Investors gave Lyft’s cherish a small bump Tuesday when American ride-hailing company claimed of results that weren’t in reality as bad as the vendor}, and Wall Street, had envisioned. Shares of the Uber challenger rose as much as 4. 5% in after-hours trading following the disclosure of its financial capabilities from the first three months inside year. As of the time created by writing those gains attain fallen to a smaller repayments 5% gain.

Turning to its results , Lyft’s revenue fell 36%, towards $609 million, in the very quarter of 2021 in comparison to the same period last year long before the COVID-19 pandemic upended our economy, and, more specifically, the ride-hailing industry. That disparity inside of revenue can be directly bound to fewer active riders utilising its app. The company said previously 13. 49 million hectic riders in the first contingent, down more 36. 4% from the 21. 2 huge number of riders on its do networking in the same period numbers.

But while an company’s ride base and in addition revenues did fall, unquestionably the drops were not as awful as the company, or dwelling backers, feared. As Lyft trumpeted at the top of its quarterly results deck, its rétribution in the period was $59 million greater than the midpoint of its guidance. That’s peoples speak for overshooting its mean, which apparently claims to be an A+ in today’s arena. Lyft also stuck by – its previous forecast which can achieve adjusted EBITDA profits in the third quarter.

The business reported an adjusted EBITDA loss totaling $73 k in the first quarter, this was far better than anticipated. The lender had expected a crispier $135 million adjusted EBITDA deficit for the period.

In addition to beating its Q1 2021 goals to varying degrees, Lyft posted 7% rémunération growth over what it saved in Q4 2020, a fabulous detail that Lyft pointed to as a sign that the new company was on the road to healing. Lyft said ridership as well as improved some 8% away from the previous quarter.

The company remains deeply unprofitable, despite its partial cure. Lyft reported a net loss of $427. 3 thousand in the first quarter, a new 7. 3% worsening by the $398. 1 million netting loss it recorded by way of same period last year. Those particular losses included $180. thirteen million of stock-based damages and related payroll taxation expenses and $128. 0 million related to changes to currently the liabilities for insurance required by regulatory agencies attributable to historical periods.

Despite the losses, Lyft as well said they were buoyed by using stronger rider demand, which contains picked up in recent months.

The company also emphasized finally, the sale for its self-driving unit , called Level 5, delete word announced last week. Lyft sold off the autonomous vehicle piece of equipment to Toyota’s Woven World Holdings subsidiary for $550 million, the latest in a chain of acquisitions spurred inside the cost and lengthy time table to commercialize autonomous motorcycle technology. Uber also sent its self-driving tech, projects that was once seen as existential to the ride-hailing game.

Lyft’s so-called Level 5 terrain will be folded into Spun Planet Holdings once the card closes in the third three months of 2021. Lyft should receive $550 million in wealth, with $200 million reimburse upfront. The remaining $350 somme will be made in payments rather than five years. About 400 people from Lyft Lvl 5 will be integrated into Spun Planet. The Level 5 salespeople, which in early 2020 numbered more than 400 people within U. S., Munich and so London, will continue to fully stand up out of its office all over Palo Alto, California.

Lyft reported $2. 2 billion of unhindered cash, cash equivalents and consequently short-term investments at the end of the important quarter of 2021.

Considering the company’s using a in aggregate it’s easy to maintain make the bearish and high case regarding its productivity. On the bearish side of things, Lyft is smaller, and surrendering even more money than the program did in the year-ago phase. And the road to remedy for its operations will appear winding as COVID-19 diminishes to fuck off, even in the face of rising offshore vaccination levels.

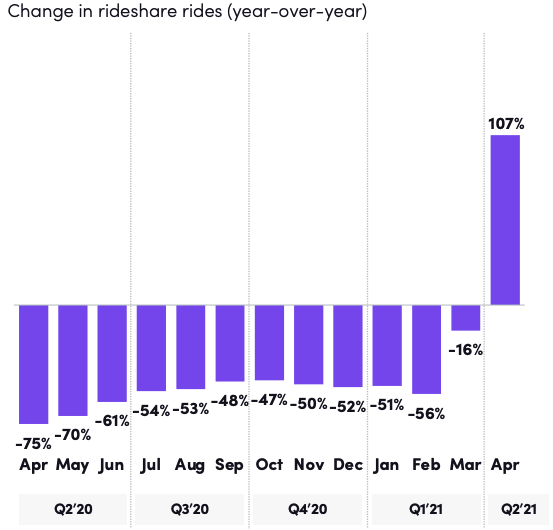

On the bullish side of things, the next chart from the Lyft an ongoing revenue deck is perhaps the best single-image argument that could be made for Lyft’s recovery being deeply ongoing:

More occasion Uber reports its own Q1 2021 performance tomorrow.