Asset tokenization has long been regarded as one of the most compelling applications of blockchain technology. Back in June 2019, the United States investment banking giant BNY Mellon declared it has the potential to “dramatically change the dynamic” for investors and unlock opportunities that were previously out of reach.

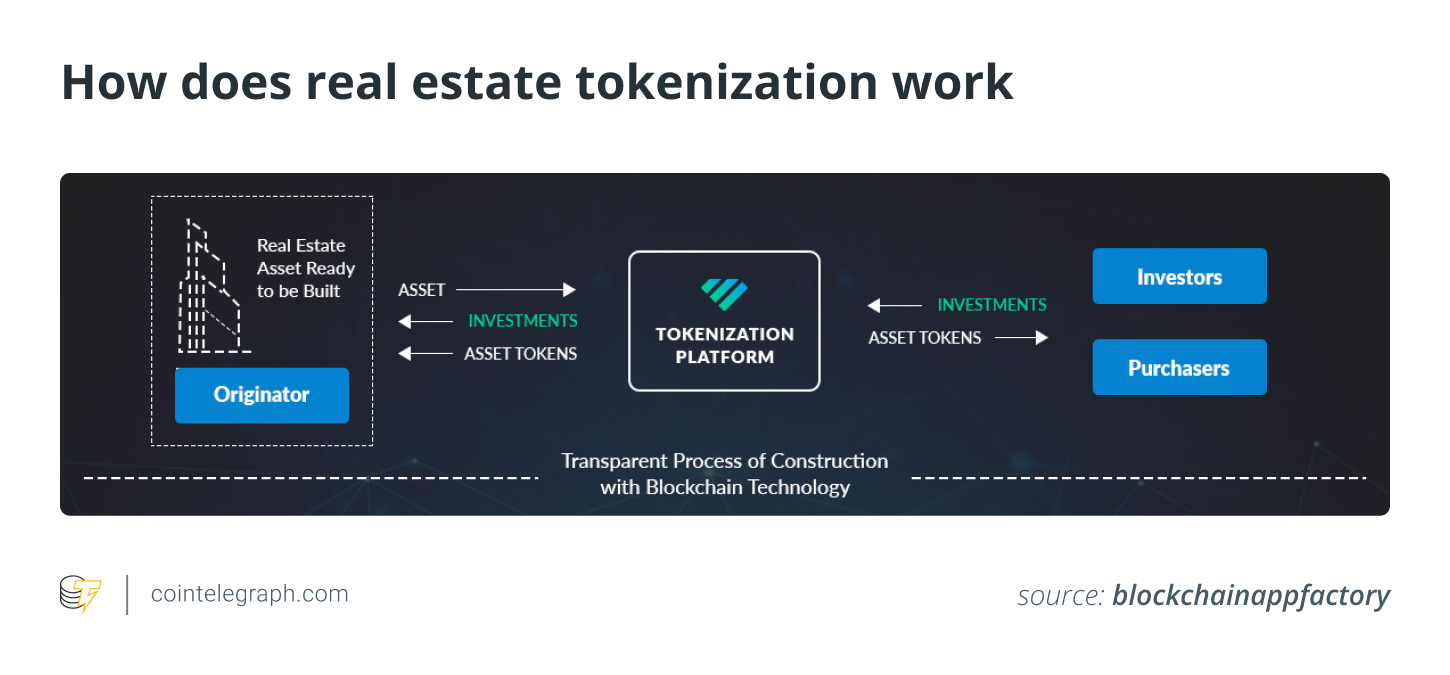

Real estate is an inevitable place to start. Tokenizing properties can open the door to fractional ownership, enabling individuals to purchase a small chunk of a building. The volatility of global markets has shown why diversification is crucial — but until now, the sheer cost of real estate has made it inaccessible for many.

The benefits might not stop here, either. It can take up to six months to close a purchase on a home, all thanks to a process that is time-consuming, agonizing and surprisingly paper-based. Tokenization has the potential to speed things up, all while offering a higher degree of trust and transparency. Enhanced liquidity could ultimately revitalize the market, making transactions frictionless.

