Stablecoin issuer Circle and venture capital firm Sequoia Capital were reportedly among the top 10 depositors at the collapsed crypto-friendly Silicon Valley Bank (SVB) in March.

According to a June 23 report from Bloomberg, the Federal Deposit Insurance Corporation (FDIC) provided documents suggesting that Circle, Sequoia, and others were covered for deposits in the billions of dollars. The Federal Reserve announced following the SVB collapse that it would work with the FDIC to make both insured and uninsured depositors whole — in most situations, the FDIC only insures up to $250,000 per depositor.

Circle reportedly held roughly $3.3 billion in deposits, while Sequoia had roughly $1 billion. Other major depositors included Silicon Valley Bank itself, SVB Financial Group, biotechnology research firm Altos Labs, and Kanzhun Limited — a China-based company behind a major online recruitment platform.

WHOA. The FDIC accidentally posted an un-redacted document showing that the big VC firm Sequoia had $1 billion on deposit at SVB when it collapsed https://t.co/hCbcHZ0yev pic.twitter.com/Ys1qbHnvDr

— Joe Weisenthal (@TheStalwart) June 23, 2023

Related: Circle CEO blames US crypto crackdown for declining USDC market cap

The failure of SVB, and the subsequent collapses of Signature Bank and First Republic Bank, have put a spotlight on how regulators in the United States handle deposit insurance. Though the Fed, FDIC, and Treasury Department said covering SVB and Signature deposits of more than $250,000 was part of a “systemic risk exception”, they have reportedly explored raising the insurance limit.

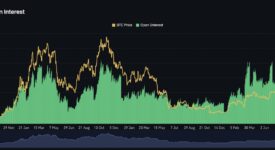

Following the failure of SVB in March and Circle confirming it had roughly $3.3 billion in exposure to the bank, the firm’s USD Coin (USDC) briefly depegged from the U.S. dollar. In June, the stablecoin issuer announced it planned to launch a native version of USDC on the Arbitrum network.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom