According to a recent research note by JPMorgan, institutional investors have withdrawn about $20 billion from their gold investments since mid-October and during the same time frame, institutional inflows into Bitcoin (BTC) have increased by $7 billion.

The bank said, “any such crowding out of gold as an ‘alternative’ currency implies big upside for Bitcoin over the long term.”

JPMorgan believes that Bitcoin’s declining volatility could increase adoption from institutional investors. If that happens, the value of the private investments in Bitcoin may mirror that of gold and this gives Bitcoin an upside target of $130,000 in the long term, added the bank.

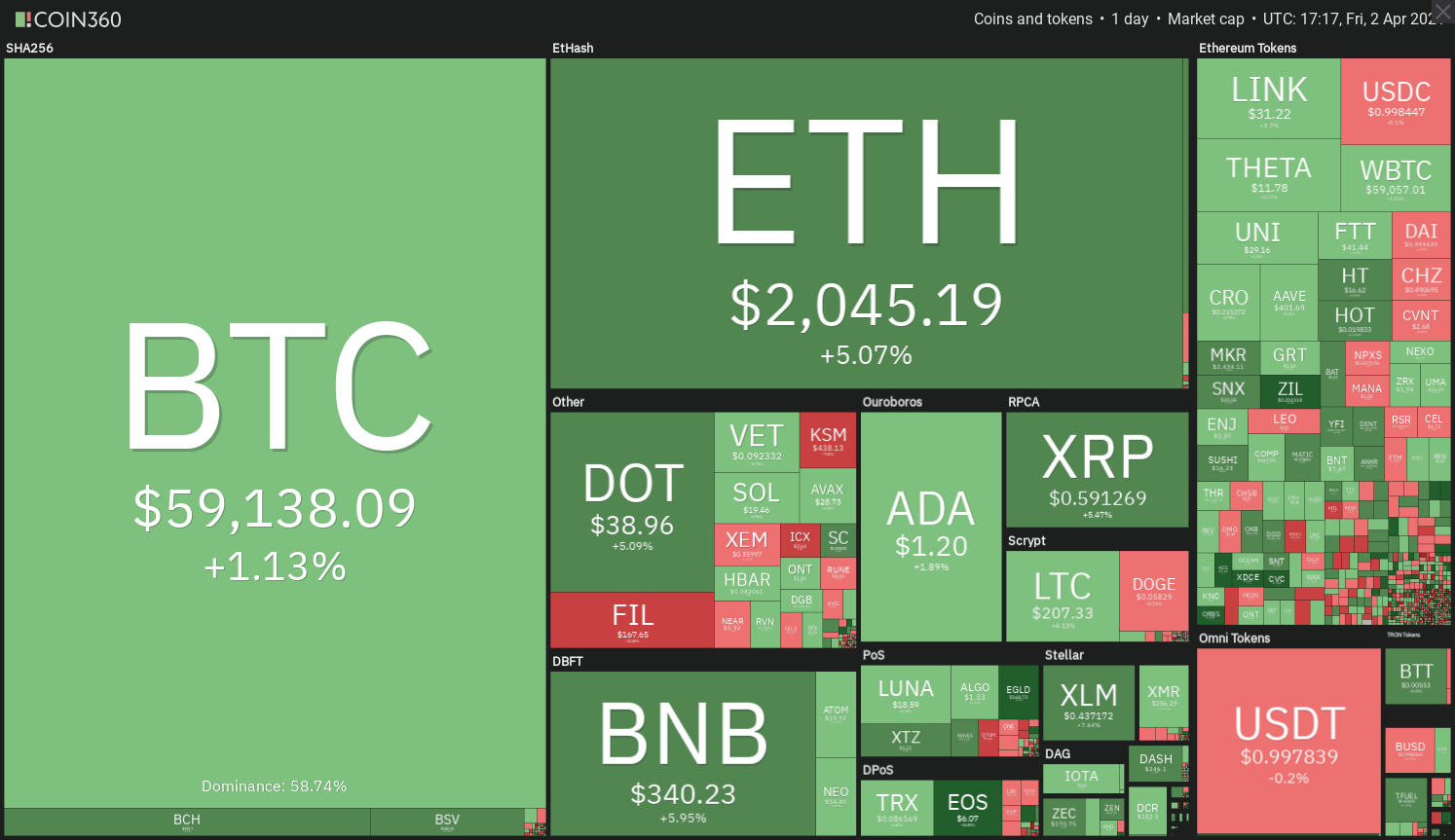

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360

In other news, billionaire investor Mark Cuban said his crypto portfolio consists of 30% Ether (ETH) because he believes it is the closest thing to being a true currency. Cuban said the remainder of his crypto portfolio consists of 60% Bitcoin and 10% in other crypto investments.

