MicroStrategy, the company which owns over 91,000 Bitcoin (BTC), saw an astounding surge in revenues in Q1, its latest figures confirm.

In a press release on April 30, CEO Michael Saylor revealed that the company’s success had gone far beyond its Bitcoin profits.

Saylor: Hodling BTC creates “substantial value”

MicroStrategy has continued to hit the headlines for its flatly bullish position on Bitcoin and its future, adding to its reserves regardless of sentiment or price.

Its advocacy has seemed to endear it to a new sector of clientele — nine months after beginning to convert its cash reserves to BTC, sales of its products and services have also boomed.

“Product licenses and subscription services revenues for the first quarter of 2021 were $31.3 million, a 52.3% increase, or a 49.8% increase on a non-GAAP constant currency basis, compared to the first quarter of 2020,” the press release states.

Total revenues for Q1 were just over $122 million, representing a 10.3% increase over the same period in 2020.

“MicroStrategy’s first quarter results were a clear example that our two-pronged corporate strategy to grow our enterprise analytics software business and acquire and hold bitcoin is generating substantial shareholder value,” Saylor commented.

He said that the company was “still happy” with its approach to BTC acquisition, adding that it would be adding to its already substantial reserves.

“We will continue to acquire and hold additional bitcoin as we seek to create additional value for shareholders,” he concluded.

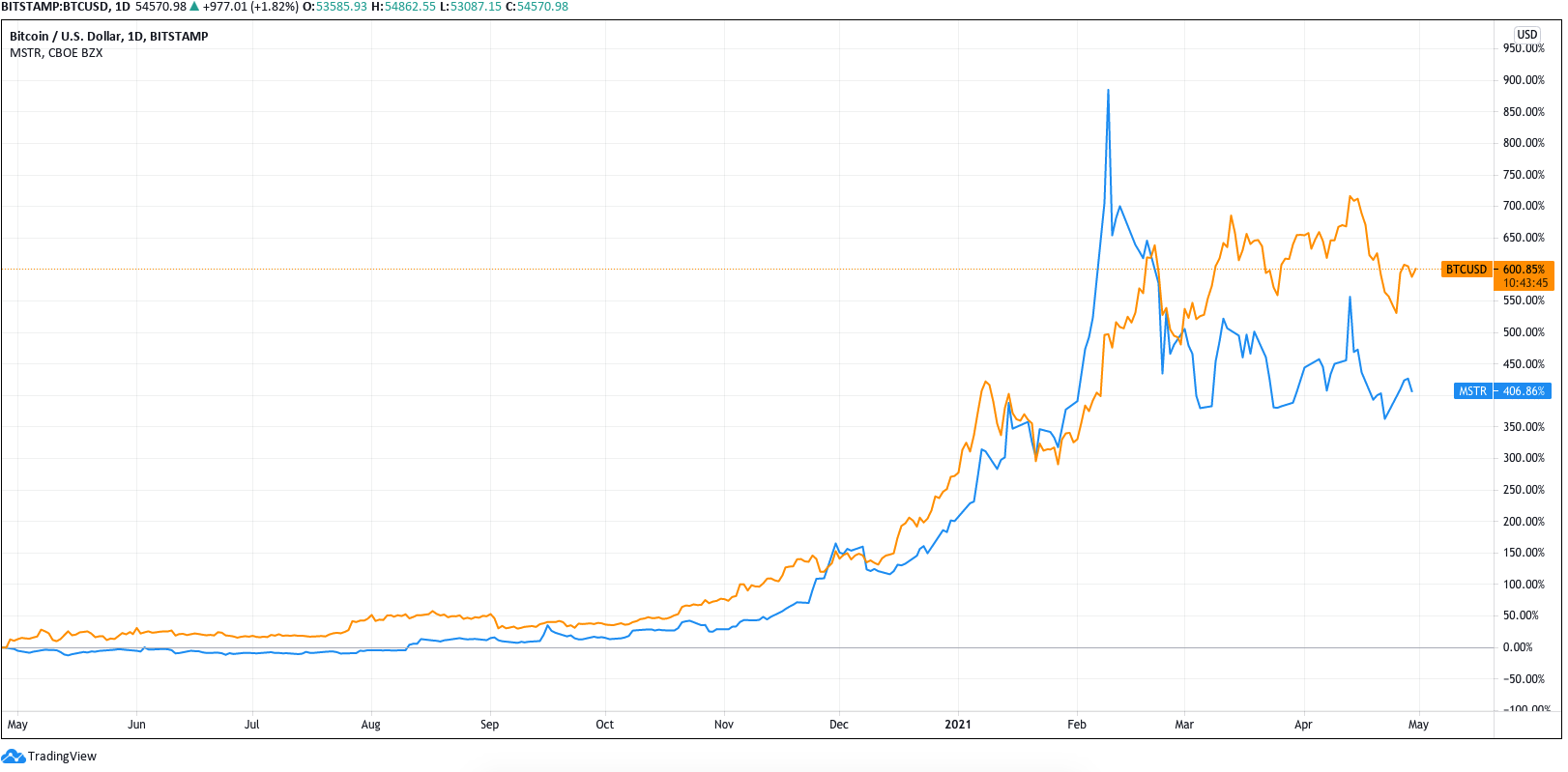

BTC (orange) vs. MSTR (blue). Source: Tradingview

BTC (orange) vs. MSTR (blue). Source: Tradingview

As Cointelegraph reported, the company’s stock price has experienced volatility this year, something which has echoed Bitcoin’s own price discovery.

Bulls have “nothing to worry about”

The numbers are a familiar boon for Bitcoin bulls, who have been left hanging this week as rumors of major corporate buy-ins from the likes of Facebook went unsubstantiated.

This combined with equally familiar ranging price action has hit enthusiasm in some quarters, while analysts argue that there is nothing to be bearish about.

“So far, so good for Bitcoin. Still nothing to worry (about),” popular trader Michaël van de Poppe summarized to Twitter followers on Thursday.

An accompanying chart highlighted resistance beginning at $55,000 for the largest cryptocurrency to overcome as altcoins began to accelerate their own gains.

BTC/USD 1-hour candle chart (Bitstamp). Source: Tradingview

BTC/USD 1-hour candle chart (Bitstamp). Source: Tradingview

At the time of writing, BTC/USD traded at around $54,700, having come full circle over the past 24 hours which included a drop below $53,000.