The parent company of subscription platform OnlyFans has become the latest firm to reveal its cryptocurrency holdings, showing it invested nearly $20 million into Ether (ETH) in 2022.

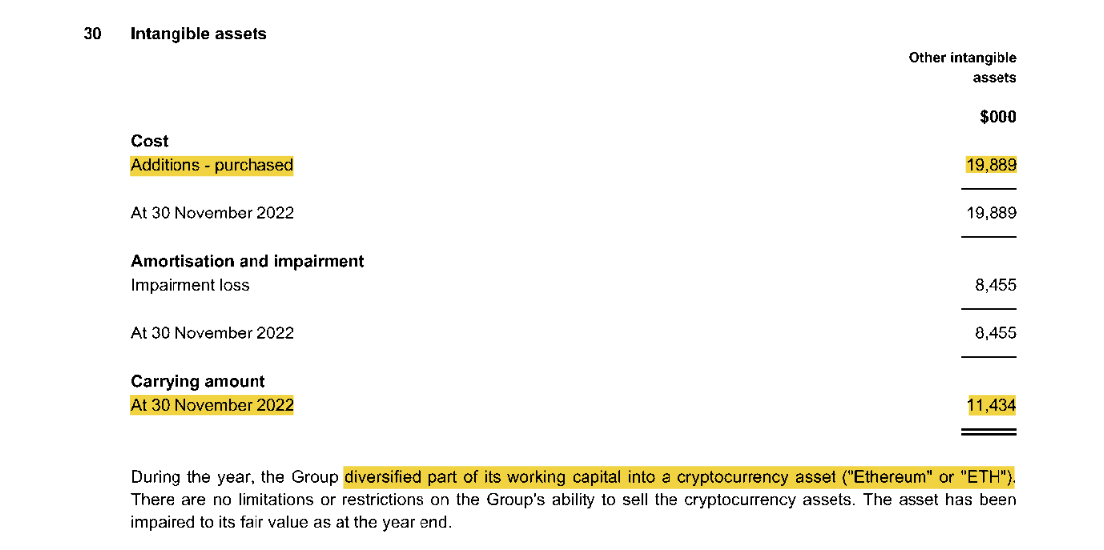

According to an Aug. 24 financial filing to the UK corporate registry, Fenix International reported that it had purchased some $19.9 million worth of ETH between 2021 and 2022. However, due to an overall decline in crypto asset prices over the course of last year, the total value of its Ether decreased by $8.5 million by the end of November 2022.

As of Nov. 30, 2022 — when ETH was worth $1,295 apiece — which placed the carrying amount of the company’s ETH holdings at $11.4 million.

Despite its lack of initial success in crypto investing — overall, the platform experienced solid growth in the reporting period ending November 30, 2022.

According to the filing, the company’s revenue increased 16.6% from $4.8 billion in 2021 to $5.6 billion in 2022. Additionally, the primarily adult entertainment platform also witnessed a 47% increase in the number of creators and a 27% increase in total subscribers.

Related: While Friend.tech booms, decentralized social has a retention problem

Its crypto investment isn’t the first time the company and its executives have ventured into the digital asset space. In Feb. 2022, the platform allowed verified creators to change their profile pictures to Ethereum-based NFTs.

In June 2022, two former OnlyFans executives launched a celebrity trading card platform called Zoop. Built on the Ethereum scaling solution Polygon, Zoop allowed users to trade 3D digital playing cards of their favorite celebrities.

The disclosure of the company’s ETH holdings came as adult content creators flocked to friend.tech — crypto’s newest decentralized social media platform — in a bid to cash in on the hype.

Big Questions: Did the NSA create Bitcoin?