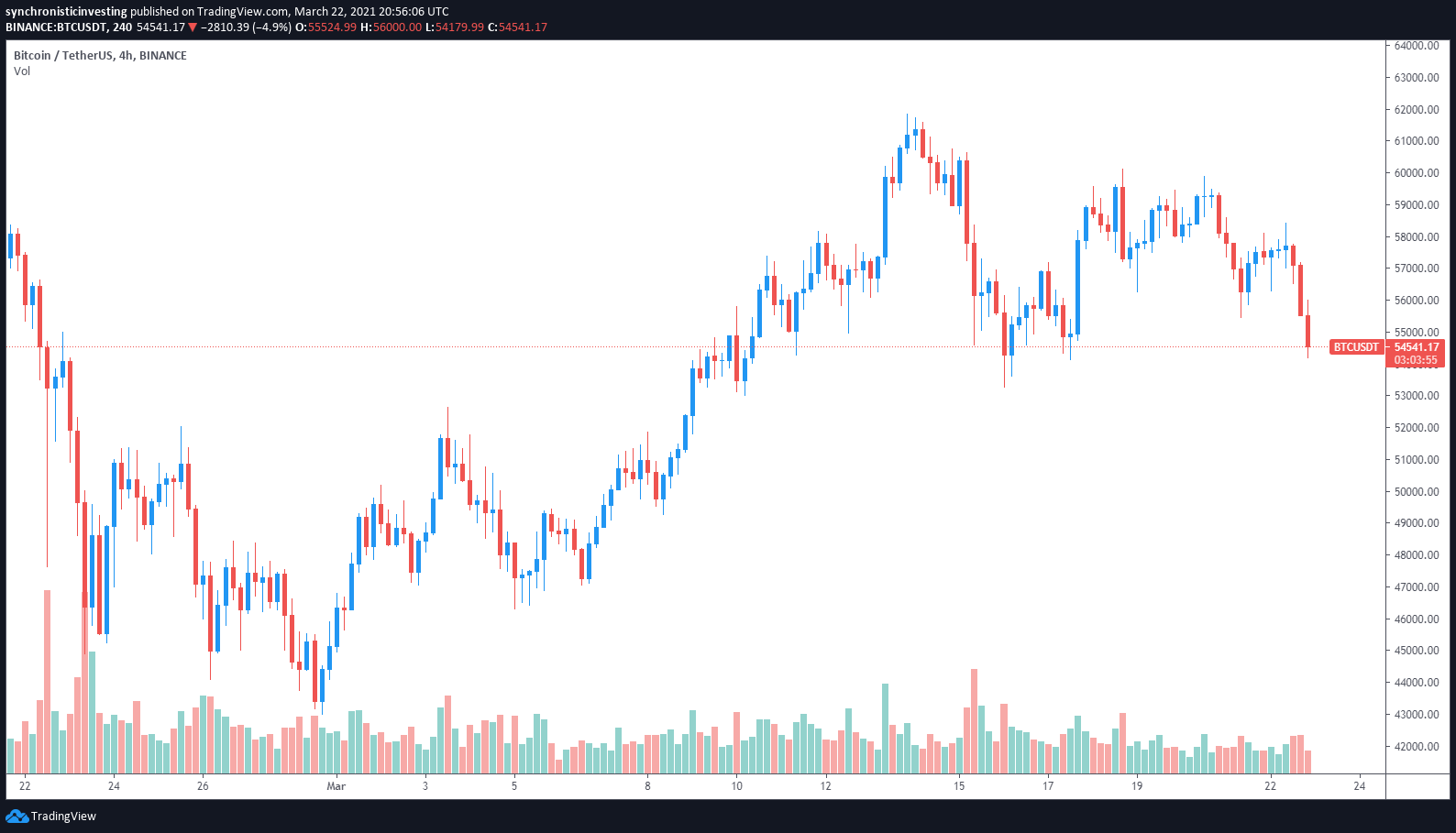

Bitcoin (BTC) bulls faced strong headwinds on March 22 that quickly dampened any attempt at a breakout above the $58,000 level despite comments from United States Federal Reserve Chair Jerome Powell which called the top cryptocurrency a “substitute for gold.”

Data from Cointelegraph Markets and TradingView show that traders made several attempts to push BTC above $58,000 over the past two days only to be rejected, with Monday’s failure resulting in a pullback to the $54,000 support level.

