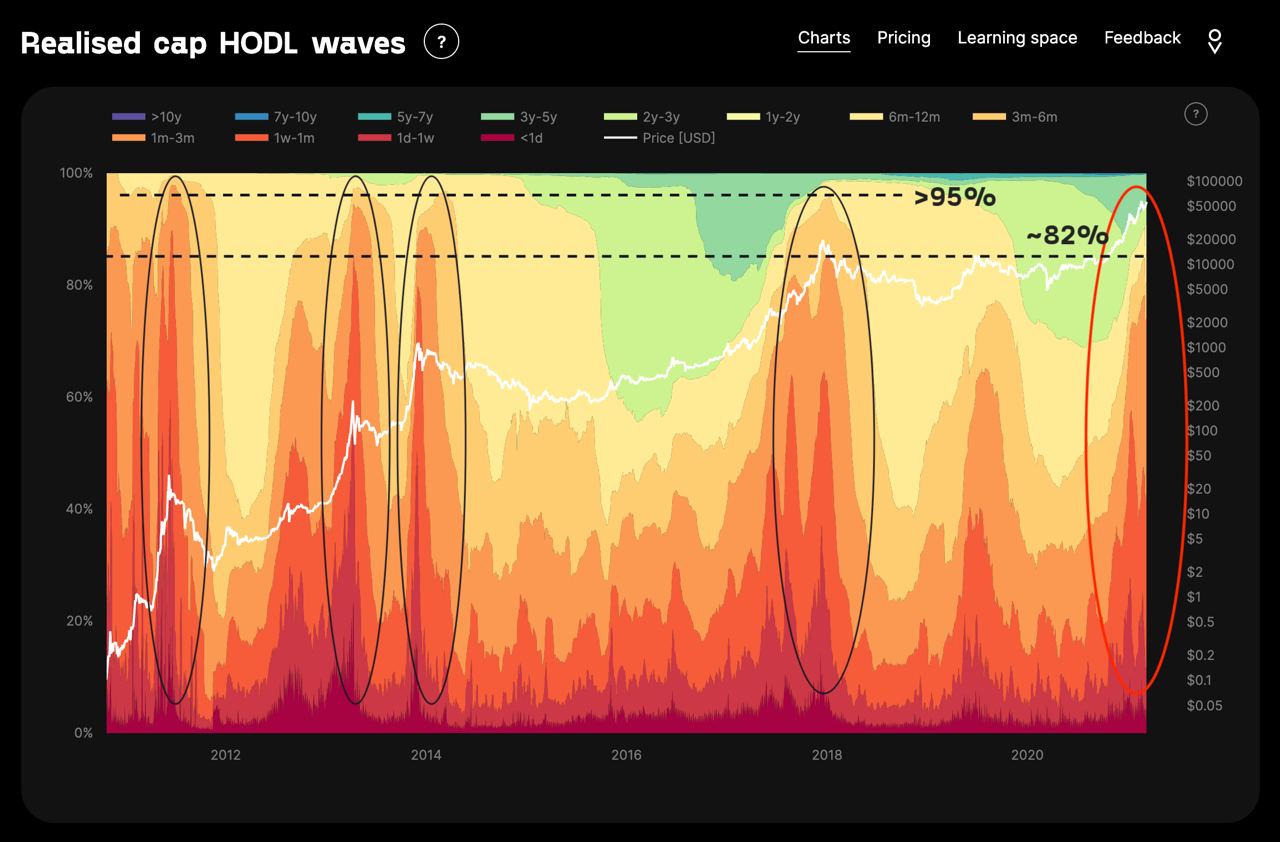

Realized cap HODL waves. Source: Whalemap

Realized cap HODL waves. Source: Whalemap

According to the research team:

“Realized Cap HODL waves show what percentage of realized capitalization belongs to HODLers of different type (1y-3y hodlers, 3y-5y and so on). Usually, macro tops occur when the market over-saturates with FOMO. This can be identified when a large % of realized capitalization belongs to short term hodlers (younger than 6 months). The last macro tops were accompanied by more than 95% of realized cap belonging hodlers of less than 6 months. Currently, we are at 82%.”

The long road to a new price hurdle

Anticipation of $60,000 and even higher had steadily built up over recent days. As Cointelegraph reported, professional analysts as well as traders were poised to announce the end of Bitcoin’s prior sideways price action as indicators pointed in bulls’ favor.

The now-standard narrative of healthy on-chain metrics combined with positive support from institutions served to bolster confidence. Now that Bitcoin price has reached the $60,000 level, many analysts have set their targets on the $72,000 zone, followed by $100,000.

The overall cryptocurrency market cap now stands at $1.118 trillion and Bitcoin’s dominance rate is 61.9%.