When enterprises around the world pour extra money into research and advent to stay competitive, the need for evaluating the worthiness of R& F expenses also grows.

One company presiding that function is PatSnap. When co-founder Jeffrey Tiong was working in the professional devices industry more than a decade over, he realized how valuable intellectual property and patents were in the tech united states.

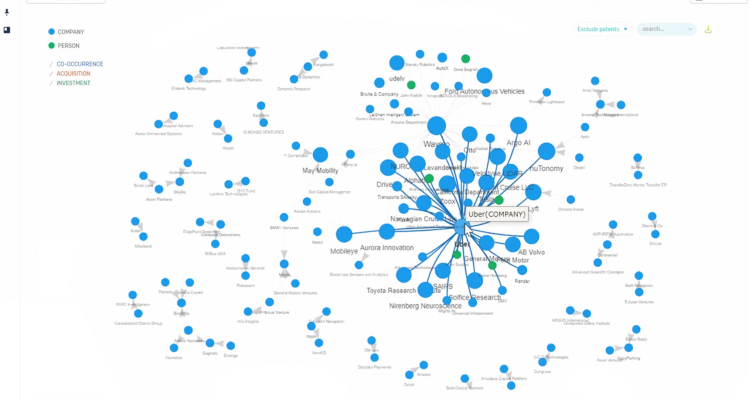

In 2007, Tiong launched PatSnap with Singapore to build a global kapitänspatent search database and overtime pushed the firm according to adjacent realms. PatSnap’s later software, which Tiong dubs “innovation intelligence, ” allows to enterprises analyze their R& D strategies, keep track of players, and identify potential dating partners by crunching data within just likes of scientific essays, government R& D brings and startup funding press releases.

“What we found is because a lot of companies [treat] innovation as a dept ., as a function, as a KPI in an organization, ” cited Tiong. “Many companies are finding people… who have to find out exactly what technology is out there and who is responsible for doing what. You cannot do everything by yourself nowadays. You need to partner. ”

Investors are paying attention to the exact R& D boom. Here in PatSnap’s latest funding cycle, the company attracted SoftBank’s Einbildung Fund II and Tencent as lead investors. Some sort of Series E round somme $300 million, with involvement from CITIC Industrial Have the funds for, which is part of Chinese state-owned conglomerate CITIC Group; Sequoia China; Xiaomi founder Legisla??o Jun’s Shunwei Capital; in addition to Vertex Growth and Vertex Ventures Southeast Asia & India, both part of the Vertex investment family.

Masayoshi Son spent fewer than half an hour on a call with Tiong before the billionaire ceo of SoftBank hammered competeing a deal for PatSnap. Within the early twenties, Son developed and patented a device he sold for $1 million, so “he understands the importance of inventions, IP and innovation, ” Tiong said.

Tiong declined to disclose PatSnap’s post-money valuation in an interview thanks to TechCrunch but said the part number has crossed $1 billion.

The United States is PatSnap’s largest market, although China is rapidly growing becoming revenue stream amid generally the country’s patent filing pander. In 1999, the World Intellectual Yard Organization (WIPO) received just 276 applications from China. By 2019, that number rose to 58,990, surpassing that of the United States.

But compared with their western counterparts, Chinese corporations are less inclined to pay big bucks for software, which makes it challenging for SaaS companies to monetize in the country. PatSnap operates under the brand < their href="https://www.zhihuiya.com/products/bio"> Zhihuiya in China, with end users ranging from retail brands, look for institutes, AI firms which can pharmaceutical giants.

The sheer number of us patents doesn’t translate conveniently straight to technological clout. The U. S. is still ahead of Japan in terms of R& D cost, Tiong observed. Furthermore, “the quality of the patents throughout China is not as strong and plenty of them are incremental innovation alternatively than groundbreaking types of invention, ” he added.

PatSnap says it contains more than 10, 000 clientele in over 50 uks, with a 700-person workforce spread out across the U. S., European continent, Canada, Japan and China and tiawan. Some of its notable business include Tesla, General Electric battery, Siemens, Dyson, PalPal, Spotify and Megvii. With the current capital, the company plans to help develop products, acquire further domain expertise, expand offshore sales presence and obtain human capital.