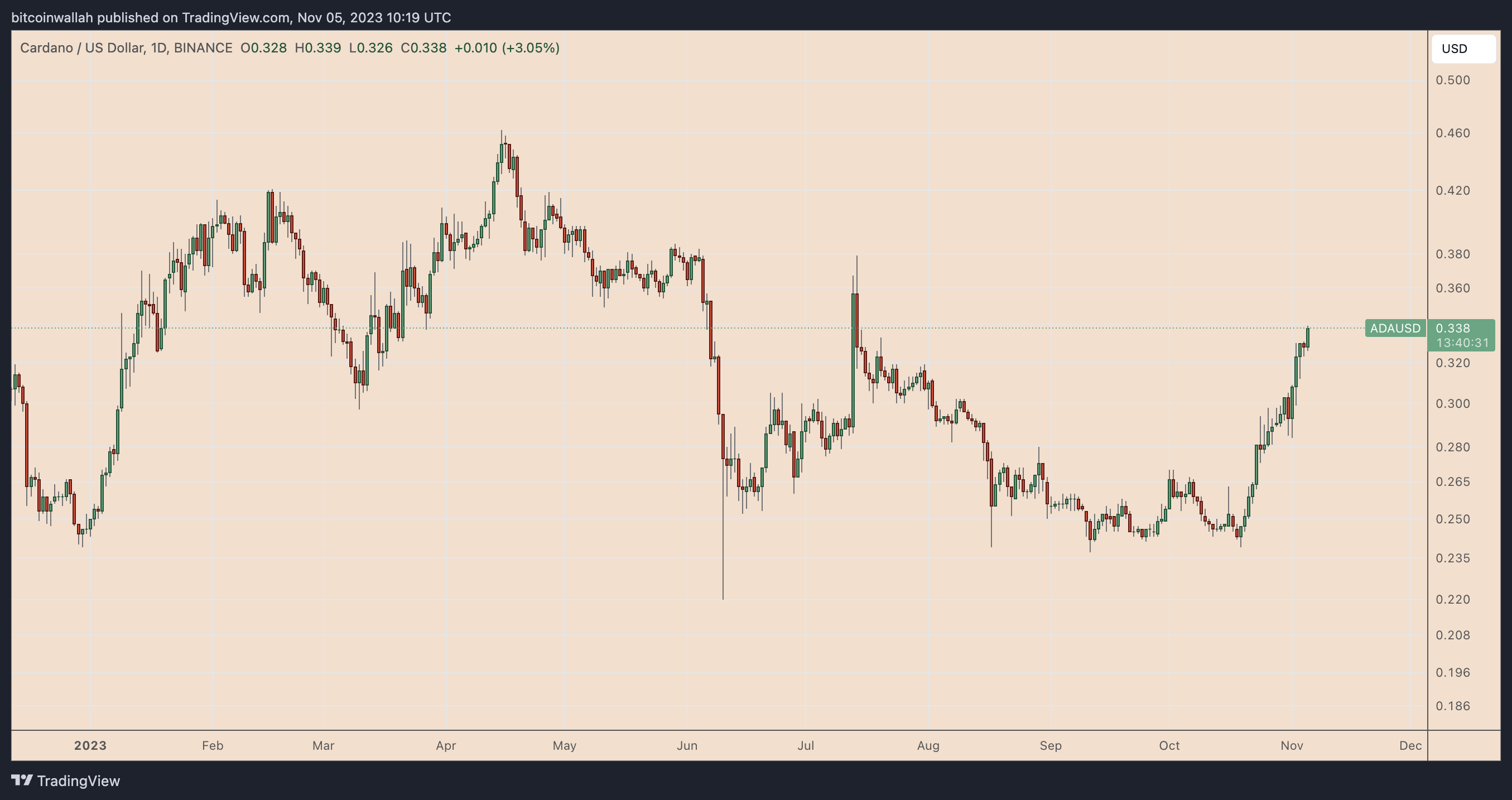

The price of Cardano (ADA) jumped 3.35% to $0.339 on Nov. 5, its highest level in about four months.

Why is ADA price up?

The weekly performance for ADA price is nearly 17%, likely boosted by the two-day Cardano Summit 2023, held from Nov. 2 to Nov. 4.

#CardanoSummit2023 Gala Awards Dinner!

