Bitcoin (BTC) is fast approaching its worst monthly performance in a decade, but some investors are using this as an opportunity to buy ultra-bullish long-term derivatives. There are currently over $900 million in call (buy) options aiming at $100,000 and higher, but what exactly are those investors seeking?

Options instruments can be used for multiple strategies, which include hedging (protection) and also aiding those betting on specific outcomes. For example, a trader could be expecting a period of lower volatility in the short term but, at the same time, some significant price oscillation toward the end of 2021.

Most novice traders fail to grasp that an investor might sell an ultra-bullish call (buy) option for September to improve gains on a short-term strategy, therefore not expecting to carry it until the expiry date.

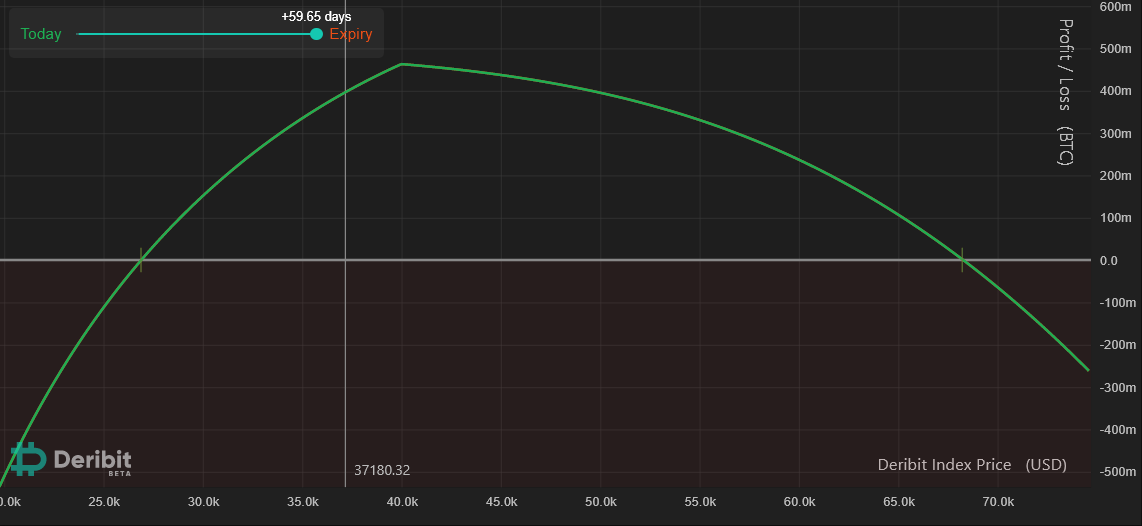

Bitcoin option profit/loss estimate. Source: Deribit Position Builder

Bitcoin option profit/loss estimate. Source: Deribit Position Builder

The chart above shows the net result of selling a Bitcoin $40,000 July 30 put. If the price remains above that threshold, the investor scores 0.189 BTC gain. Meanwhile, any outcome below $33,700 will yield a negative result. For example, at $30,000, the net loss is 0.144 BTC.

The same trade will occur in the example shown below, but the investor will also sell 40 contracts of the $140,000 call option for Sept. 24. The investor is letting go of gains from a potential price increase in exchange for higher net profit at present levels.

Bitcoin option profit/loss estimate. Source: Deribit Position Builder

Bitcoin option profit/loss estimate. Source: Deribit Position Builder

Take notice of how the same $40,000 outcome now results in a 0.464 BTC gain, and any price level above $26,850 yields a positive result. However, due to ultra-bullish calls, the trade will also net negative outcomes if Bitcoin trades above $68,170 on July 30.

Therefore, analyzing those ultra-bullish options separately doesn’t always provide a clear picture of investors’ intentions.

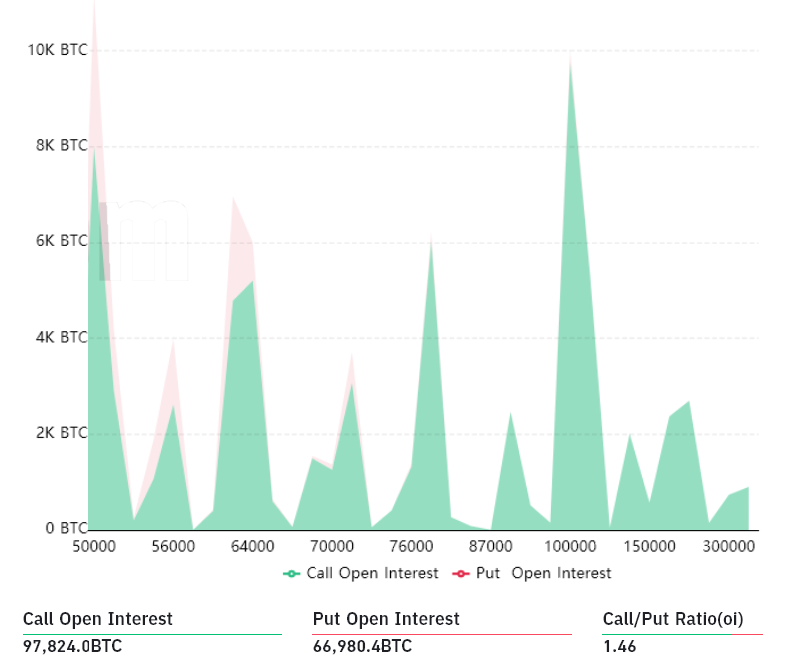

Aggregate Bitcoin options open interest: Source: Bybt

Aggregate Bitcoin options open interest: Source: Bybt

There are currently 24,625 Bitcoin call option contracts at $100,000 or higher, equivalent to $910 million in open interest.

Sure, it sounds like a lot, but the current market value of these ultra-bullish options is $15.4 million. For example, a Dec. 31 call option with a $120,000 strike is worth $1,500.

As a comparison, a $30,000 protective put option for July 30 is worth $2,700. Therefore, instead of focusing exclusively on open interest, one should factor in the actual cost for each option.

While these flashy $300,000 Bitcoin call options make headlines, they do not necessarily reflect true investors’ expectations.

For Bitcoin holders, it makes sense to sell call options of $100,000 and higher and pocket the premium. Worst case scenario, one will be making a sale in December at $100,000, which does not sound like a bad investment at all.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.