BTC/USDT 4-hour chart. Source: TradingView

BTC/USDT 4-hour chart. Source: TradingView

On-chain analysis shows that while BTC price struggles to climb back above $60,000, whale wallets have been in accumulation mode over the past 30 days indicating that some of the wealthiest Bitcoin holders still see more upside for the current bull market.

Mainstream cryptocurrency adoption gains traction

The macro picture for the cryptocurrency sector continues to improve as the globally recognized TIME magazine revealed that it is looking for a CFO who is comfortable with Bitcoin and cryptocurrencies as the publication has begun exploring the creation of one-of-a-kind non-fungible tokens based on some of its most iconic covers.

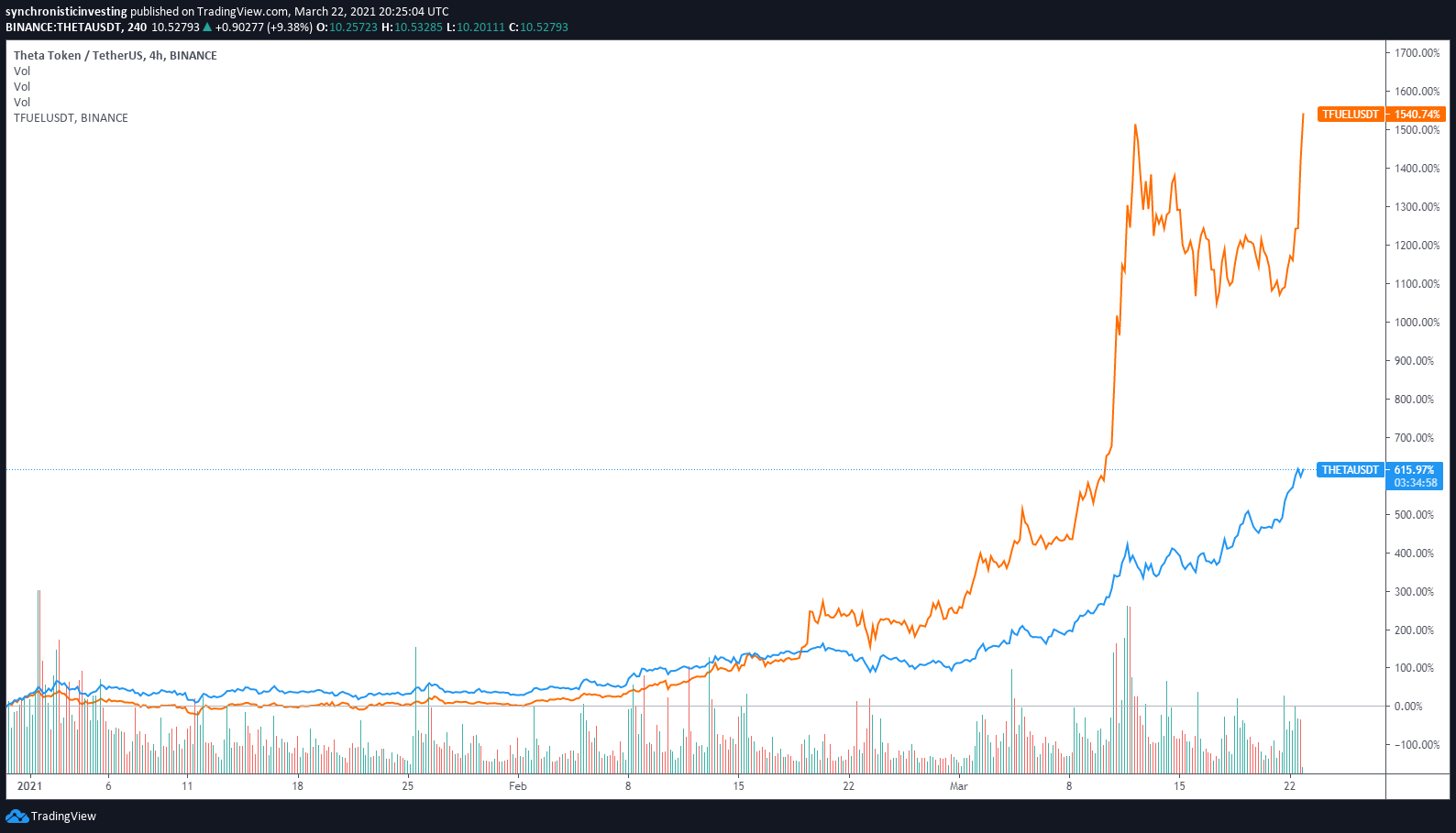

Now that blockchain technology has evolved to the point where it can handle processes like video and music streaming, platforms with a first-mover advantage in those sectors have seen their prices breakout over the past few months as mainstream audiences are increasingly exposed to the cryptocurrency ecosystem.

