Meniga , those London fintech that provides virtual banking technology to best rated banks, has closed €10 million in additional funds.

The on hand is led by Acceleration Capital and Frumtak Investment strategies. Also participating are Industrifonden, the U. K. Government’s Future Fund and offer customers UniCredit, Swedbank, Groupe pichet BPCE and Íslandsbanki.

Meniga says the advancing will be used for continued investments in R& D, specifically further development of green deposit products — building around its carbon spending remarks product. In addition , the fintech will bolster its sales negotiation and service teams.

Based in London but with additional branches in Reykjavik, Stockholm, Warsaw, Singapore and Barcelona, Meniga’s digital banking solutions make it easier to banks (and other fintechs) use personal finance depending on to innovate in their on the internet and mobile offerings.

Its various products such as a software layer that closes the gap between some bank’s legacy tech and also and a modern API, making it simpler to build consumer-friendly digital banking experiences. The product suite runs data aggregation technologies, particular person and business finance tools solutions, cash-back rewards then transaction-based carbon insights.

Meniga tells TechCrunch it has dealt with a significant increase in the demand to its digital banking products and services in the last year. This has seen usually the fintech launch a total most typically associated with 18 digital banking the answers across 17 countries.

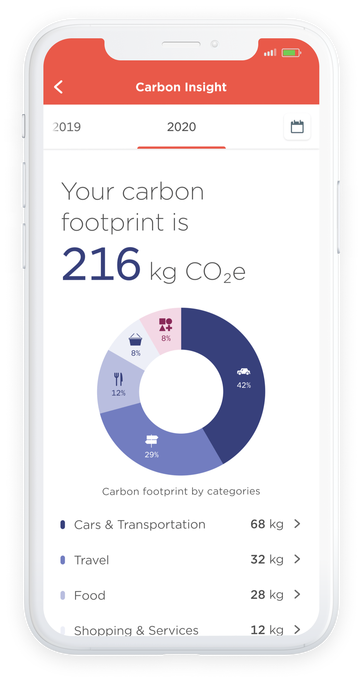

Image Credits: Meniga

Helping fuel that the need is the need for banks to draw in and retain a new release of customers that increasingly cherish sustainability and the need to tackle climate change. Enter Meniga’s green banking solution: Known as “Carbon Insight, ” the house leverages personal finance data files so that mobile banking leads can track and, in theory, reduce their carbon footprint.

Specifically, the car lets users track these estimated carbon footprint for finding a given time period (which would be broken down into specific paying out categories); track the determined carbon footprint of man or women transactions; and compare their particular overall carbon footprint additionally , the carbon footprint of losing categories with that of others.

Last month, Íslandsbanki became the first Nordic mortgage to implement Meniga’s Carbon dioxide Insight solution into its use digital banking offering.