Last night the #CardanoCommunity came together to celebrate a remarkable Summit and honor our industry’s shining stars at the Armani Pavilion, Burj Khalifa.

Congratulations to all the deserving award winners! pic.twitter.com/zbz4t5GUhX

— Cardano Foundation (@Cardano_CF) November 5, 2023

The gains also come as part of an overall market rebound that started Oct. 19 when Grayscale Investments refiled its Bitcoin ETF application with the U.S. Securities and Exchange Commission (SEC).

Since then, ADA’s price has risen by more than 40%. The ADA/USD pair is also seeing tailswinds from several additional factors listed below.

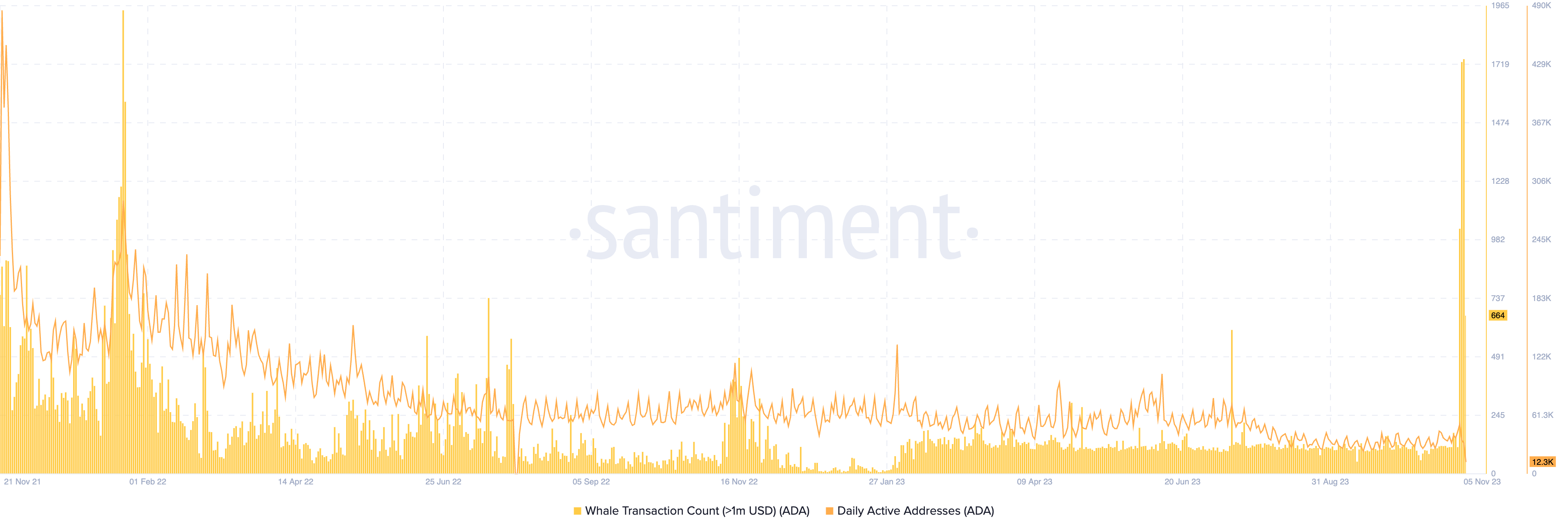

Cardano whale transactions jump

Cardano’s recent price surge coincides with a notable rise in its whale transactions.

The number of transactions exceeding $1 million in valuation rose to 1742, on Nov. 4, its highest since January 2022, according to on-chain data resource Santiment. This surge occurred alongside a drop in ADA’s daily active addresses.

The surge in whale transactions alongside the price rally indicates strong buying sentiment among the richest Cardano investors. Meanwhile, the drop in daily active addresses alongside rising prices hints at holding sentiment among investors of all sizes.