Theta (THETA) and Theta Fuel (TFUEL) have taken the lead when it comes to blockchain-based video streaming with the dual token system enjoying astronomical growth in 2021 that continues to push its price to new all-time highs.

THETA/USDT vs. TFUEL/USDT 4-hour chart. Source: TradingView

THETA/USDT vs. TFUEL/USDT 4-hour chart. Source: TradingView

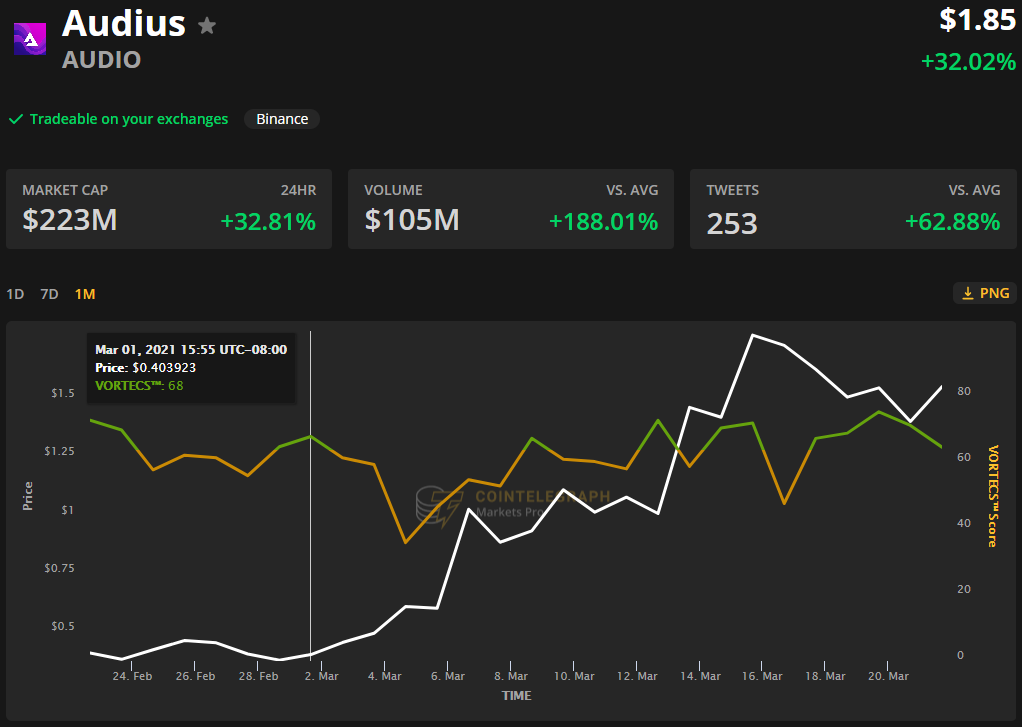

Audius (AUDIO), a music streaming platform, has also rallied strongly over the past month as its price increased from $0.356 on Feb. 28 to a new all-time high at $2.05 on March 16.

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for AUDIO on March 1, prior to the recent price rise.

The VORTECS™ score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

VORTECS™ Score (green) vs. AUDIO price. Source: Cointelegraph Markets Pro

VORTECS™ Score (green) vs. AUDIO price. Source: Cointelegraph Markets Pro

As seen in the chart above, the VORTECS™ score for AUDIO was in the green late in February and hit a high of 68 on March 1, roughly 24-hours before the price began to increase by 400% over the next two weeks.

Following the price peak on March 16, AUDIO price and its VORTECS™ score experienced a pullback that lasted several days. The VORTECS™ score then turned green again and reached a high of 71 on March 20, roughly 15 hours before its recent price rise.

