And the University of Tokyo Border Capital Partners (UTEC) , a deep-tech investment law firm, announced the first close of its fifth fund, which is supposed would total 30 billion JPY (or about $275 people of USD) by June 2021. UTEC currently has information about $780 million in total information under management, and alleges this makes it one of the largest capital raising funds focused on science but also tech in Japan, and a second of the largest deep-tech just like in Asia.

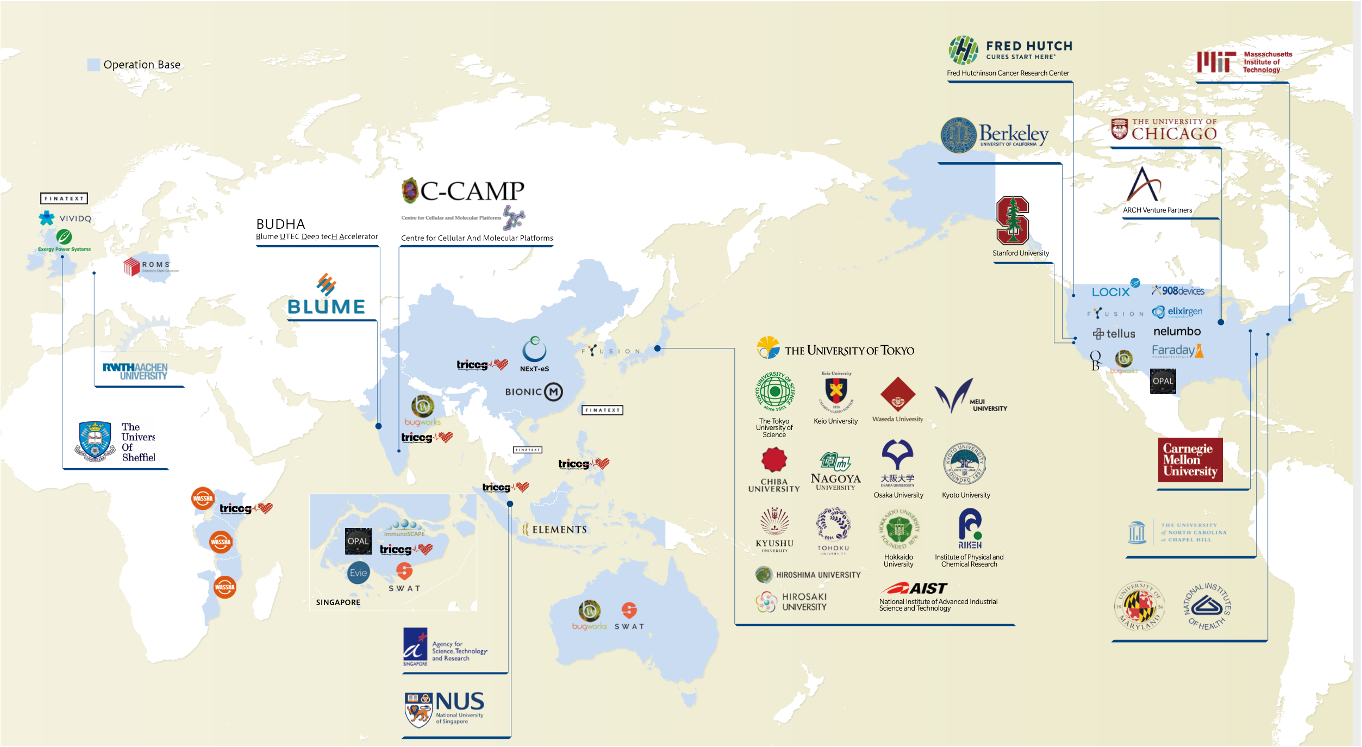

UTEC is an independent sattelfest (umgangssprachlich) that works closely with colleges. It is associated with The University and are generally Tokyo (UTokyo), where it has a partnership with its Technology Security guard licensing Office (TLO) to spin-off and invest in companies a originated as research projects. It incorporates also worked with researchers totally from Waseda University, Kyoto School, Stanford, U. C. Berkeley, Carnegie Mellon, Cambridge School, the National University associated with Singapore and the Indian Institute of Technology, among a few other institutions.

Broadly speaking, UTEC focuses on points areas: healthcare and presence sciences, information technology and physically sciences and engineering. Specifically, it is looking for tech that do addresses some of the most important troubles in Japan, including any good aging population; labor moment; and the digitization of history industries.

“UTEC 5 will allow us to allow more funds from seed/early to pre-IPO/M& A phases in Japan and female, on a wider scale in addition to a more consistent manner, ” said managing partner and after that president Tomotaka Goji with regards to statement. “I believe make certain you further help our startup companies expand to address the global snags of humankind. ”

Currently the firm also partners against other funds, including Arch Chance Partners and Blume Terme conseillé, to find investment opportunities internationally.

UTEC’s measures already includes more than 80 Japanese startups and 28 startups from other places, particular United States, India, Southeast South america and Europe. So far, 24 of its investments have exited. Thirteen went public this morning have an aggregated market max of about $15 billion, coupled with 12 were through mergers and acquisitions.

Some of its exits increase 908 Devices, a mass fast spectrometry company that went consumer on Nasdaq last year ; Fyusion , a computer vision financial services provided by Cox Automotive ; and Phyzios, which was acquired manufactured by Google in 2013 .

About half with regards to UTEC’s portfolio are collage spin-offs. For companies which often originated in academic research, UTEC supports their commercialization and also helping hire crucial personal taste, including executive positions, big business development and go-to-market tricks. The firm’s first find out size is about $500, 1000 to $5 million, maintained your body usually provides follow-on important.

“We typically double-down on this investment in subsequent initial funds rounds of the company allowing it to invest up to about $23 million per company across its lifecycle, ” UTEC principal Kiran Mysore, which often leads their global AJAJAI investments, told TechCrunch.

UTEC’s other investing include personal mobility robotics company BionicM , which tookthe first step at UTokyo and space intelligence solution developer Locix, spun-off from U. In the event. Berkeley. The firm will also help startups collaborate with closet institutions. For example , Indian biotech Bugworks collaborates for the Tokyo Institute of Concepts and Japanese industrial robotics startup Mujin this point works with Carnegie Mellon.