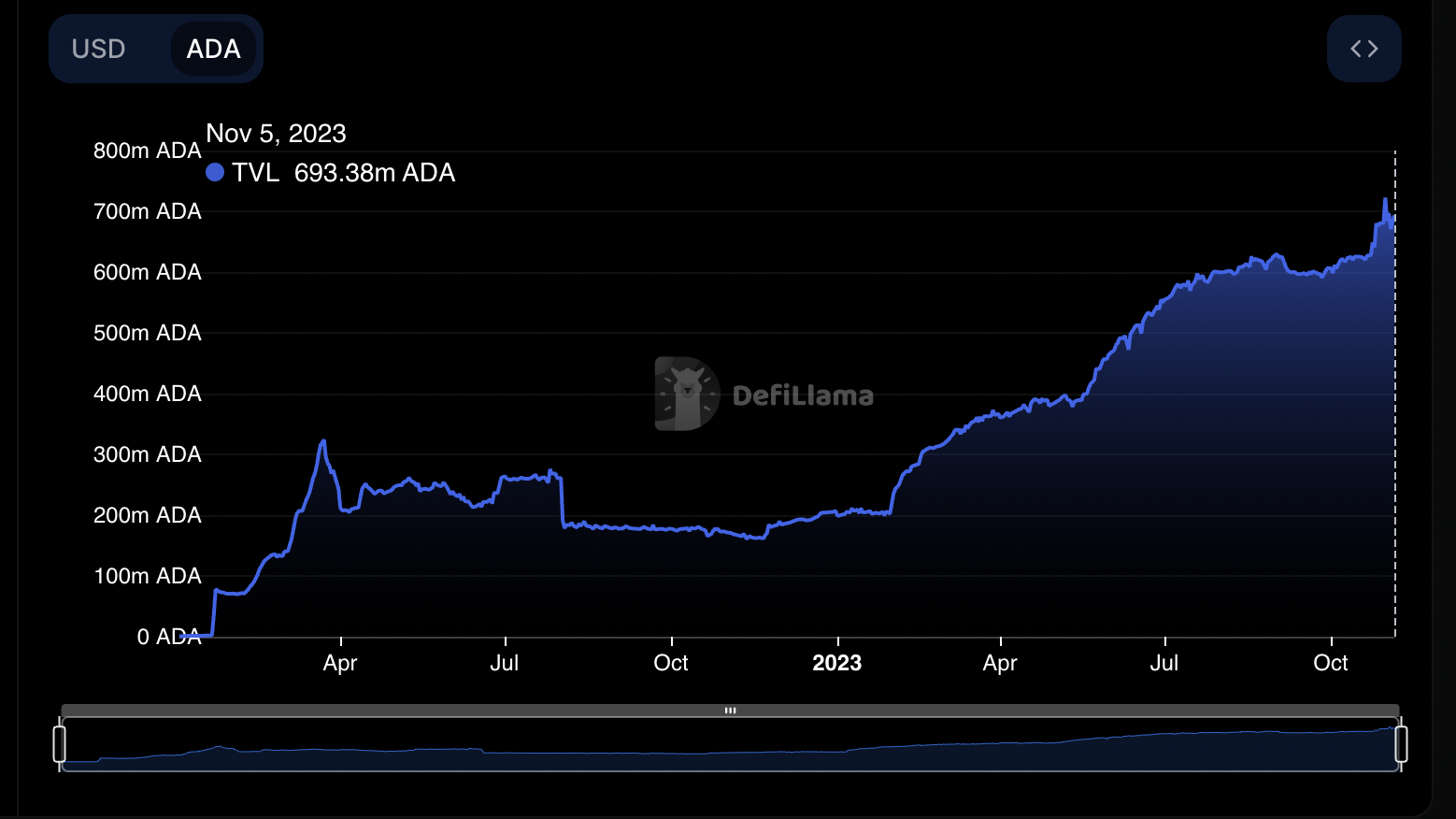

Cardano DeFi TVL is soaring

A persistent rise in Cardano’s total-value-locked (TVL) is another positive indicator.

As of Oct. 31, Cardano’s TVL had reached a record high of 680.76 million ADA, according to data tracked by DefiLlama. A high TVL indicates a healthy liquidity pool, which makes the underlying network attractive among investors seeking higher incentives and rewards.

Cardano price: technical breakout

ADA’s price rise also comes as part of a broader technical breakout. Notably, ADA’s price successfully broke out of its prevailing falling wedge pattern on Oct. 1, as shown below.

Falling wedges are considered bullish reversal patterns. As a rule, a rising wedge target is equal to the maximum distance between its upper and lower trendline.

Related: Cardano stablecoin project gambled away investors’ money before rug

Thus, ADA’s price eyeing a rally up to $0.359 in November, up about 5.5% from current price levels.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.