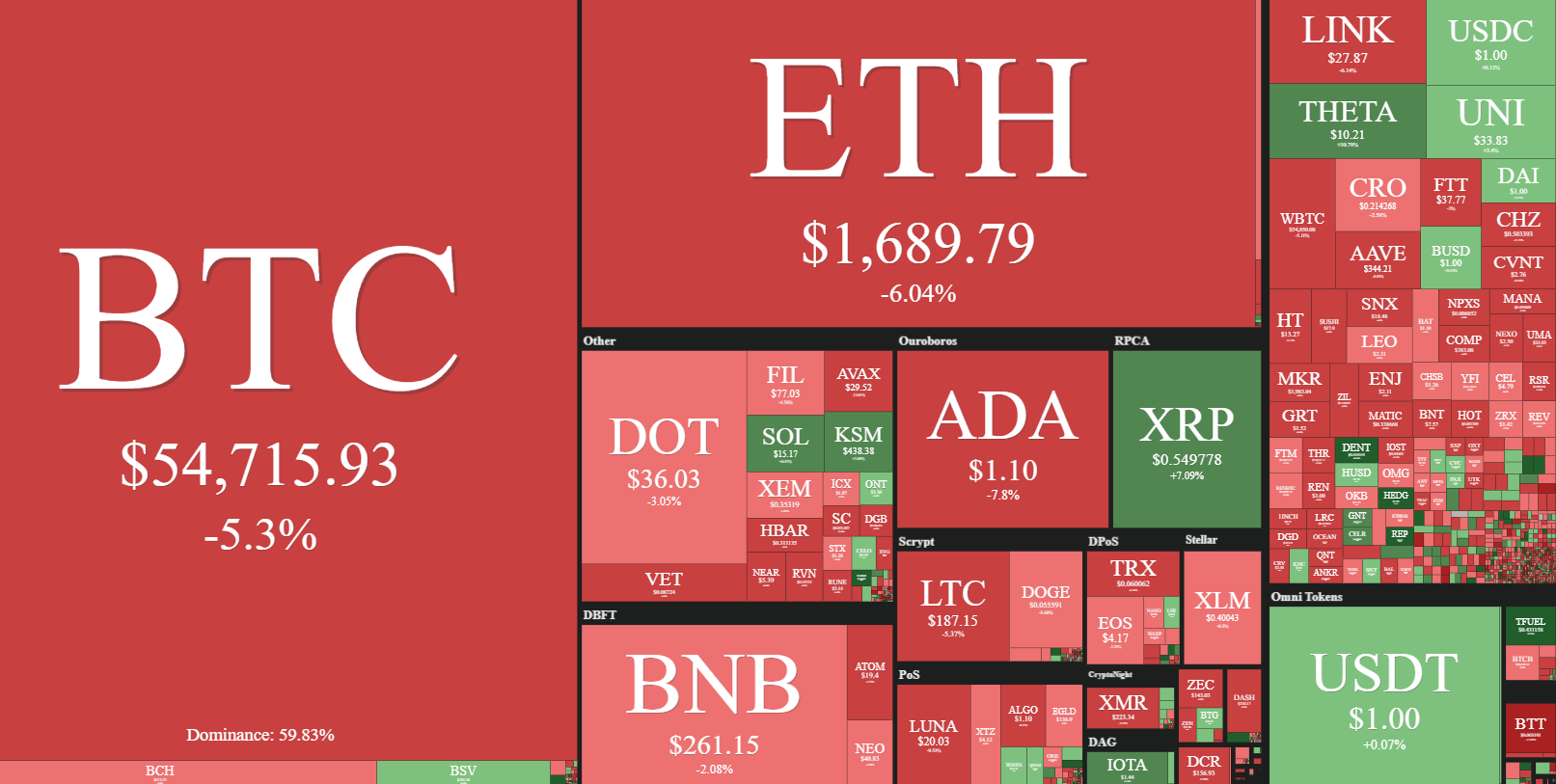

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360

Other notable altcoin performances on March 22 include Augur (REP), which has seen its price increase 30% to a multi-year high of $39.30, and XRP, which spiked 20% to an intraday high at $0.60 as members of the XRP army look to get the token relisted on exchanges that suspended services in response to th actions from the U.S. Securities and Exchange Commission.

The overall cryptocurrency market cap now stands at $1.746 trillion and Bitcoin’s dominance rate is 59.8%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.