There are also ramifications in the world of business. Franchising has proven an exceptionally popular way of expanding a brand — with McDonald’s, Subway and Chick-fil-A just some of the fast-food giants that allow entrepreneurs to open their own stores. Here’s the problem, though: there are huge expenses involved with this kind of investment. According to the HR company ADP, startup costs can be as high as $5 million — a sum that few individuals could summon up on their own. The fractional ownership achieved through tokenization can remove barriers to entry, delivering tangible benefits for every participant in such an ecosystem.

Elsewhere, tokenization could offer a modern twist on crowdfunding, which has allowed cutting-edge products to hit the market with the support of everyday consumers. Embracing blockchain can allow entrepreneurs to reach a wider cross-section of investors, all while delivering higher levels of liquidity. This could also transform the way pricey infrastructure projects get off the ground, especially in the renewable energy sector. Not only could this unlock fresh funding in the race to slash carbon emissions, but this could also bring down household bills.

Over on the star-studded streets of Hollywood, tokenization is already making its presence felt. From film productions to music rights, passionate fans can now take a financial stake in the creations they care about most. This can also free content creators from the confines of record labels and movie studios, allowing them to take risks and take control of their destiny. Better still, it also means anyone can become a celebrity. One compelling use case in this arena relates to Stoner Cats, an animated series backed by NFTs that was launched by Mila Kunis in 2021. It sold out in just 35 minutes.

Making tokenization usable

One could argue that this is just the tip of the iceberg when it comes to the potential use cases for tokenization, but there are challenges that stand in the way. One of them is regulation, and fractured frameworks in jurisdictions around the world mean there’s a lack of cohesion for entrepreneurs who want to embrace this technology.

It’s also a very new space, with limited historical data and ties to a volatile market. That’s where platforms like Brickken come in. Similar to Shopify enabling customized e-commerce stores, Brickken enables tokenizing businesses to create their own custom Token Store, further enhancing the demystification of tokenization. This project’s goal is to help digital assets be created, sold and managed in a seamless way. By offering a series of user-friendly tools and features presented in an all-in-one platform, Brickken empowers companies to easily embrace tokenization and infuse a 21st-century twist into their business model.

One of the most significant use cases for Brickken’s platform is the tokenization of real estate. By leveraging blockchain technology, Brickken facilitates fractional ownership of real estate, making real estate investing more accessible and inclusive. Through tokenization, investors can acquire fractional ownership tokens that represent a portion of the property’s value. This approach opens new avenues for liquidity, reduces barriers to entry, and enables a more efficient and transparent real estate market.

Beyond real estate tokenization, Brickken offers companies the ability to tokenize their equity or debt instruments, revolutionizing the way capital is raised. Through the platform, companies can create digital tokens that represent equity or debt instruments, allowing investors to participate in the growth and success of the business. This approach opens up new opportunities for startups and established companies alike, providing greater access to capital and fostering a more inclusive investment ecosystem.

Moreover, Brickken is addressing the challenge of limited capital in renewable energy investments by tokenizing projects, promoting fractional ownership and accessibility. Investors can now purchase fractional shares, overcoming financial barriers and supporting sustainable initiatives.

Simplifying life through tokenization

Billed as a no-code solution that is white-label by nature, Brickken says it offers a global ecosystem of partners to ensure each client is supported at every step of their journey, holding their hand while assets are fractionalized.

A key component of this ecosystem is the platform’s native token BKN, which provides users with access to a variety of services and benefits. Token holders can participate in tokenized investments, gaining exposure to real estate, art, intellectual property and other exciting asset classes. In addition, BKN tokens grant users exclusive access to premium features, discounts and rewards within the Brickken marketplace. Holders can also participate in governance decisions and shape the future direction of the platform.

Brickken’s key point is this: While tokenization may not be in the mainstream yet, there are already compelling examples where tokenization is adding real value to people’s lives.

Ludovico Rossi, Brickken’s chief revenue officer, said:

“Fractional ownership is the transformative progression of the sharing economy, and asset tokenization is its powerful enabler. This paradigm shift will shape our future, surpassing the impact of the sharing economy as we enter an era where fractional ownership becomes the norm. Brace yourself, the wave is imminent.”

To facilitate the adoption of tokenized assets, Brickken is launching its Token Issuer Academy, which provides comprehensive guidance, tutorials, and tools for successful enterprise tokenization for individuals and businesses. By joining the Academy, participants will gain essential knowledge on how to create, distribute, and manage tokens using the Brickken Token Suite, enabling them to harness the potential of blockchain technology and decentralized finance.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.