CryptoQuant CEO Ki Young Ju recently highlighted that 400,000 Ether had left Coinbase, a sign that institutional investors may have started accumulating the top altcoin.

The increased adoption of cryptocurrencies by legacy financial institutions and investors is a positive sign but will this newsflow act as a tailwind and boost the price of the top-10 cryptocurrencies?

Let’s analyze the charts to find out.

BTC/USDT

Bitcoin formed a Doji candlestick pattern on March 31 and April 1, which suggests indecision among the bulls and the bears. However, the positive sign is that the bulls have not given up much ground. The bulls are again trying to push the price above the $60,000 resistance.

BTC/USDT daily chart. Source: TradingView

BTC/USDT daily chart. Source: TradingView

A strong breakout above the $60,000 to $61,825.84 overhead resistance zone will suggest that bulls are back in the driver’s seat. That could signal the start of the next leg of the uptrend, which has a target objective at $69,279 and then $79,566.

Traders can keep an eye on the relative strength index because a break above the downtrend line will indicate a pick-up in momentum.

Contrary to this assumption, if the price once again reverses direction from the overhead resistance zone, the BTC/USDT pair could drop to the 50-day simple moving average ($53,362). A break below this critical support could attract profit-booking from short-term traders and that could pull the price down to $50,460.02 and then $43,006.77.

ETH/USDT

Ether broke out of the symmetrical triangle on March 31 and has continued its journey higher. Today, the bulls have pushed the biggest altcoin above the all-time high at $2,040.77.

ETH/USDT daily chart. Source: TradingView

ETH/USDT daily chart. Source: TradingView

The 20-day exponential moving average ($1,798) has turned up and the RSI is near the overbought territory, indicating advantage to the bulls.

If the buyers can sustain the price above $2,040.77, the ETH/USDT pair could start the next leg of the up-move. The pattern target of the breakout from the triangle is $2,618.14.

Contrary to this assumption, if the price turns down from the current level, a drop to the 20-day EMA is possible. A strong bounce off it will signal strength and the bulls will again try to resume the uptrend.

This bullish view will invalidate if the bears sink the price below the trendline. Such a move could pull the price down to $1,289.

BNB/USDT

After some hesitation on March 31, Binance Coin (BNB) broke above the $315 resistance on April 1 and has followed it up with a breakout above the all-time high at $348.69 today. If the bulls can sustain the breakout, the altcoin could rally to $400 and then $430.

BNB/USDT daily chart. Source: TradingView

BNB/USDT daily chart. Source: TradingView

The upsloping moving averages and the RSI in the overbought territory suggest that bulls are in command.

However, if the bulls fail to defend the price above $348.69, the BNB/USDT pair could drop to $315. If the bulls can flip this level into support, it will increase the possibility of the resumption of the uptrend.

This bullish view will invalidate if the pair turns down and breaks below the moving averages. Such a move will suggest that the current breakout was a bull trap.

ADA/USDT

Cardano (ADA) has been stuck in a tight range for the past few days but the positive sign is that the bulls have not allowed the price to dip below the 20-day EMA ($1.17). This suggests a lack of buying but does not show an urgency among traders to dump their positions.

ADA/USDT daily chart. Source: TradingView

ADA/USDT daily chart. Source: TradingView

The bulls may now attempt to push the price above $1.30. If they succeed, the ADA/USDT pair could rally to $1.48. This is an important resistance because the price had turned down from it on Feb. 27 and March 18.

If that happens once again, the pair could extend its stay inside the range for a few more days. However, if the bulls propel the price above $1.48, the pair could resume its uptrend that may reach $2. This bullish view will invalidate on a break and close below $1.03.

DOT/USDT

Polkadot (DOT) had turned down from the downtrend line on April 1 but the bulls did not give up much ground. This shows that traders did not close their positions in a hurry. The buyers have pushed the price above the downtrend line today.

