The price of Bitcoin (BTC) has surpassed $61,000 on April 10 for the first time in nearly a month. Following the breakout, traders are starting to look at new levels of resistance and support in the short-term as optimism returns to the market.

In the near term, besides the all-time high at around $61,800, there are three key Bitcoin price levels to observe: $61,188, $58,387 and $53,000.

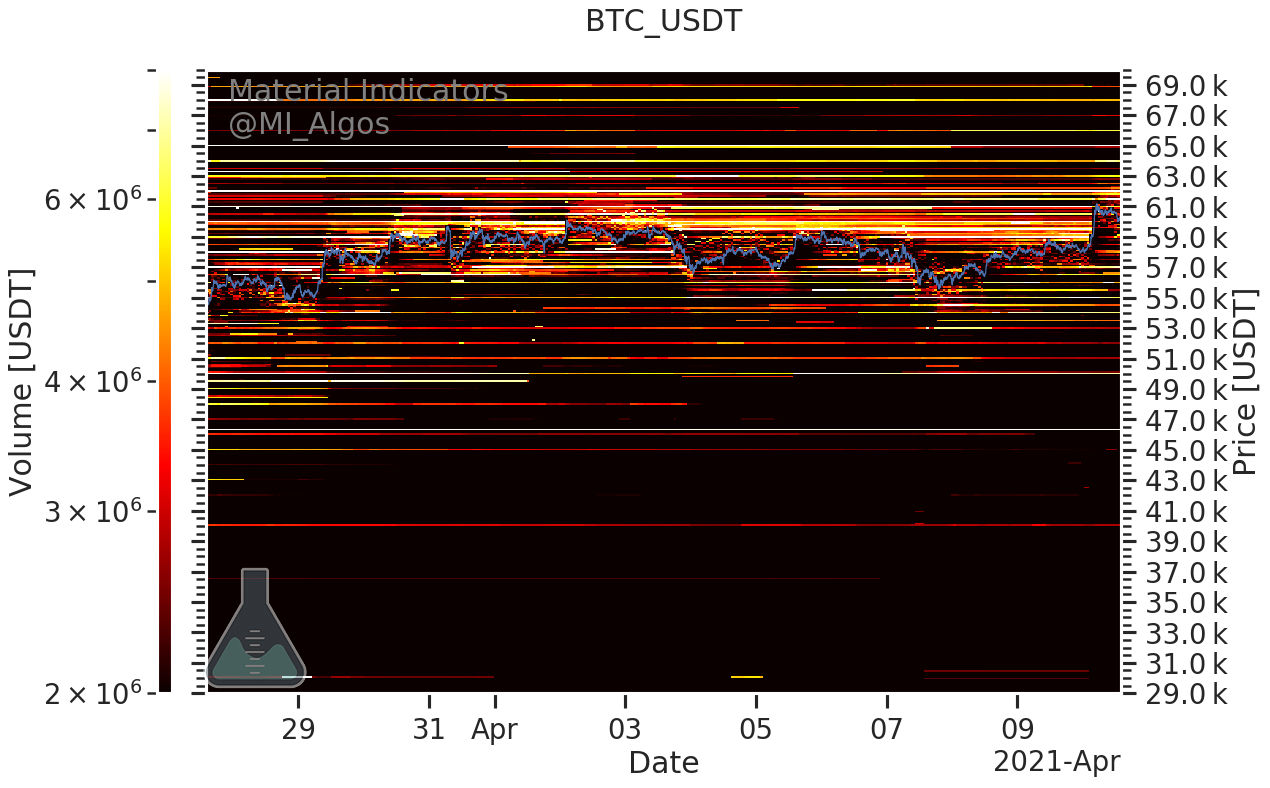

BTC_USDT orderbook heatmap (Binance). Source: Material Indicators

BTC_USDT orderbook heatmap (Binance). Source: Material Indicators

As long as the price of Bitcoin stays above $58,387 and keeps attempting to break out above $61,188, it would likely see a new record high in the foreseeable future.

If Bitcoin breaks out to a new record high, traders also anticipate the altcoin market to pullback slightly for the time being, at least until BTC starts to stagnate after reaching a new high.