DOT/USDT daily chart. Source: TradingView

DOT/USDT daily chart. Source: TradingView

The 20-day EMA ($35.06) has started to turn up and the RSI is in the positive zone, indicating advantage to the bulls. If the buyers can sustain the price above the downtrend line, the DOT/USDT pair could challenge the all-time high at $42.28.

A breakout and close above $42.28 could resume the uptrend with the next possible move to $53.50. This bullish view will invalidate if the price turns down from the current level or the all-time high and slips below the moving averages. That could pull the price down to $26.50.

XRP/USDT

After hesitating near $0.60 for the past few days, the bulls are currently attempting to propel XRP to the $0.65 overhead resistance. This level is likely to act as a stiff resistance because the price has turned down from it on five previous occasions.

XRP/USDT daily chart. Source: TradingView

XRP/USDT daily chart. Source: TradingView

However, the rising 20-day EMA ($0.53) and the RSI above 65 suggest the path of least resistance is to the upside. If the bulls can push and sustain the price above $0.65, the XRP/USDT pair could rally to $0.78 and then $1.

This bullish view will invalidate if the price turns down and breaks below the moving averages. Such a move will indicate that traders are selling on rallies. That could keep the pair range-bound between $0.42 and $0.65 for a few more days.

UNI/USDT

Uniswap (UNI) has been stuck between both the moving averages for the past few days. The bears could not sink and sustain the price below the 50-day SMA ($27.59) on March 31 and the bulls could not sustain the price above the 20-day EMA ($29.13) on April 1.

UNI/USDT daily chart. Source: TradingView

UNI/USDT daily chart. Source: TradingView

The flat 20-day EMA and the RSI just above the midpoint suggest a balance between supply and demand.

This neutral view could tilt in favor of the bulls if they propel and sustain the price above $30.31 today. If that happens, the UNI/USDT pair could start to move up toward the $35.20 overhead resistance.

On the other hand, if the price turns down and breaks below $25.50, the pair could witness increased selling pressure, which may pull the price down to $18.

LTC/USDT

Litecoin (LTC) recovered sharply from its intraday low on March 31 and broke above the 50-day SMA ($197) on April 1. The bulls will now try to push the price above the resistance line of the symmetrical triangle.

LTC/USDT daily chart. Source: TradingView

LTC/USDT daily chart. Source: TradingView

If they manage to do that, the LTC/USDT pair could rally to $230 and then to $246.96. The pattern target of the breakout from the triangle is $307.42. However, the marginally rising 20-day EMA ($193) and the RSI at the downtrend line suggest a weak bullish momentum.

If the price turns down from the resistance line, the pair may extend its stay inside the triangle for a few more days. The bears will gain the upper hand on a break below the trendline of the triangle.

LINK/USDT

Chainlink (LINK) reversed course from $26.18 on March 31 and rose above the downtrend line of the descending triangle. This move invalidates the bearish setup and the bulls will now try to propel the price above the overhead resistance at $32.

LINK/USDT daily chart. Source: TradingView

LINK/USDT daily chart. Source: TradingView

If they succeed, the LINK/USDT pair could start its march toward the all-time high at $36.93. The 20-day EMA ($28.45) has started to turn up and the RSI has risen above 59, indicating a minor advantage to the bulls.

However, if the bulls fail to propel the price above $32, then the pair could drop to the moving averages. If the price rebounds off the moving averages, it will indicate that traders are buying on minor dips. The bulls will then make one more attempt to push the price above $32.

Contrary to this assumption, if the price turns down from the overhead resistance and breaks below the moving averages, then the pair could remain stuck inside the $24 to $32 range for a few more days.

THETA/USDT

THETA is currently range-bound in an uptrend. The price action of the past few days has formed a symmetrical triangle, which usually acts as a continuation pattern.

THETA/USDT daily chart. Source: TradingView

THETA/USDT daily chart. Source: TradingView

Both moving averages are sloping up and the RSI is at 63, indicating the path of least resistance is to the upside.

If the bulls can propel the price above the triangle, the THETA/USDT pair could rally to the all-time high at $14.96 and then to the pattern target at $17.85.

This bullish view will invalidate if the price turns down and breaks below the triangle. Such a move will increase the possibility of a break below the critical support at $10.35, signaling a deeper correction.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.