$58,000 flipping into support is critical for more upside

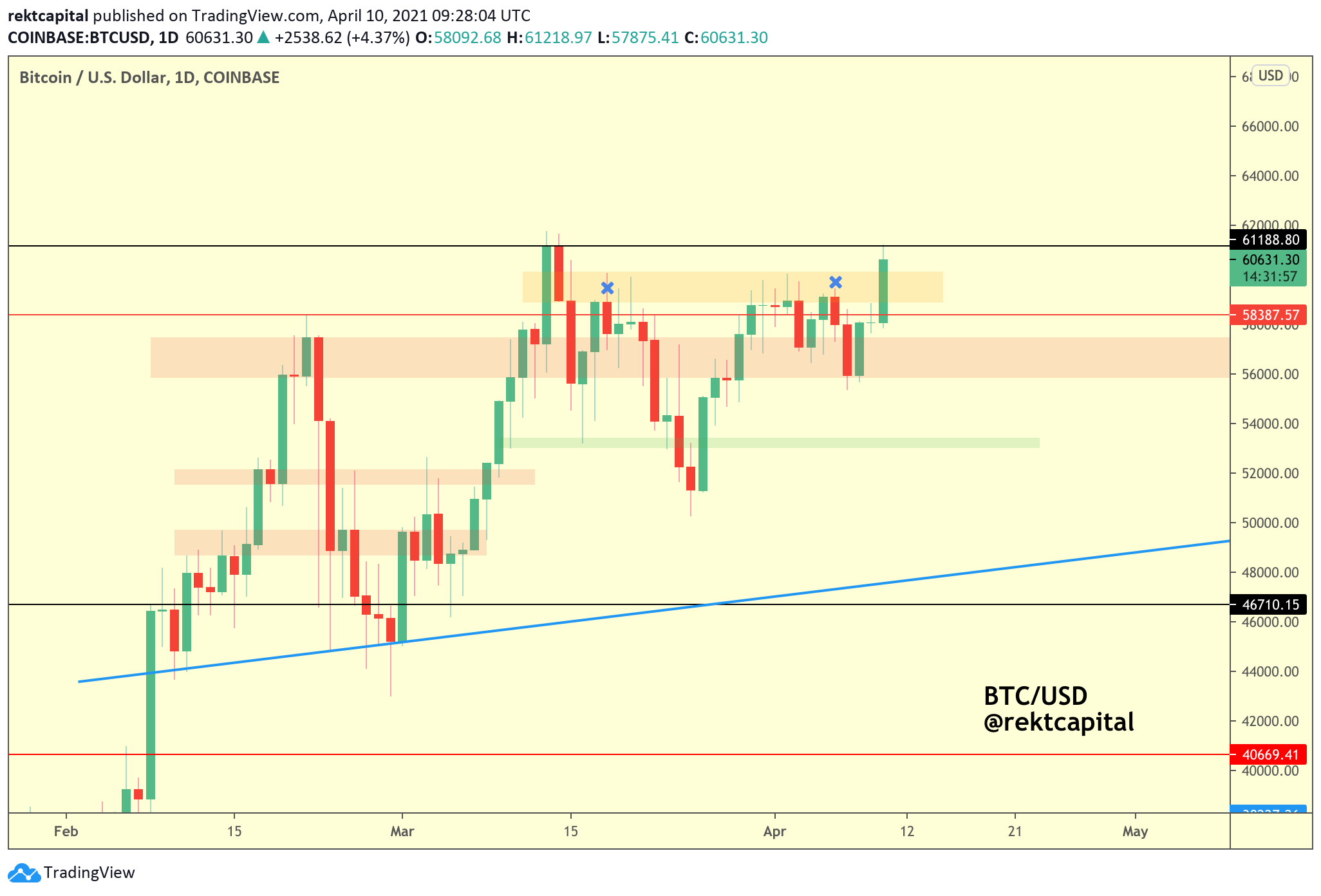

According to the pseudonymous trader “Rekt capital,” the key for Bitcoin to cleanly reach a new all-time high in the coming days is to solidify $58,000 as a support area.

The $58,000 level is an important area because it marks the peak of the initial BTC rally to the $60,000 resistance level in mid-February, as shown in the graph below.

BTC/USD 1-day price chart (Coinbase). Source: Rekt Capital, TradingView.com

BTC/USD 1-day price chart (Coinbase). Source: Rekt Capital, TradingView.com

In technical analysis, when the price of an asset stabilizes above the previous peak, it is considered to be a very bullish sign.

The trader noted:

“BTC was able to still keep the red area even though it rejected from orange And in fact, the rejections from orange has been weaker Right now, BTC is pressing beyond orange [$58,000]. Turning orange into a support would bring Bitcoin very close to a new All Time High.”

Raoul Pal, the CEO of Global Macro Investor, emphasized that the macro view of Bitcoin remains positive.

Pal emphasized that Bitcoin broke out of a three-month range, which indicates that BTC’s technical momentum is starting to regain steam. He said:

“Kind of feels like a big deal to see BTC break a 3 month range and a wedge. It should create a powerful move to the upside. (Axis scrunched on chart to hint at the upside for dramatic effect.”

A cryptocurrency derivatives trader “Cactus” also added that on-chain analytics are stronger than ever, considering that large BTC exchange outflows indicate accumulation among high-net-worth investors.

$BTC / USD

Seeing some huge bullish momentum for BTC…

– On-chain analytics are stronger than ever

– We are seeing biggest exchange outflow’s ever

– Previous monthly close is now support

– Highest weekly close ever likely to be printed pic.twitter.com/zovWNVrKuS— Cactus (@TheCryptoCactus) April 10, 2021

As Bitcoin rallies, beware of altcoin stagnance

Meanwhile, other traders are expecting the altcoin market to take a breather if Bitcoin enters price discovery once again.

Kaleo, a well-known pseudonymous trader, said that there is a high chance altcoins do not rally nearly as much as expected when the volume is sucked up by Bitcoin.

The trader explained:

“For those that are new, be careful being to deep into alts when $BTC is on the brink of price discovery. Profits from alts tend to flow back into Bitcoin. This doesn’t mean the USD price won’t go up, just that there’s a solid chance it won’t go up nearly as much.”

In the short term, Bitcoin would likely outperform altcoins if it continues to rally, and the momentum would only shift to altcoins once BTC consolidates as it finds a new range after breaking new highs.